From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJapan Steel Market Reacts to Trump’s Tariff Threats; Plant Activity Varies

The Japanese steel market faces uncertainty as potential tariffs loom. The observed changes in plant activity levels can be related to the trade tensions described in “Trump puts new 25% tariffs on imports from Japan, South Korea” and “Trump’s tariff pause is set to expire, threatening a trade war flare-up“. It should be noted that a definitive causal relationship cannot be proven based only on the satellite data and the articles.

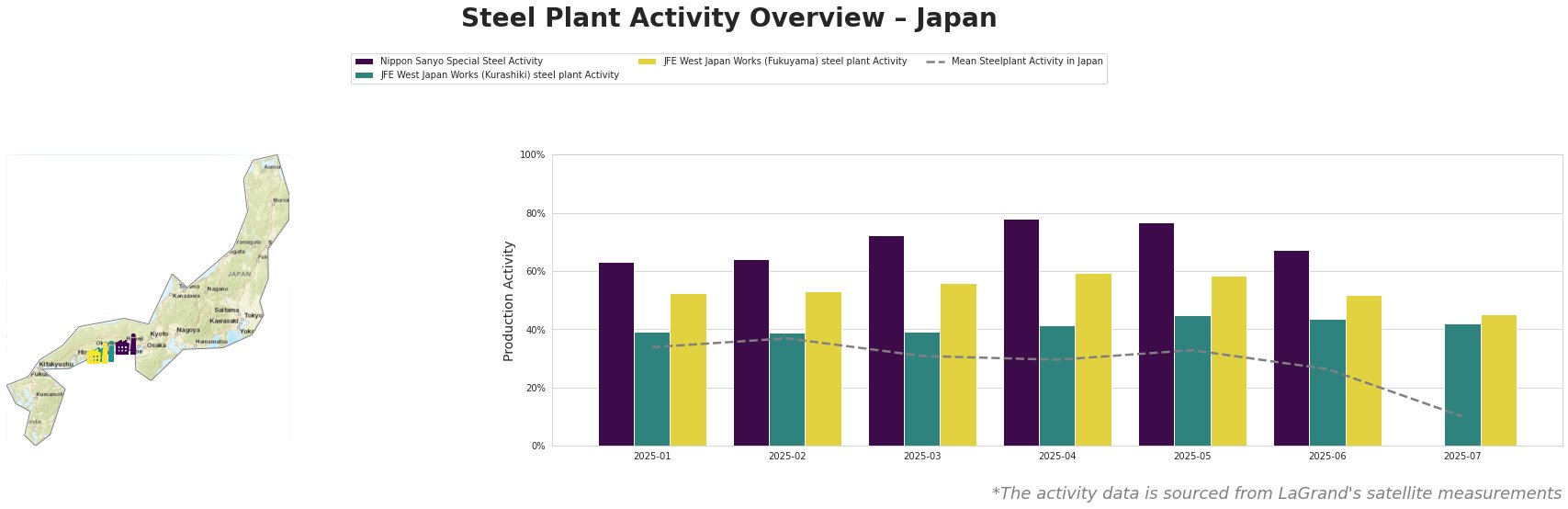

The mean steel plant activity in Japan saw a significant decline in July, dropping to 10.0% from 26.0% in June. Individual plant activity varied considerably. Nippon Sanyo Special Steel consistently operated above the mean, peaking in April at 78.0% before dropping to 67.0% in June and missing a data point in July. Both JFE West Japan Works plants followed similar patterns, with the Kurashiki plant consistently operating below the mean, and the Fukuyama plant operating above it.

Nippon Sanyo Special Steel, located in the Kansai region, is a ResponsibleSteel certified plant focusing on semi-finished and finished rolled products using electric arc furnaces (EAFs). Despite strong activity from January to May, peaking at 78% in April, activity dropped to 67% in June, and no data for July could be established. No direct connection could be established between this activity and the news articles.

JFE West Japan Works (Kurashiki) is an integrated steel plant in the Chūgoku region with a crude steel capacity of 10,000 ttpa, utilizing basic oxygen furnaces (BOF). Its activity remained relatively stable from January to July, ranging between 39% and 45%, below the Japanese average. The relative stability could be explained by domestic orders but no direct connection could be established with the named news articles.

JFE West Japan Works (Fukuyama), also in the Chūgoku region, is an integrated steel plant with a larger crude steel capacity of 13,000 ttpa, utilizing basic oxygen furnaces (BOF). Its activity was above the Japanese average for January to June, peaking at 59% in April, before dropping to 45% in July. The “Trump puts new 25% tariffs on imports from Japan, South Korea” article explicitly identifies Japan as a target, potentially explaining the activity decrease in July.

Given the announced 25% tariffs on Japanese steel imports into the US as detailed in “Trump puts new 25% tariffs on imports from Japan, South Korea“, steel buyers should anticipate potential supply disruptions, particularly from plants heavily reliant on exports to the US, especially in the Chūgoku region.

Therefore, buyers should:

* Diversify supply sources: Explore alternative suppliers outside of Japan to mitigate risks associated with the new tariffs.

* Accelerate purchases: Consider increasing steel purchases from JFE West Japan Works (Kurashiki), as they have exhibited steady activity which may signal more reliable supply than the other plants.

* Monitor policy changes: Closely track developments related to the “Trump’s tariff pause is set to expire, threatening a trade war flare-up” and “Trump verlängert Zoll-Frist – und droht erneut” articles, as any changes could significantly impact the market.