From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Rebar Price Surge Amidst Stable European Longs Market: A Steel Plant Activity Analysis

Europe’s steel market presents a mixed picture, with Italian rebar prices experiencing significant increases due to constrained supply, as highlighted in “Prices continue to rise in the Italian steel reinforcement market“. This situation is occurring amidst a broader context of stability in the European longs market, reported in “European longs market stable amid seasonal and international uncertainty“, and stable thick-sheet metal prices, according to “EU thick-sheet metal prices overview: thick-sheet metal prices in Europe are stable despite seasonal slowdown“. The rise in Italian prices for rebar is potentially linked to an increase in steel plant activity at Feralpi Siderurgica Lonato steel plant in Italy, while no direct link to the other plant activities can be established.

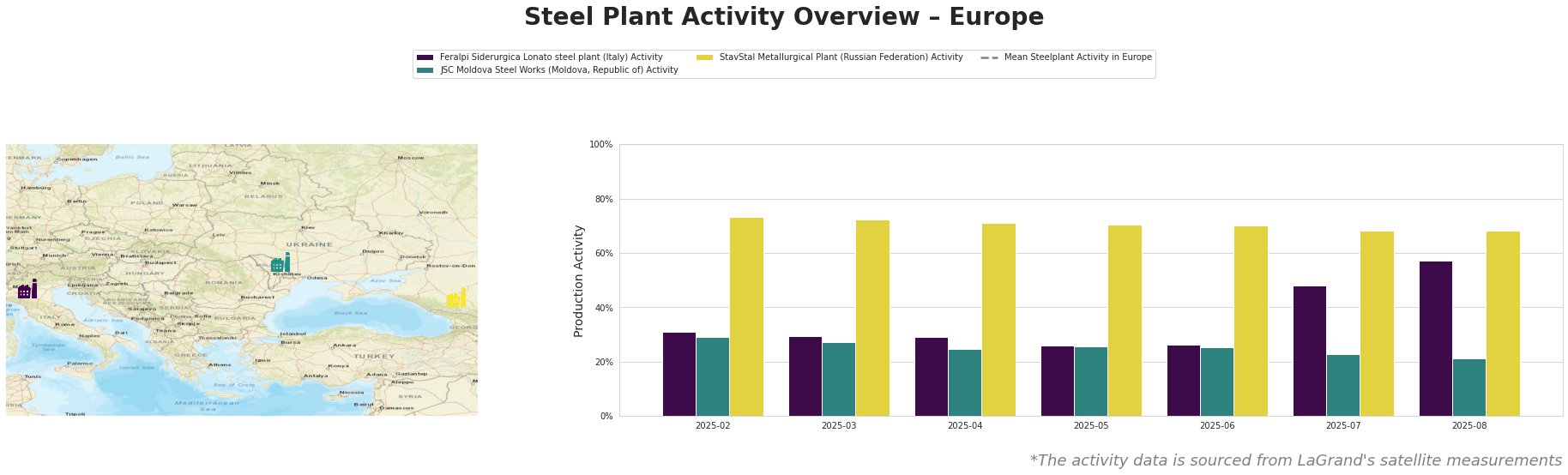

Across the observed plants, activity levels were quite varied. The provided activity data has invalid negative values for the “Mean Steelplant Activity in Europe” and cannot be used. The Feralpi Siderurgica Lonato steel plant shows a notable increase in activity. JSC Moldova Steel Works shows a generally decreasing activity trend. StavStal Metallurgical Plant’s activity is relatively stable, albeit with a slight decline.

Feralpi Siderurgica Lonato, located in the Province of Brescia, Italy, is an EAF-based steel plant with a crude steel capacity of 1.1 million tonnes per annum, producing primarily rebar, billets, mesh, and wire rod. The satellite data shows a significant increase in activity from 26% in June to 57% in August. This increase potentially reflects a response to rising Italian rebar prices and demand, as reported in “Prices continue to rise in the Italian steel reinforcement market“, however, no direct connection could be established because the steel plant is undergoing maintenance.

JSC Moldova Steel Works, situated in Transnistria, has a crude steel capacity of 1 million tonnes per annum using EAF technology, producing wire rod, rebar, and billets. The observed activity shows a continuous decrease from 29% in February to 21% in August. No direct correlation can be established between this decline and the provided news articles.

StavStal Metallurgical Plant, located in Stavropol Krai, Russia, operates with EAF technology and has a crude steel capacity of 500,000 tonnes per annum, producing square billets, rebar, and wire rod. The plant’s activity decreased slightly from 73% in February to 68% in August, showing a relatively stable operational level. No direct connection to any of the provided news articles can be established.

The increase in Italian rebar prices, detailed in “Prices continue to rise in the Italian steel reinforcement market“, alongside stable European longs market conditions “European longs market stable amid seasonal and international uncertainty“, presents a potential supply risk for buyers focused on the Italian market. Given the strong demand and manufacturers’ maintenance period, steel buyers should consider:

- Securing rebar supply from alternative sources outside of Italy, taking into account potentially higher transportation costs. The article “Turkey’s HRC exports increase by 43.1 percent in H1 2025” shows increasing exports from Turkey which might be a viable alternative.

- Negotiating contracts with built-in price adjustment mechanisms to account for potential further price increases in the short term.

- Monitoring the end of the maintenance period for Italian manufacturers, anticipating a possible price correction in September as noted in “European longs market stable amid seasonal and international uncertainty“.