From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Rebar Price Surge and Export Slump: European Steel Market Overview

Europe’s steel market shows mixed signals, with Italy experiencing rising rebar prices amid export declines, contrasted by stable to increasing activity at select steel plants. As reported in “Rebar prices keep climbing in Italy amid reported limited availability,” rebar prices are escalating due to supply constraints. “Italy steel exports decline to ten-year low” and “Italy’s steel exports have dropped to a ten-year low” highlight a significant downturn in Italian steel exports. No direct connection to these trends could be established via plant activity shifts.

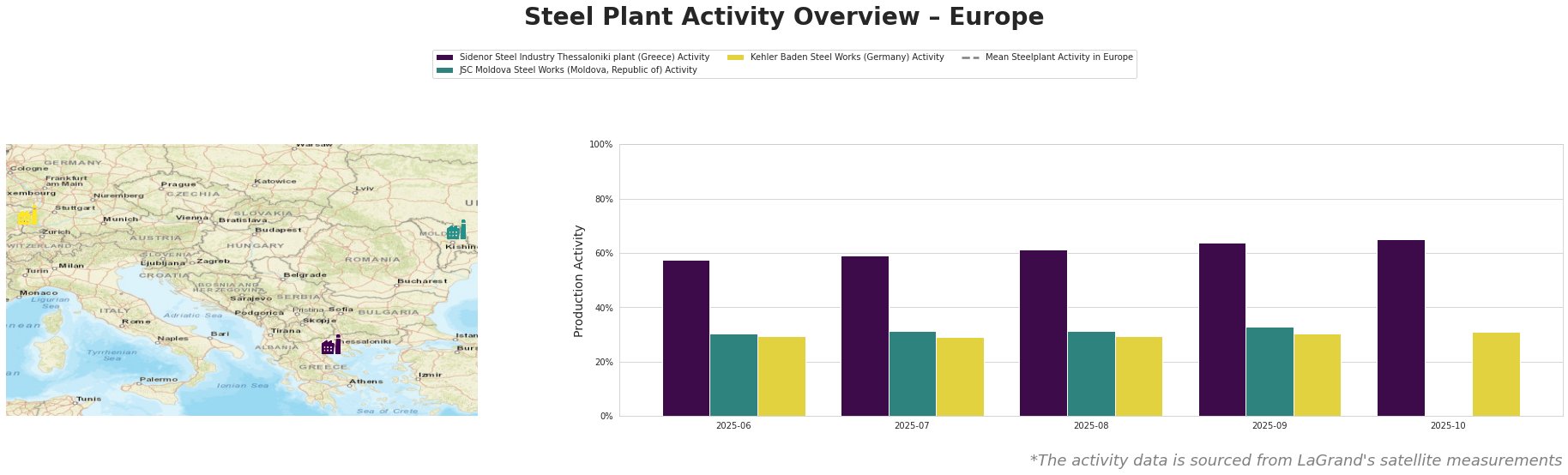

Overall, plant activity across the measured European sites displays a consistent trend between June and October 2025. Sidenor Steel Industry Thessaloniki plant (Greece) shows a gradual increase, while JSC Moldova Steel Works (Moldova, Republic of) maintained relatively stable activity, and Kehler Baden Steel Works (Germany) also saw consistent levels. The mean steel plant activity in Europe experienced a decrease in September and October.

Sidenor Steel Industry Thessaloniki plant, an electric arc furnace (EAF) based facility with a crude steel capacity of 800 thousand tonnes, mainly produces rebar, bars & coil, merchant bars and wire rod for building and infrastructure purposes. Satellite data indicates steadily increasing activity from 58% in June to 65% in October. The recent rise in activity does not directly correlate with any of the provided news articles.

JSC Moldova Steel Works, with a 1 million tonne crude steel capacity through EAF, primarily produces wire rod, rebar and billet. Its activity increased slightly from 30% in June to 33% in September. No satellite data is available for October. No direct connection between the plant’s activity and the provided news articles can be established.

Kehler Baden Steel Works, an EAF-based plant producing 2.5 million tonnes of crude steel annually, manufactures wire rod, bar, rebar, and billet for the building and infrastructure sectors. Satellite data shows relatively stable activity levels, increasing slightly from 29% in June to 31% in October. This stable activity level doesn’t directly align with any of the provided news articles.

The rising rebar prices in Italy, as reported in “Rebar prices keep climbing in Italy amid reported limited availability,” suggest potential supply challenges despite stable activity at some European steel plants. Procurement professionals focused on Italian rebar should consider:

- Securing Rebar Supply: Given the limited availability reported in Italy, proactively secure rebar supply from alternative sources, potentially including imports. Consider forward purchasing to mitigate potential price increases.

- Monitoring Export Dynamics: The decline in Italian steel exports reported in “Italy steel exports decline to ten-year low” may further tighten domestic supply, potentially driving prices higher. Closely monitor export and import data to anticipate shifts in market dynamics.

- Diversifying Suppliers: While some plants display stable activity, disruptions at facilities like Pittini Group’s Ferriere Nord can impact supply, as mentioned in “Rebar prices keep climbing in Italy amid reported limited availability“. Diversify rebar suppliers to minimize risks related to localized production issues.