From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Under Pressure: Declining Activity Amidst Price Concerns

Italy’s steel market faces headwinds, with declining plant activity coinciding with pricing concerns. The struggles outlined in “Low Italian, Spanish pricing concerns European longs mills” and “European longs prices decline amid sluggish activity” reflect the broader market downturn. However, direct causal links between these articles and specific plant activity changes cannot be definitively established without further information.

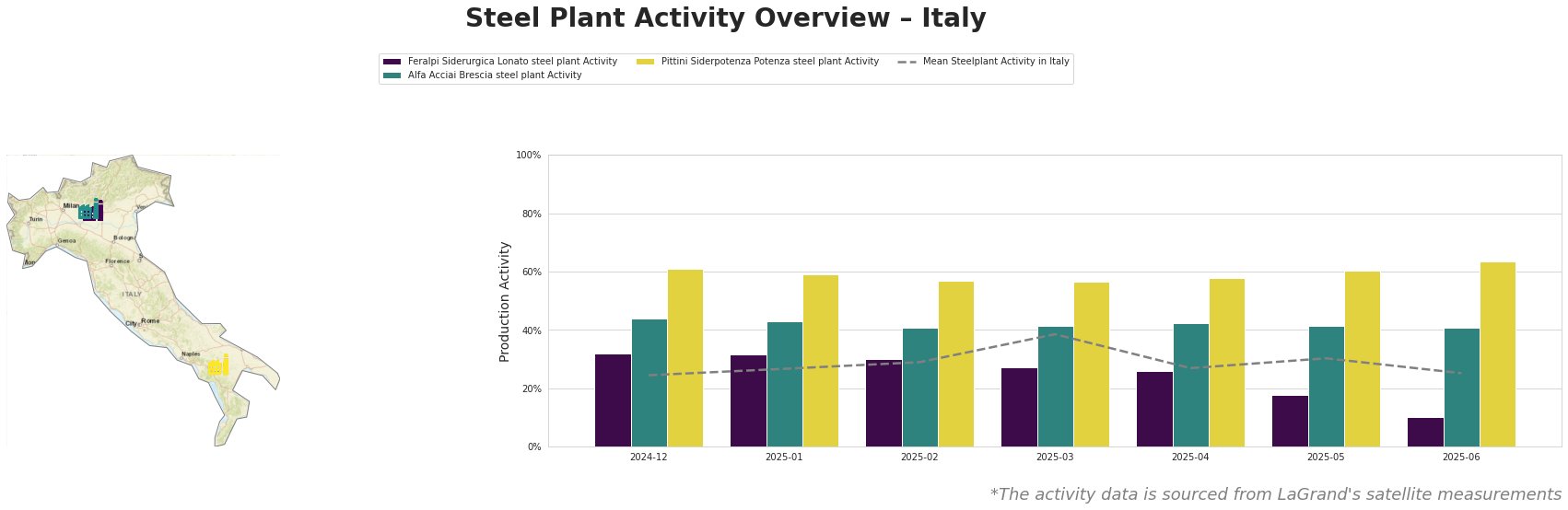

Overall, the mean steel plant activity in Italy fluctuated, peaking in March at 39.0% and declining to 25.0% by June. Feralpi Siderurgica Lonato shows a sharp decline in activity, while Alfa Acciai Brescia remains relatively stable, and Pittini Siderpotenza exhibits the highest activity levels.

Feralpi Siderurgica Lonato steel plant: This EAF-based plant, with a crude steel capacity of 1100 ttpa, experienced a significant drop in activity from 32.0% in December 2024 and January 2025 to just 10.0% in June 2025. This substantial decrease may reflect the “sluggish activity” described in “European longs prices decline amid sluggish activity,” particularly given Feralpi’s production of rebar and wire rod. However, a direct causal link cannot be explicitly established.

Alfa Acciai Brescia steel plant: This plant, also EAF-based with a capacity of 1700 ttpa, demonstrates a more stable activity level, fluctuating between 41.0% and 44.0% over the observed period. While “Low Italian, Spanish pricing concerns European longs mills” mentions pricing pressure on Italian rebar (a key Alfa Acciai product), the plant’s activity remained relatively consistent. Therefore, a direct link between news and activity is not evident.

Pittini Siderpotenza Potenza steel plant: Activity at this EAF-based plant (700 ttpa capacity) is consistently higher than the Italian average, reaching 64.0% in June 2025. This may indicate resilience in its rebar production, potentially serving the building and infrastructure sector. However, no direct connection can be established between the sustained plant activity and news articles.

Given the significant activity drop at Feralpi Siderurgica Lonato, coupled with the overall negative sentiment in the Italian long steel market as described in “European longs prices decline amid sluggish activity” and “Low Italian, Spanish pricing concerns European longs mills,” steel buyers should:

-

Prioritize securing rebar and wire rod supply contracts in advance, especially from alternative sources to mitigate potential disruptions linked to the Feralpi plant’s reduced output.

-

Closely monitor scrap price fluctuations in Italy, as mentioned in “Low Italian, Spanish pricing concerns European longs mills,” and their potential impact on rebar pricing from other producers like Alfa Acciai and Pittini. This will help to anticipate price adjustments and optimize purchasing decisions.