From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItaly’s Steel Market Thrives amid Stable Prices and Increased Domestic Activity

Recent developments in Italy’s steel industry indicate a very positive market sentiment, driven by stable pricing and increased domestic production activity. Notably, Northern European steel heavy plate prices rise; Italy market stable amid bullish offers details how Italian plate prices have remained largely unchanged, with some mills successfully pushing for higher prices, which is illustrated by stable activity levels at domestic plants. Additionally, the article European domestic HRC prices rise as pressure from import reduces corroborates increased activity levels in Italian mills, as HRC prices adjust due to decreased imports influenced by the new EU Carbon Border Adjustment Mechanism (CBAM).

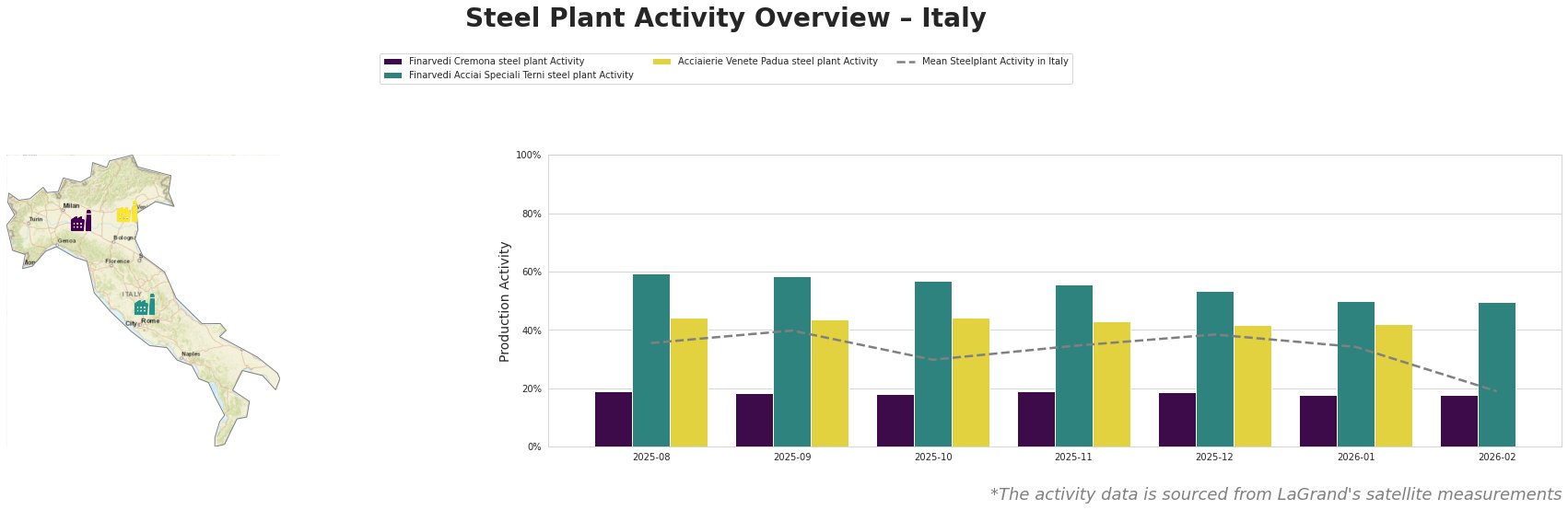

Measured Activity Overview

The mean activity across Italian steel plants declined from 34% to 19% in January and February 2026, reflecting notable instability. Finarvedi Cremona and Acciaierie Venete maintained particularly low activity rates of 18% and 42%, while Finarvedi Acciai Speciali Terni stabilized around 50%. The decreased mean activity aligns with reports from Italian coil derivative prices increase, highlighting a transient resurgence of interest, although true demand recovery remains uncertain.

Finarvedi Cremona Steel Plant

Located in the Province of Cremona, Finarvedi Cremona operates with an EAF capacity of 3,850 tonnes, focusing on semi-finished and finished rolled products such as hot rolled coil and galvanized products. Activity levels dropped from 19% in November 2025 to 18% in January and February 2026, lacking a direct correlation with pricing stability as noted in Northern European steel heavy plate prices rise; Italy market stable amid bullish offers. Given the stable plate prices, this activity stagnation may indicate underlying market caution due to regulatory challenges.

Finarvedi Acciai Speciali Terni Steel Plant

Finarvedi Acciai Speciali Terni, in the Province of Terni, has a substantial EAF capacity of 1,450 tonnes and produces a variety of products, including stainless steels and cold-rolled sheets. Activity also dropped from 56% to 50% in January and February 2026. This adjustment appears indirectly linked to the broader market environment, as reflected in European domestic HRC prices rise as pressure from import reduces, where domestic dynamics offer opportunities; however, further recovery remains contingent on regulatory clarity.

Acciaierie Venete Padua Steel Plant

Acciaierie Venete in Podova explores its EAF capacity of 600 tonnes, primarily generating semi-finished and finished rolled products. The plant’s activity, which remained stable around 44% until February 2026, may benefit indirectly from rising prices noted in both Italian coil derivative prices increase and Prices for rolled steel products in Europe remained unchanged amid new orders in Italy and subdued growth in the Nordic market. Nonetheless, secondary market pressures may hinder further growth.

Evaluated Market Implications

- Potential Supply Disruptions: The fluctuating activity levels, particularly at Finarvedi’s plants, signal possible future supply disruptions. Buyers should monitor these plants closely, given their critical role in fulfilling domestic demand.

- Recommended Procurement Actions:

- Engage with Finarvedi Acciai Speciali Terni for future purchases, leveraging moderately stable pricing in the HRC segment. The 50% activity level can support commitments for forthcoming orders.

- Constantly assess competitiveness in light of the Italian coil derivative prices increase, which may necessitate price adjustments over time. Current reports suggest potential shortages, prompting buyers to secure orders early to avoid stockouts.

- Anticipate regulatory impacts from the CBAM, adjusting procurement strategies accordingly, especially in light of rising costs and compliance challenges highlighted in Northern European steel heavy plate prices rise; Italy market stable amid bullish offers.

These actionable insights align with ongoing price stability signaling an optimistic outlook, yet caution remains warranted given evolving regulatory landscapes and market dynamics.