From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Steel Market Outlook: Positive Momentum Backed by FTA Momentum and Plant Activity

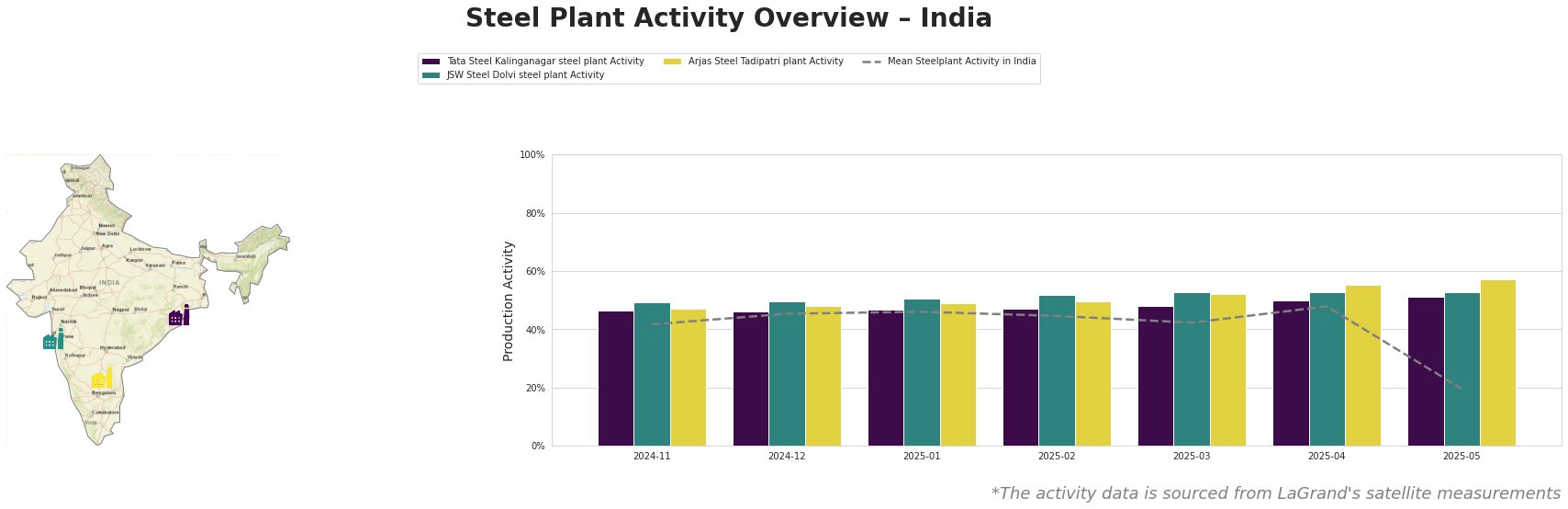

Recent developments in India’s steel sector reflect a Very Positive sentiment bolstered by robust governmental agreements and increasing plant activity. The India, UK Sign Trade Pact, PM Modi Says It Will Deepen Strategic Partnership and As India, UK Clinch Landmark Trade Deal, A Look At The Gains And Hurdles articles illustrate significant tariff reductions that stimulate trade and production capacity, particularly benefiting the automotive sector. Although no direct correlation with satellite activity data was established, the ongoing positive trajectory suggests enhanced operational efficiencies across steel plants.

Tata Steel Kalinganagar’s activity rose notably to 51.0%, reflecting ongoing investments and a strong focus on automotive supply amidst the backdrop of the India-UK FTA. The “India-UK Free Trade Agreement To Drive Down Premium Cars, SUV Prices“ emphasizes increased demand in this sector, supporting prolonged operational stability.

JSW Steel Dolvi observed consistent growth, peaking at 53.0%. A strong correlation with the India-UK FTA cuts tariffs on Indian auto imports indicates potential expansions in automotive component production and requests for premium rolled steel.

Arjas Steel Tadipatri achieved its highest activity level at 57.0%, aligning with reduced tariffs on critical imports that improve production inputs, as highlighted in the “Automotive Brands That Stand To Benefit From The FTA”.

The recent significant deviations in activity levels should alert buyers to potential supply disruptions, particularly in May 2025 where a dramatic decline to 20.0% in overall mean activity highlights the risk amid geopolitical tensions and economic shifts.

Procurement Recommendations:

– For Tata Steel Kalinganagar: Buyers should consider securing long-term contracts anticipating a sustained increase in demand from the automotive sector, directly supported by favorable trade agreements.

– For JSW Steel Dolvi: Engage with this facility to leverage growth in the automotive and transportation sectors, while monitoring material availability, given the recent high output.

– For Arjas Steel Tadipatri: Given the sharp increase in activity, it is crucial to negotiate firm agreements to mitigate risks of supply disruptions, especially in light of fluctuating operational capacities that may arise from recent trade dynamics.

In summary, the synergistic interplay of trade agreements and plant activity levels signals a strategic environment for steel procurement in India, warranting proactive engagement and strategic contracts.