From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Steel Expansion Drives Positive Asian Market Sentiment: Tata & SAIL Lead Capacity Surge

Asia’s steel market exhibits a positive outlook driven by significant capacity expansions in India. According to “Tata Steel plans to turn Kalinganagar into its largest production base” and “India plans to double the capacity of the steel mill in Rourkela“, major players like Tata Steel and SAIL are investing heavily in increasing their production capabilities. The satellite data does not currently reveal any direct influence on Hmisho Steel Hassia plant, State Company for Iron & Steel Basra plant, and Al Ittefaq National Steel Dammam plant activities, of the expansion projects by Tata Steel and SAIL.

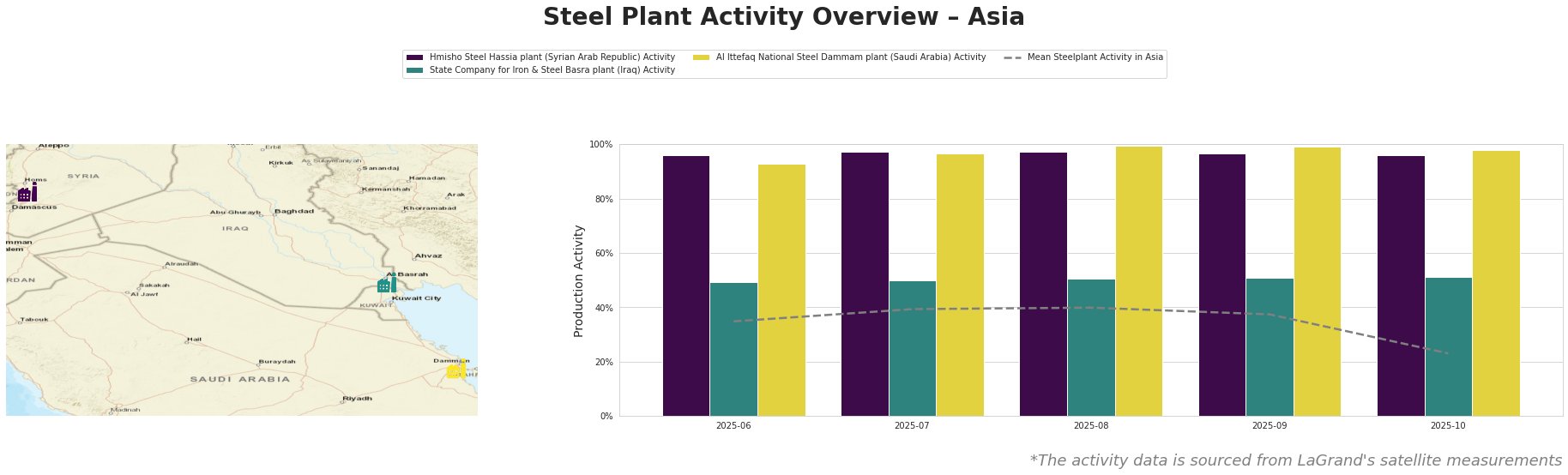

Overall, mean steel plant activity in Asia experienced fluctuations, peaking at 40% in August 2025 and then dropping significantly to 23% in October 2025. The other plants, however, show more stable, high activity. The Hmisho Steel Hassia plant in Syria consistently operated at very high activity levels, between 96% and 97%, significantly above the Asian average. The State Company for Iron & Steel Basra plant in Iraq maintained a stable activity level around 50-51%, also above the overall Asian average for most months. Al Ittefaq National Steel Dammam plant in Saudi Arabia also showed very high activity, peaking at 100% in August 2025 and remaining above 90% throughout the observed period. The drop in overall Asian activity in October is not reflected in any of these plants, and no direct connection to the named news articles can be established.

Hmisho Steel Hassia plant, located in Homs, Syria, demonstrates remarkably stable and high activity (96-97%) despite regional market dynamics. The plant has a crude steel capacity of 800,000 tons per year, utilizing both BF and EAF technologies. The plant is certified by ResponsibleSteel. This contrasts with the observed drop in the overall mean Asian steel plant activity in October 2025, suggesting localized factors may be influencing its output. No direct link to the news articles about Indian expansion can be established.

The State Company for Iron & Steel Basra plant in Basra, Iraq, shows a more moderate but stable activity level around 50-51%. This electric arc furnace (EAF)-based plant with a 500,000 tons/year crude steel capacity, also certified by ResponsibleSteel, primarily produces semi-finished products like billets. Its consistent performance doesn’t reflect the wider Asian market fluctuations. There are no explicit connections between the expansion plans of Tata Steel and SAIL and the activity of this plant.

Al Ittefaq National Steel Dammam plant, situated in the Eastern Province of Saudi Arabia, also maintains very high activity levels, nearing or reaching 100%. This integrated (DRI-EAF) plant, with a crude steel capacity of 1 million tons per year and a pelletizing capacity of 2.5 million tons, produces semi-finished products. The stable high activity contrasts the overal Asian drop in october. There is no apparent impact from, or direct connection to, the developments described in the named news articles.

With Indian steelmakers expanding capacity as highlighted in “Tata Steel plans to turn Kalinganagar into its largest production base” and “India plans to double the capacity of the steel mill in Rourkela,” buyers should anticipate increased availability of steel from India in the medium term. However, given that “Demand for steel in India remains on a growth trajectory” anticipate that domestic demand might absorb a large part of that increased capacity. Procurement strategists should leverage SAIL’s and Tata Steel’s expansion plans to negotiate potentially favorable contract terms, but be aware of increasing scrap costs. No supply disruptions were observed in the selected steel plants.