From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJapan Steel Market: Declining Activity Signals Challenges Ahead for Buyers

Japan’s steel market faces significant challenges as evidenced by the recent shift in export performance and reduced production activity across major plants. According to “Japan’s Steel Exports Down 3.8% In January–November 2025,” steel exports plummeted to 2.40 million metric tons in November, marking a 5.7% decline from October and revealing a difficult landscape for the country’s steel industry. Additional insights revealed in “Japan’s scrap exports fall in November“ indicate a dramatic 21% decrease in scrap exports due to lower overseas demand, particularly stemming from Vietnam’s construction sector slowdown. These developments correlate with observable reductions in production activity reported through satellite monitoring of key steel facilities.

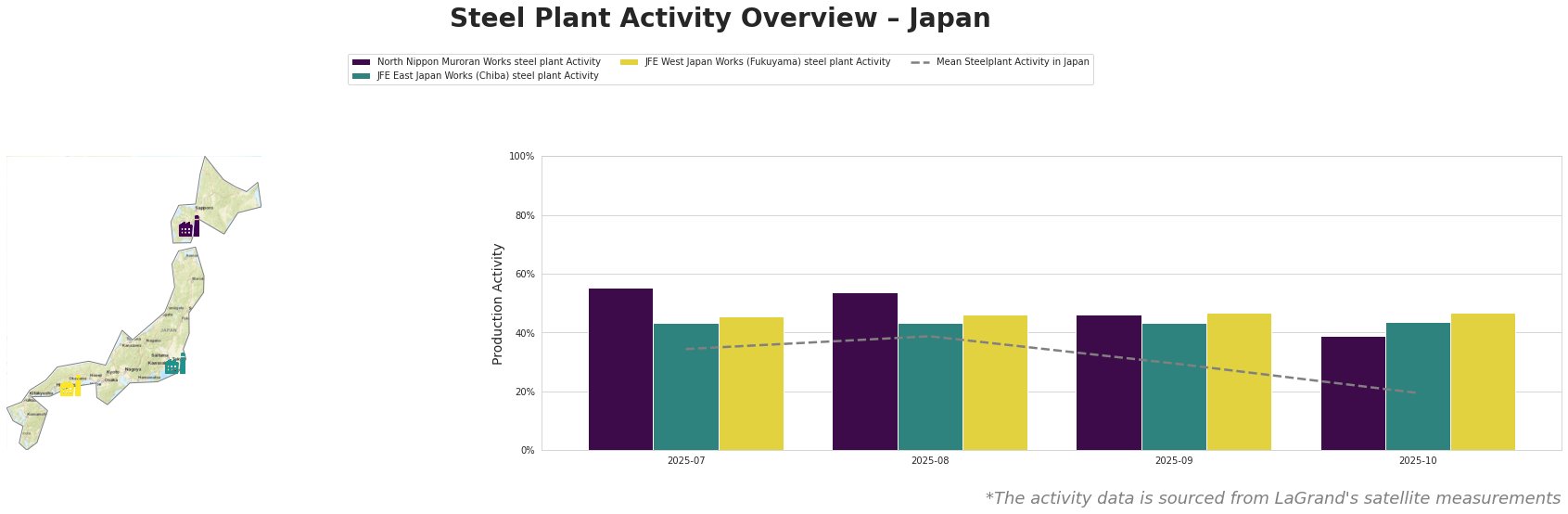

The North Nippon Muroran Works steel plant has seen a steady decrease in activity from 55% in July to 39% by October, contrasting sharply with the declining mean activity across all observed plants dropping to 19%. This substantial 29% decline in activity can be linked to the overall downward trend in Japan’s steel exports and domestic demand for crude steel, as noted in “Japan’s steel demand outlook on Q1 2026 signals 1.6 percent decline.”

Similarly, JFE East Japan Works (Chiba) has maintained relative activity stability but mirrors a broader market concern as the industry’s demand outlook remains weak. The facility’s activity was observed at 44% in October, slowing alongside national trends of decreased demand. Lastly, JFE West Japan Works (Fukuyama) also reflected minimal fluctuations in activity, consistent with the general downward pressure from anticipated decreases in both the automotive and construction sectors.

Considering these clear signals of declining demand and export performance:

– Supply Disruptions: Potential procurement challenges should be anticipated from North Nippon Muroran Works, which is experiencing the most pronounced activity drop and may face operational cutbacks, further complicating supply chains.

– Procurement Recommendations: Steel buyers are urged to secure orders now, especially from the JFE facilities where activity levels appear more stable relative to the mean. Given the anticipated further decrease in scrap availability and prices likely to reflect international disparities, immediate procurement actions are advised to mitigate future cost escalations.

These insights provide a clear directive for steel buyers navigating a precarious market environment, where proactive strategies are essential to ensure continued access to supplies amidst declining production capabilities.