From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItaly’s Steel Sector Booms: Marcegaglia Investment Drives Optimism Amidst Activity Shifts

Italy’s steel market shows positive momentum, driven by substantial investments in modernization and decarbonization. “Marcegaglia invests €364 million in modernization of plants in Italy” and “Marcegaglia invests €278 million in Ravenna, logistics, decarbonization and innovation at core of new industrial plan” highlight significant upgrades across Marcegaglia’s Italian facilities, but a direct correlation to immediate activity changes at the Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant is not directly evident from the provided data.

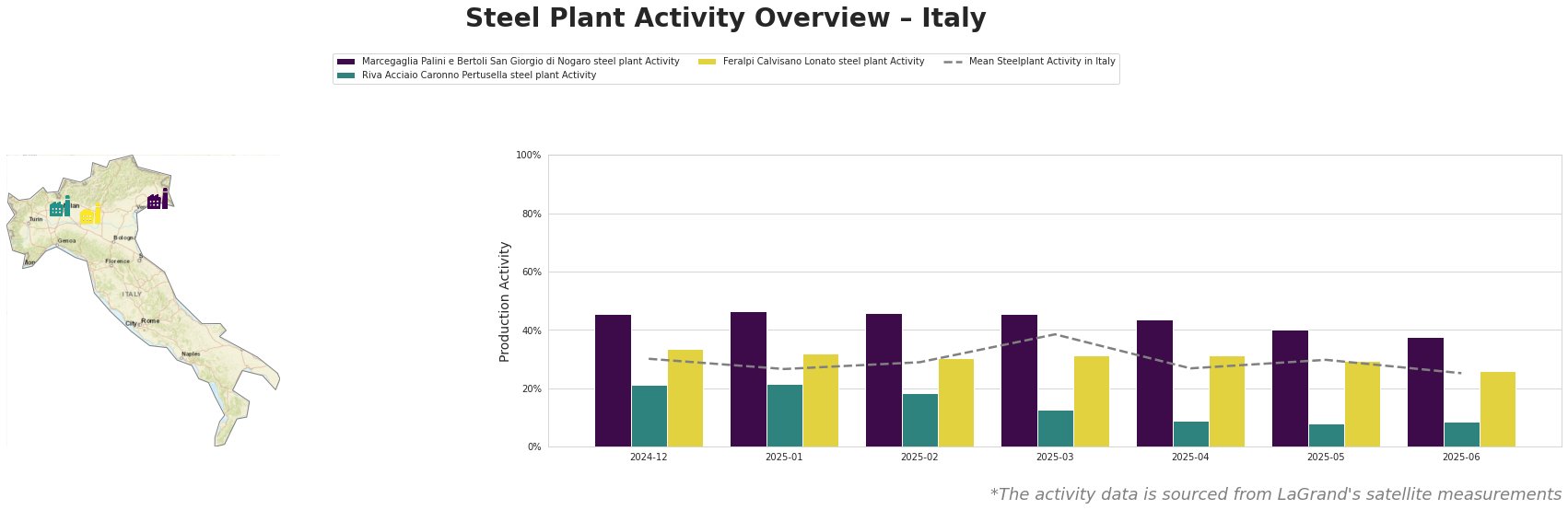

The table reveals a fluctuating activity landscape. The average steel plant activity in Italy decreased from 30% in December 2024 to 25% in June 2025. Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant consistently operated above the Italian average but experienced a decline from a peak of 47% in January 2025 to 38% in June 2025. Riva Acciaio Caronno Pertusella steel plant saw a significant drop, plummeting from 21% in December 2024 and January 2025 to only 8% in May and June 2025. Feralpi Calvisano Lonato steel plant showed relative stability, with activity ranging from 26% to 34%. No direct link can be established between the news articles and activity trends at Riva Acciaio Caronno Pertusella steel plant or Feralpi Calvisano Lonato steel plant.

Marcegaglia Palini e Bertoli San Giorgio di Nogaro, located in the Province of Udine, possesses a crude steel capacity of 600ktpa via EAF technology and boasts ResponsibleSteel Certification, producing primarily hot-rolled plates for building & infrastructure, energy, tools & machinery, and transport sectors. While “Marcegaglia invests €364 million in modernization of plants in Italy” and other articles detail substantial investments aimed at modernization and decarbonization, the satellite data shows a decrease in activity from 47% in January 2025 to 38% in June 2025. It is plausible that the dip may be related to preparation for the modernization projects, but no direct connection can be explicitly established based solely on the provided information.

Riva Acciaio Caronno Pertusella, situated in the Province of Varese, has a crude steel capacity of 780ktpa via EAF, employs 200 workers, holds ResponsibleSteel Certification, and specializes in billets and blooms for the automotive, building & infrastructure, energy, and tools & machinery industries. The plant’s activity displays a marked decline from 21% at the start of the observation period to a mere 8% in May and June 2025. No explicit connections could be established between this notable drop and the named news articles.

Feralpi Calvisano Lonato, located in the Province of Brescia, has a crude steel capacity of 600ktpa via EAF and is ResponsibleSteel Certified, producing billets for an unspecified end-user sector. The plant’s activity shows a relatively stable trend between 26% and 34%. No explicit connections could be established between the named news articles and the observed activity levels.

The investment by Marcegaglia signals a long-term strengthening of their production capabilities, potentially reducing reliance on external suppliers. The observed decrease in activity at the Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant, though not directly linked to the modernization efforts, warrants monitoring. The significant activity drop at Riva Acciaio Caronno Pertusella presents a more immediate concern.

Procurement Recommendation: Steel buyers should proactively engage with Riva Acciaio to understand the cause of the production decrease and assess potential supply disruptions. Buyers dependent on billets and blooms should explore alternative suppliers to mitigate risks. Conversely, Marcegaglia’s investment plan indicates enhanced long-term reliability, making them a potentially more secure partner for steel procurement.