From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Heats Up: ArcelorMittal Price Hikes Meet Rising Plant Activity

The Italian steel market is showing signs of a post-summer resurgence, driven by rising prices and increasing activity at key plants. ArcelorMittal’s recent price increases, as reported in “ArcelorMittal raises hot-rolled steel prices to €610/t” and “ArcelorMittal raises prices for hot-rolled steel for the second time this summer,” reflect anticipated import restrictions and rising demand. While the article “Seasonal lull keeps European HRC market subdued, despite ArcelorMittal price hike plans” notes a current market lull due to seasonal factors, rising plant activity suggests preparations for increased production.

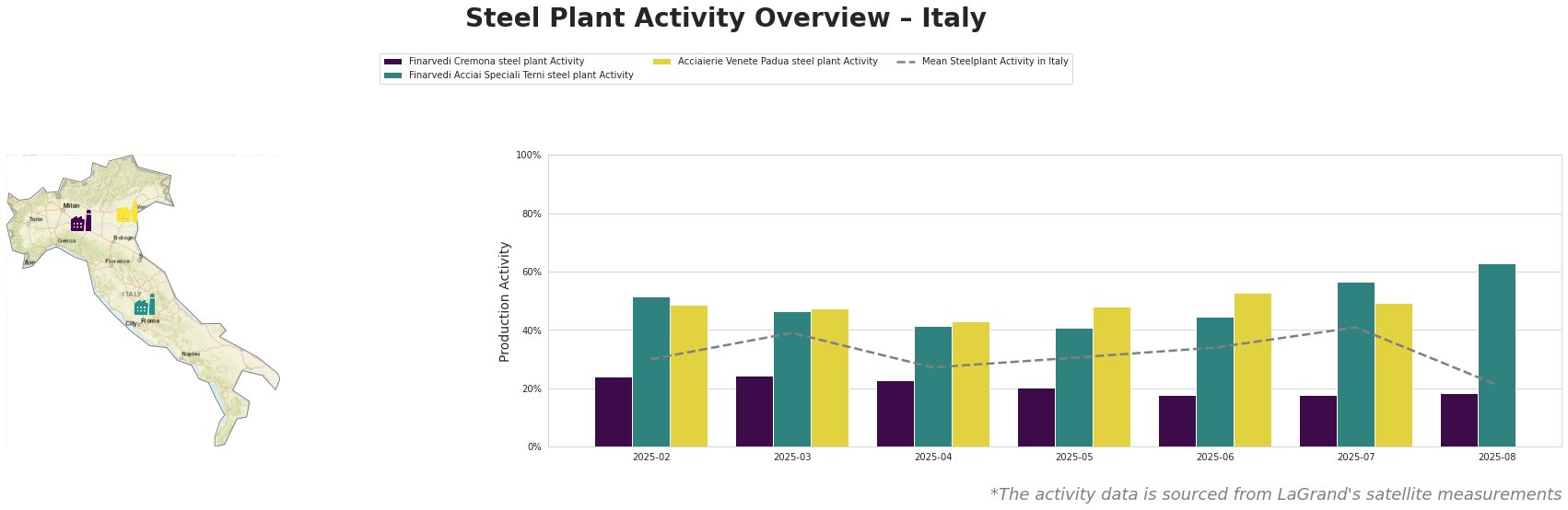

Overall plant activity in Italy averaged 21% in August, marking a significant drop from 41% in July. Finarvedi Cremona steel plant activity remained stable at 18% since June, consistently below the Italian average. Finarvedi Acciai Speciali Terni steel plant saw a peak of 63% activity in August, significantly exceeding the mean Italian steel plant activity and its own previous months. Acciaierie Venete Padua steel plant activity data is not available for August.

Finarvedi Cremona, located in the Province of Cremona, is an EAF-based steel plant with a crude steel capacity of 3850 ttpa, specializing in hot-rolled coil, galvanized products, and pickled products for the automotive sector. Activity at Finarvedi Cremona has remained consistently low, at 18% since June, despite the broader market anticipation of rising prices. There is no direct connection that can be established between the news articles and observed activities for Finarvedi Cremona.

Finarvedi Acciai Speciali Terni, located in the Province of Terni, is an EAF-based plant with a crude steel capacity of 1450 ttpa, focused on stainless steels, hot and cold-rolled coils and strips, serving various sectors including automotive and building/infrastructure. The plant’s activity rose steadily, reaching a peak of 63% in August, significantly above the mean activity level across Italy, even as the “Seasonal lull” article indicates overall subdued European HRC market conditions. No direct connection to rising prices as per “ArcelorMittal raises hot-rolled steel prices to €610/t” can be explicitly established.

Acciaierie Venete Padua, situated in the Province of Padua, operates an EAF with a crude steel capacity of 600 ttpa, producing bars, round bars, and wire rod for automotive, construction, and energy sectors. Activity decreased from a peak of 53% in June to 49% in July. Activity data is unavailable for August, preventing an analysis of any potential correlation with the news articles.

Evaluated Market Implications:

ArcelorMittal’s price hikes, coupled with the anticipated EU import restrictions and CBAM, suggest a tightening supply of HRC in Italy. The sharp increase in activity at Finarvedi Acciai Speciali Terni could indicate an attempt to capitalize on these rising prices, whereas, for Finarvedi Cremona, no immediate reaction to this situation is visible through plant activity.

Recommended Procurement Action:

For steel buyers, it is crucial to closely monitor import price trends and factor in potential supply chain disruptions due to import restrictions. Given ArcelorMittal’s price increases and the potential for further increases due to CBAM and import restrictions, procurement professionals should:

- Accelerate Q4 procurement: Secure HRC volumes now to avoid potentially higher prices later in the quarter, particularly from domestic producers.

- Diversify Supplier Base: Actively explore alternative supply options, including carefully evaluating import offers from countries not heavily impacted by potential EU restrictions, however, take into consideration additional potential import duties and regulations.

These measures should help mitigate risks associated with rising prices and potential supply constraints in the Italian steel market.