From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Steel Market Outlook: A Surge in Activity Amid Strategic Trade Agreements

Recent developments in India’s steel market indicate a very positive sentiment, spurred by international trade negotiations and heightened regional activity. Notably, the article “India offers US zero duties on steel and auto parts“ outlines India’s proposal to eliminate tariffs on U.S. steel imports, which coincides with recent satellite data reflecting increased activity levels across major plants. However, ongoing geopolitical tensions, such as those highlighted in “Trade, Shipping, Mail: India’s 3-Pronged Measures Against Pak, Its Response“, may impact regional trade dynamics, though no direct link to steel production changes was observed.

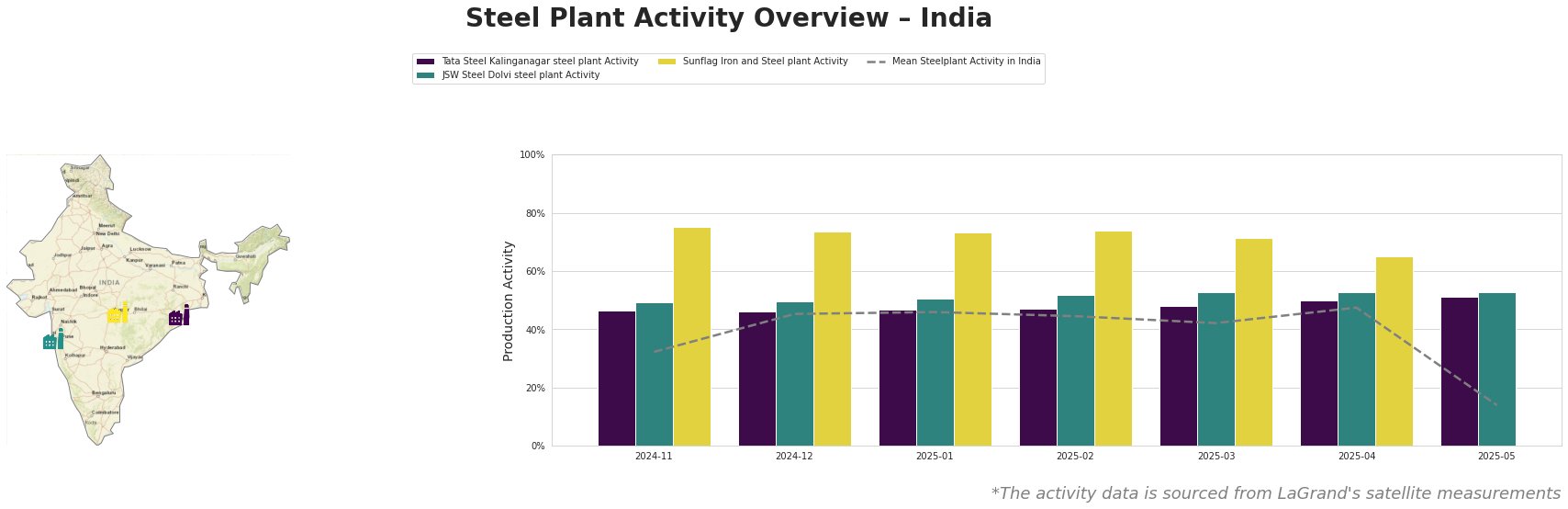

Tata Steel Kalinganagar, located in Odisha, exhibits a stable activity trend, consistently around 46-51% from late 2024 through April 2025, showcasing gradual resilience despite recent global uncertainties. The plant operates an integrated steelmaking process primarily serving the automotive sector.

JSW Steel Dolvi reflects a similar trend, with activity peaking at 53% around March 2025, aligning well with India’s favorable trade offers and the potential increase in U.S. imports. This facility primarily utilizes a combination of DRI and BF technologies and serves multiple sectors, creating a robust foundation for production resilience.

Sunflag Iron and Steel, despite being lower in overall activity, spiked to 75% in November 2024, suggesting robust demand in certain segments. However, recent activity figures remain blank, potentially indicating production halts due to regional trade impacts. These fluctuations are not explicitly connected to any recent news article; rather, they reveal internal market dynamics at play.

Impact from the developments in trade agreements and direct ties to activity levels substantiate a strategic procurement approach. Buyers should strategize around steel procurement to capitalize on potential tariff eliminations with the U.S. and the newly formed India-UK trade pact, which promises improved access.

Given the “India, UK Sign Trade Pact, PM Modi Says It Will Deepen Strategic Partnership“, steel buyers are encouraged to engage proactively with suppliers to mitigate potential supply disruptions caused by emerging geopolitical challenges with Pakistan. With JSW and Tata operating above the national mean, focusing on these plants could yield competitive pricing and availability. Steel buyers should also monitor the implications of tariff changes on U.S. imports to optimize sourcing strategies based on evolving trade dynamics.