From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Infrastructure Push Drives Optimistic Steel Outlook Despite Green Transition Challenges

Asia’s steel market sentiment is very positive, driven by anticipated demand increases in India and environmental compliance changes. The optimistic outlook is supported by news of large-scale infrastructure investments: “Investments in infrastructure will support additional demand for steel in India, – minister“. While these developments promise growth, the transition to greener steel production, as outlined in “Ernst & Young: India’s green hydrogen cost for steelmaking to halve by 2030” and “New Environmental Compliance Standards Introduced for Steel Production in Asia“, present challenges and opportunities. The provided satellite activity data shows fluctuations in plant activity, and where possible, these will be linked to the named news articles.

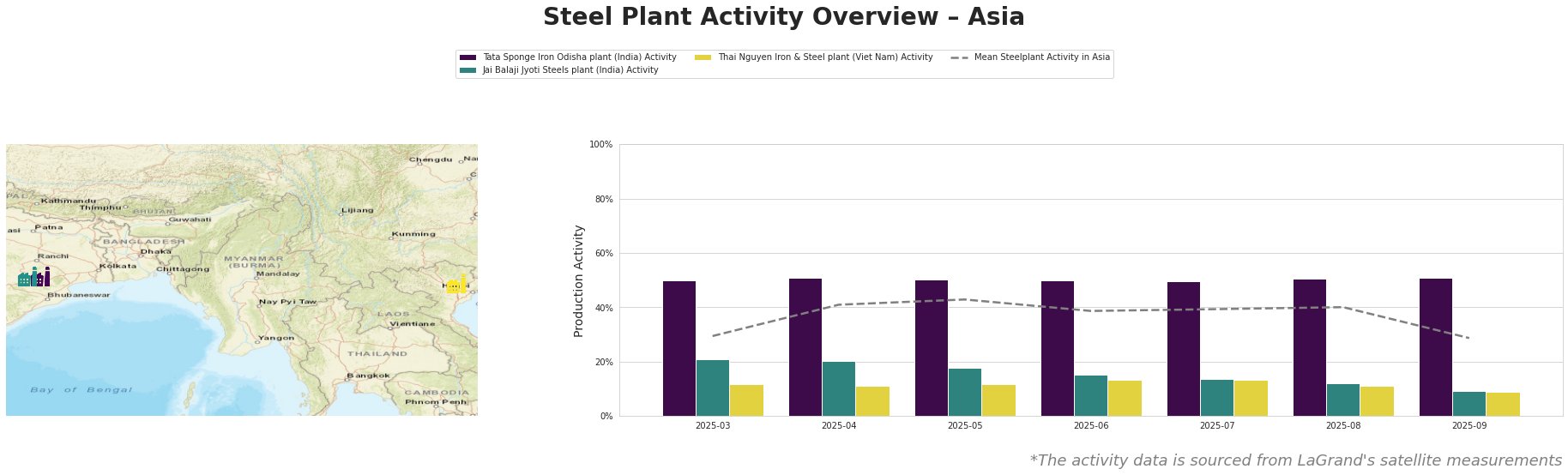

The mean steel plant activity in Asia peaked in May 2025 at 43.0% and then decreased significantly to 29.0% in September 2025. Tata Sponge Iron Odisha plant has remained relatively stable, hovering around 50-51%. Jai Balaji Jyoti Steels plant has shown a consistent decline in activity, reaching a low of 9.0% in September 2025. Thai Nguyen Iron & Steel plant has had relatively low and stable activity, with a slight decrease to 9.0% in September 2025.

Tata Sponge Iron Odisha plant: This plant, located in Odisha, India, focuses on ironmaking using DRI technology, with a DRI capacity of 400 ttpa. Satellite data shows the plant’s activity remaining stable around 50-51% between March and September 2025, significantly above the mean activity for Asia. While “Investments in infrastructure will support additional demand for steel in India, – minister” could positively impact the plant, as it increases overall demand for steel products, a direct connection between the plant’s activity levels and the news is not explicitly established in the provided information.

Jai Balaji Jyoti Steels plant: Also located in Odisha, India, this plant is an integrated steel producer with a DRI capacity of 120 ttpa and an EAF capacity of 92 ttpa. It produces crude, semi-finished, and finished rolled products. The plant’s activity has consistently declined from 21.0% in March 2025 to 9.0% in September 2025, significantly below the mean activity for Asia. The EY report “Ernst & Young: India’s green hydrogen cost for steelmaking to halve by 2030” mentions economic and mindset barriers among Indian steelmakers slowing the transition to greener technologies, potentially impacting plants relying on older technologies. However, a direct connection between the plant’s activity levels and the news articles cannot be explicitly established.

Thai Nguyen Iron & Steel plant: Located in Thai Nguyen, Viet Nam, this plant has a crude steel capacity of 500 ttpa, utilizing both BF and DRI processes. Its activity has been relatively low and stable. In September 2025 activity dropped to 9%. While “New Environmental Compliance Standards Introduced for Steel Production in Asia” may pose challenges and require investments in cleaner technologies, a direct impact on the plant’s recent activity cannot be explicitly established based on the provided information.

Given the consistent decline in activity at the Jai Balaji Jyoti Steels plant, which is below average compared to mean activity, steel buyers should:

- Monitor this plant closely for potential supply disruptions. The steady decline suggests possible operational challenges or a strategic shift. Buyers who rely on products like DRI, billets, bars, and wire rods from this plant need to consider alternative suppliers.

- Diversify sourcing. To mitigate risks associated with potential supply disruptions from Jai Balaji Jyoti Steels, buyers should broaden their supplier base.

- Evaluate alternative suppliers. The report clearly states that India plans to invest heavily in infrastructure and will need to source suppliers that can deliver with the new imposed environmental compliance standards. Thai Nguyen Iron & Steel plant can potentially fulfill the demand, as the plant uses both BF and DRI process.