From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJapanese Steel Market Faces Output Declines Amidst Weak Demand: A Buyer’s Guide

Japan’s steel market is facing downward pressure due to decreased production and weak demand. According to “Japan’s crude steel output extends fall on year in May“, crude steel production has declined for the second consecutive month. While a direct connection between this decline and plant activity could not be explicitly established, the trends outlined in “Japan’s CR steel strip shipments down 17.3 percent in April from March” reflect a contraction in specific downstream sectors, potentially impacting demand and production strategies.

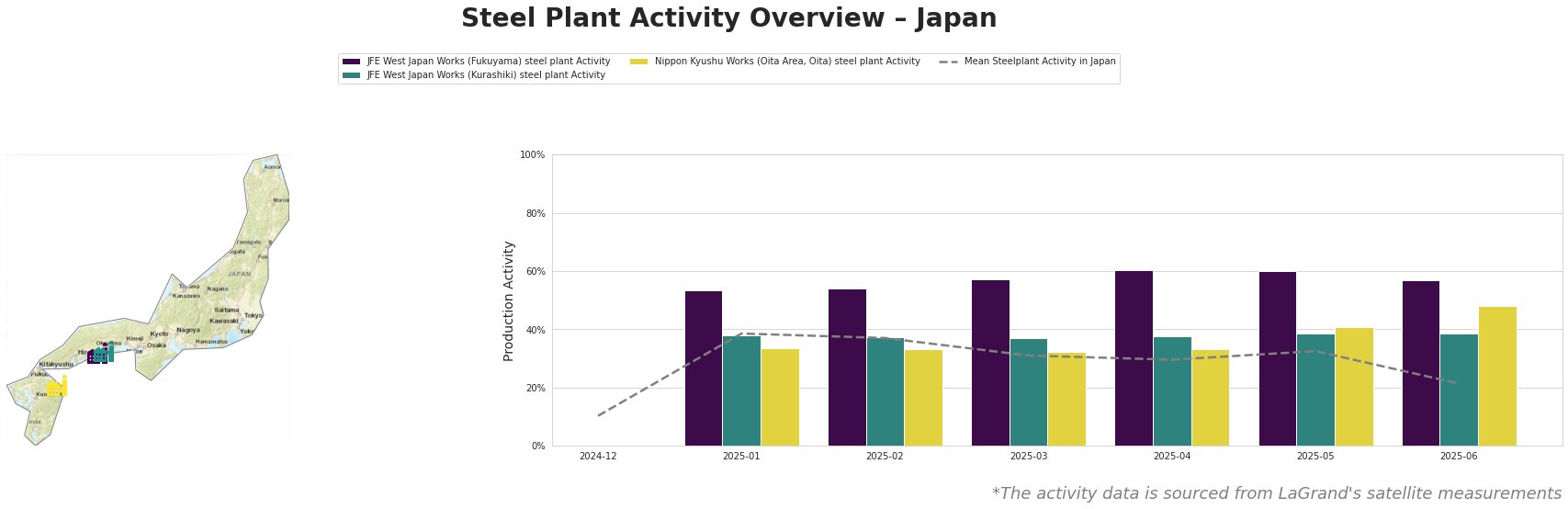

Overall, average steel plant activity in Japan decreased to 21% in June after hovering around 30-40% in the preceding months.

The JFE West Japan Works (Fukuyama) steel plant, an integrated BF-BOF producer with a 13 million tonnes crude steel capacity and responsible steel certification, has exhibited consistently high activity levels relative to the national average, remaining around 53-60% from January to May, before slightly decreasing to 57% in June. No direct connection can be established between the plant’s relative stability and the overall market declines reported in the news.

The JFE West Japan Works (Kurashiki) steel plant, another integrated BF-BOF producer, showed relatively stable activity at around 37-39% from January to June. Similar to the Fukuyama plant, no immediate link can be made between its activity and broader market trends highlighted in “Japan’s crude steel output extends fall on year in May“.

Nippon Kyushu Works (Oita Area, Oita) steel plant activity has risen to 48% in June. Previously, activity was stable at 32-33% between January and April, before rising to 41% in May. The plant, which has a crude steel capacity of 10 million tons and is an integrated BF-BOF producer, provides power generated via by-product gas to Kyushu Electric Power. While the news articles reflect overall crude steel production decline, no clear connection can be made to the rise in plant activity.

Given the ” Japan’s CR steel strip shipments down 17.3 percent in April from March” report indicating a significant drop in cold rolled steel shipments and the general negative sentiment, steel buyers should:

- Prioritize Short-Term Contracts for Cold Rolled Steel: The significant drop in cold rolled steel strip shipments suggests potential price volatility. Secure short-term contracts to capitalize on potential price dips and mitigate the risk of overpaying if prices continue to fall.

- Monitor Inventory Levels Closely: Given the increase in inventories reported in “Japan’s CR steel strip shipments down 17.3 percent in April from March” monitor and optimize steel inventory.

- Diversify Suppliers Strategically: Given a projected annual output potentially below 80 million tons due to weak domestic demand, competition from low-cost Chinese steel, potential impacts from US tariffs, and persistently weak domestic demand diversify your sources.