From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Rebar Prices Decline Amid Weak Demand: Steel Market Faces Uncertainty

The Italian steel market faces downward pressure on rebar prices, as evidenced by the articles “European longs market mostly stable, Italian rebar prices decline” and “The European long products market is mostly stable, and prices for Italian rebar are declining.” These price declines coincide with weak demand and a pessimistic outlook, as highlighted in the news articles. While the articles point to declining prices, a direct relationship to specific plant activity levels cannot be definitively established through the provided data alone.

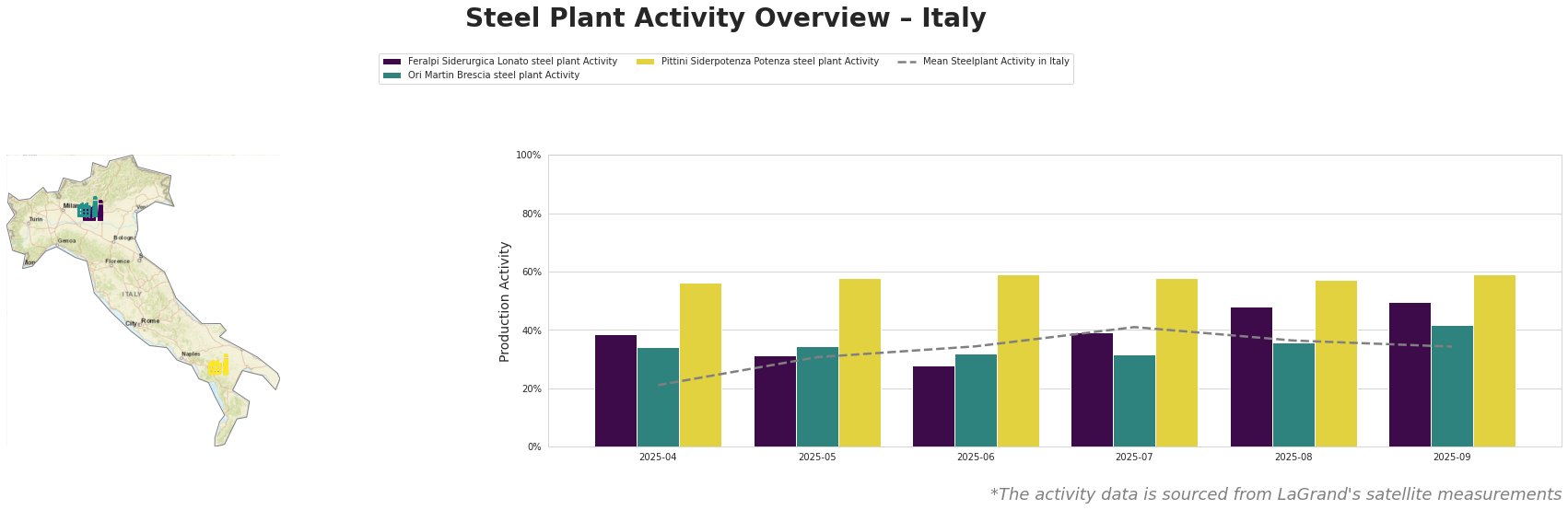

Overall, average steel plant activity in Italy has fluctuated, reaching a peak in July 2025 and declining slightly by September 2025. Individual plant activity shows distinct trends. Pittini Siderpotenza consistently operates well above the mean, while Ori Martin’s activity remains consistently near or below the mean activity level.

Feralpi Siderurgica Lonato steel plant: This plant, located in the Province of Brescia, boasts an EAF-based crude steel capacity of 1.1 million tonnes per year and produces rebar, billets, mesh, and wire rod. Its activity experienced a dip in June 2025, followed by a rise, reaching 50% activity in September 2025, exceeding its April level. The news article “Price increases in Italy have failed amid a sluggish recovery after the holidays” indicates that the post-holiday recovery has been disappointing. Whether the volatility of activity levels at Feralpi is linked is unclear.

Ori Martin Brescia steel plant: Also located in the Province of Brescia, Ori Martin has a crude steel capacity of 650,000 tonnes per year, relying on EAF technology. Its product portfolio includes billets, rolled products, wire, and wire rod, catering to sectors like automotive and energy. Ori Martin’s activity remained fairly stable, hovering around the lower end of the other plants. A rise in activity from 36% in August 2025 to 42% in September 2025. No direct link to news articles can be established from the provided information.

Pittini Siderpotenza Potenza steel plant: Situated in the Province of Potenza, this plant has a 700,000-tonne-per-year EAF-based capacity, focusing on rebar production for the building and infrastructure sector. The plant activity has remained consistently high over the observed period, fluctuating between 56% and 59%. The news articles report on Italian Rebar price decline, a key product produced by the plant, but whether or not that affects the plants activity cannot be established.

Given the reported decline in Italian rebar prices and the overall negative market sentiment, coupled with a possible link to the plant activities, steel buyers should closely monitor inventory levels and negotiate contracts with suppliers to reflect the downward price trend. Analysts should focus on tracking demand fluctuations and any further impact on steel plant activity.