From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Steel Market Outlook: Positive Growth Driven by Strategic Budget Initiatives

India’s steel sector is experiencing significant upward momentum, buoyed by strategic government initiatives as outlined in Budget 2026: Big Push For Growth, Jobs And A New Tax Era To Power Viksit Bharat. This proactive fiscal policy directly correlates with enhanced steel plant activities, evidenced by satellite data revealing noteworthy trends across key facilities.

Recent outage limitations stem from the Budget 2026: Fertilizer Subsidy Pegged Higher At Rs 1.7 Lakh Crore For FY27, emphasizing a robust commitment to economic growth and infrastructure, which in turn supports increased demand for steel. However, observed fluctuations in average steel plant activities indicate a diverse performance landscape across individual facilities.

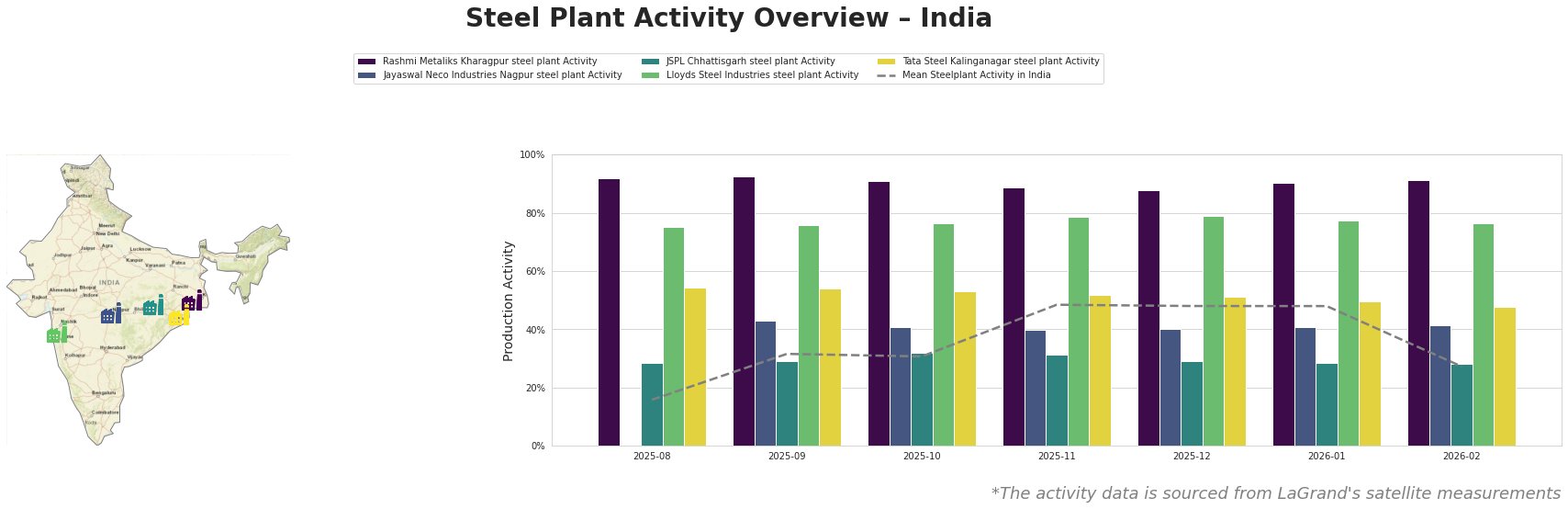

Rashmi Metaliks Kharagpur steel plant shows remarkable resilience, maintaining activity levels above 89%, notably in November 2025 with 89% and again in February 2026 at 91%. This aligns with the government’s push in the Budget 2026 for revitalization in manufacturing, likely bolstering production output responsive to increasing demand.

Jayawwal Neco Industries Nagpur saw a decline from 43% in September to stable levels around 41% through early 2026, aligning with market uncertainties. In contrast, JSPL Chhattisgarh’s diminutive activity levels (down to 28% in February) may likely reflect challenges rather than direct news correlations, as no immediate link to budgetary enhancements can be established.

Lloyds Steel exhibited steady growth, peaking at 79% in December 2025 before slight declines. The performance is directly tied to the focused government strategies aimed at increasing local industry output as promoted in the recent budget discussions.

The Tata Steel Kalinganagar facility faced stable market activity challenges reflecting national trends, with activity dropping to 48% in February—this trajectory could affect procurement strategies moving forward.

Steel buyers are advised to monitor fluctuations closely. Given the sustained high levels of activity in Rashmi Metaliks and the recovering trajectory of Lloyds, buyers may find favorable procurement opportunities in those segments. Caution is warranted for supply disruptions at JSPL and Tata Steel, which may indicate potential areas for sourcing diversification. Overall, strategic inventory management and leveraging current production outputs will be critical to align with anticipated growth stemming from the robust 2026 budgetary promises.