From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJapan Steel Market Faces Tariff Uncertainty Amidst Production Slowdown

Japan’s steel market is facing increased uncertainty due to potential US tariffs, influencing domestic steel plant activity. The news article “Trump puts new 25% tariffs on imports from Japan, South Korea” directly relates to concerns over reduced exports and potential production cuts. While a direct relationship between the tariff threats and observed activity declines at some plants can be inferred, no explicit connection is evident for others.

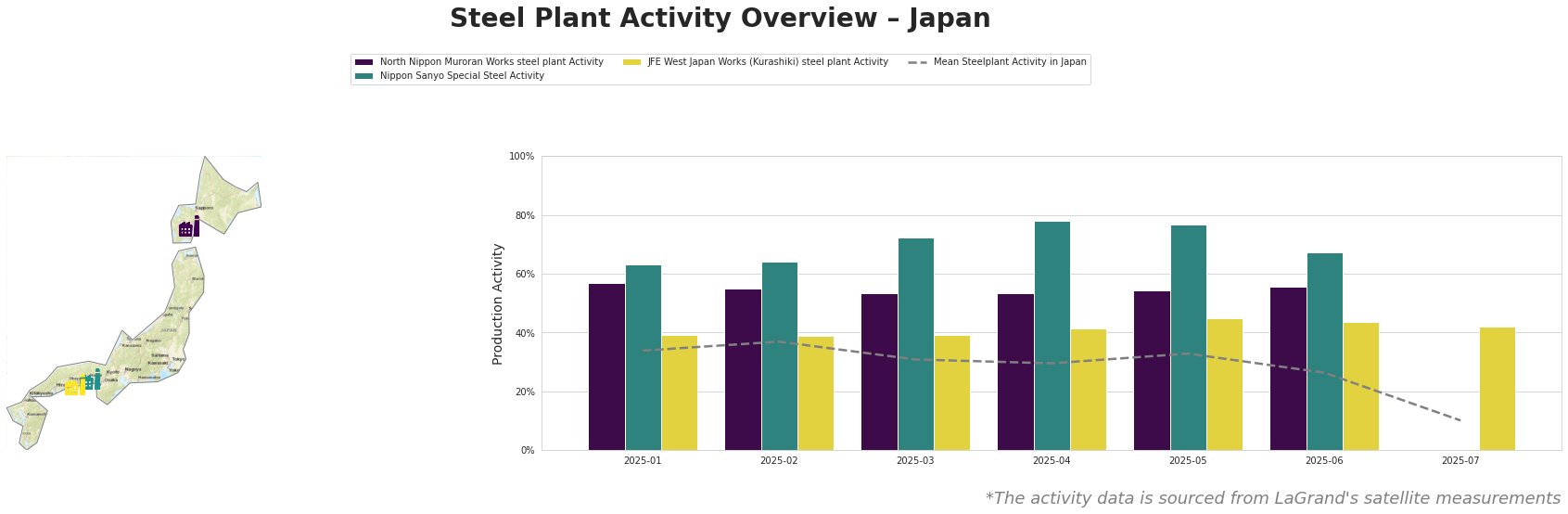

The recent activity trends across key Japanese steel plants are as follows:

Overall, the mean steel plant activity in Japan shows a declining trend, culminating in a significant drop to 10% in July.

North Nippon Muroran Works: This integrated steel plant, featuring both BOF and EAF processes and a 2598 ttpa crude steel capacity, has maintained relatively stable activity between 54% and 57% from January to June. Given its production of bars and wires for the automotive sector, the stability does not yet reflect potential impacts from the tariffs outlined in “Trump puts new 25% tariffs on imports from Japan, South Korea.” The plant’s relatively high activity compared to the national average may reflect existing contracts or a focus on domestic demand. The absence of July data prevents further assessment.

Nippon Sanyo Special Steel: This electric arc furnace (EAF) based plant, producing special steel products with a 1596 ttpa crude steel capacity, exhibited the highest activity levels among the monitored plants, peaking at 78% in April before decreasing to 67% by June. Given its diverse end-user sectors, the gradual decrease could be attributed to a broader economic slowdown rather than solely tariff concerns. Without July data, a definitive link to the news articles cannot be established.

JFE West Japan Works (Kurashiki): This integrated steel plant, boasting a substantial 10000 ttpa crude steel capacity, showed relatively stable activity between 39% and 45% from January to June. The observed activity is near the national average during the entire period. Production includes hot/cold rolled sheets, and plates which supply the automotive, building, and energy sectors. The activity level may not fully reflect the impact of potential tariffs. The absence of July data prevents further evaluation.

The drastic decline in the mean activity level across all plants in July (to 10%) without corresponding data for Nippon Sanyo Special Steel and North Nippon Muroran Works, suggests a potentially significant disruption. Given the news article “Trump puts new 25% tariffs on imports from Japan, South Korea,” this disruption could be linked to anticipatory production cuts in response to the looming tariffs, although other factors may also contribute.

Given the uncertainty surrounding tariffs and the observed decline in overall steel plant activity, steel buyers and market analysts should consider the following procurement actions:

- Evaluate Inventory Levels: Steel buyers reliant on Japanese steel, particularly from the JFE West Japan Works (Kurashiki) facility, should assess their current inventory levels and consider increasing stocks where feasible to mitigate potential supply disruptions.

- Diversify Supply Sources: Explore alternative steel suppliers outside of Japan, particularly for products similar to those produced by JFE West Japan Works (Kurashiki), to reduce dependence on a single region facing tariff risks.

- Monitor Trade Negotiations: Closely monitor ongoing trade negotiations between the US and Japan, as outlined in “Trump verlängert Zoll-Frist – und droht erneut“, to anticipate potential tariff implementations or reversals and adjust procurement strategies accordingly.

- Negotiate Contract Terms: Review existing steel supply contracts with Japanese suppliers and negotiate clauses that address potential tariff impacts, such as price adjustments or force majeure provisions.

- Focus on Domestic Supply: Given the absence of evidence that North Nippon Muroran Works or Nippon Sanyo Special Steel have reduced production, procurement analysts should investigate these plants as possible internal suppliers.

Avoid broad generalizations about the entire Japanese steel market. Instead, focus on the specific plants and product categories most likely to be affected by the tariffs.