From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Reacts to CBAM: Price Hikes & Activity Shifts

The Italian steel market is navigating a complex landscape of rising prices and uncertainty surrounding the Carbon Border Adjustment Mechanism (CBAM). Recent price increases in heavy plate, as reported in “Steel heavy plate prices edge higher supported by persistent expectations of CBAM costs“, align with market optimism for further price gains despite stagnant HRC trading conditions as described in “European HRC trading at near standstill amid ample stocks, CBAM uncertainty“. Additionally, Arcelor Mittal has raised the prices for long products which include rebar, a key product for a number of producers within Italy. This is described in the article titled “ArcelorMittal raises prices for long products in Europe by €30/t“. There is no immediately apparent link between reported satellite activity data and these price pressures.

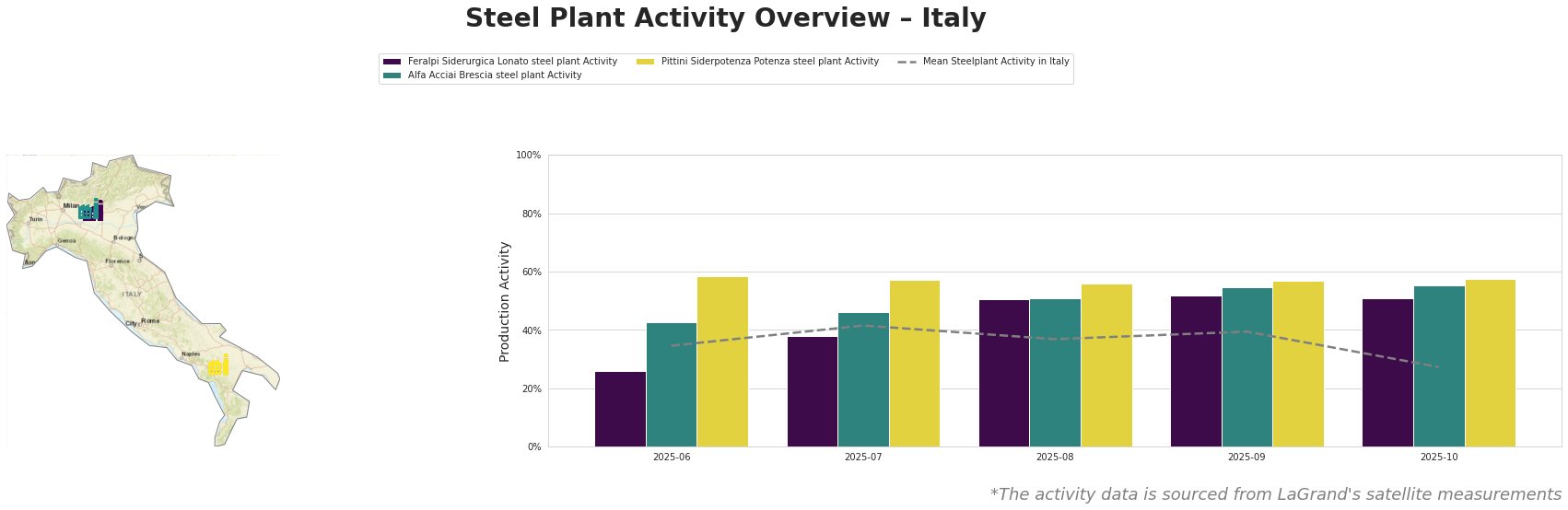

Observed steel plant activity in Italy shows diverging trends. While the mean steel plant activity experienced a sharp decline in October, dropping to 27% from 39% in September, individual plants, specifically Feralpi Siderurgica Lonato, Alfa Acciai Brescia, and Pittini Siderpotenza, maintained relatively high activity levels. Feralpi Siderurgica Lonato saw a slight decrease from 52% to 51%, while Alfa Acciai Brescia held steady at 55%, and Pittini Siderpotenza increased to 58%.

Feralpi Siderurgica Lonato, located in the Province of Brescia, operates a 1.1 million tonne per year EAF-based steel plant producing rebar, billets, mesh, and wire rod. Despite the overall market downturn in October, its activity remained high at 51%, contrasting with a low of 26% in June and showing a steadily upward trend through to September. As the news article “ArcelorMittal raises prices for long products in Europe by €30/t” stated that the price increases would apply to rebar and wire rod it can be assumed that the continued high level of production observed at this plant is, at least in part, connected.

Alfa Acciai Brescia, also in the Province of Brescia, has a larger EAF-based capacity of 1.7 million tonnes per year, focusing on billet and rebar production. Its activity has been consistently above the Italian average, reaching 55% in both September and October. This plant’s elevated production of rebar aligns with ArcelorMittal’s price increases for long products including rebar as described in the article “ArcelorMittal raises prices for long products in Europe by €30/t“. This correlation supports the possibility that Alfa Acciai Brescia, is responding to anticipated demand.

Pittini Siderpotenza, located in the Province of Potenza, operates a 700,000-tonne per year EAF steel plant that produces rebar for the building and infrastructure sectors. The plant has demonstrated high and stable activity relative to the other plants, with October reaching 58%, making it the most active out of the observed steel plants. Like the other two producers, the connection to the price increase as described in the article “ArcelorMittal raises prices for long products in Europe by €30/t” may be influencing the plant’s continued high level of activity.

The observed price increases reported in “Steel heavy plate prices edge higher supported by persistent expectations of CBAM costs” and “ArcelorMittal raises prices for long products in Europe by €30/t” do not appear to correlate directly with decreases in plant activity, suggesting that producers are confident in the market’s capacity to absorb costs, at least in the long product sector. However, the increase in costs may be impacting trading levels as described in “European HRC trading at near standstill amid ample stocks, CBAM uncertainty“.

Given the consistent activity at Feralpi Siderurgica Lonato, Alfa Acciai Brescia, and Pittini Siderpotenza amid rising long product prices, steel buyers should:

- Secure rebar supply contracts promptly to mitigate potential price increases.

- Prioritize domestic sourcing from these actively producing plants to reduce exposure to CBAM-related import uncertainties.

- Closely monitor the impact of CBAM on import prices and adjust procurement strategies accordingly, particularly for HRC where uncertainty persists.