From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s DRI Production Soars: Rotary Kilns Lead Growth Amidst Stable Trade

India’s direct reduced iron (DRI) sector is experiencing robust growth, fueled by rotary kiln production. This trend is supported by the news article “Report: Worldwide DRI Production Sets New Record,” which highlights a significant 13.9% rise in Indian rotary kiln-based DRI output. Further solidifying this positive trend, “Global DRI output up nine percent in July 2025” indicates that India led global DRI production in July 2025 with 4.98 million metric tons. While “Global DRI trade to remain stable in 2025 despite tariffs and sanctions” suggests stable trade flows, the focus remains on domestic production increases.

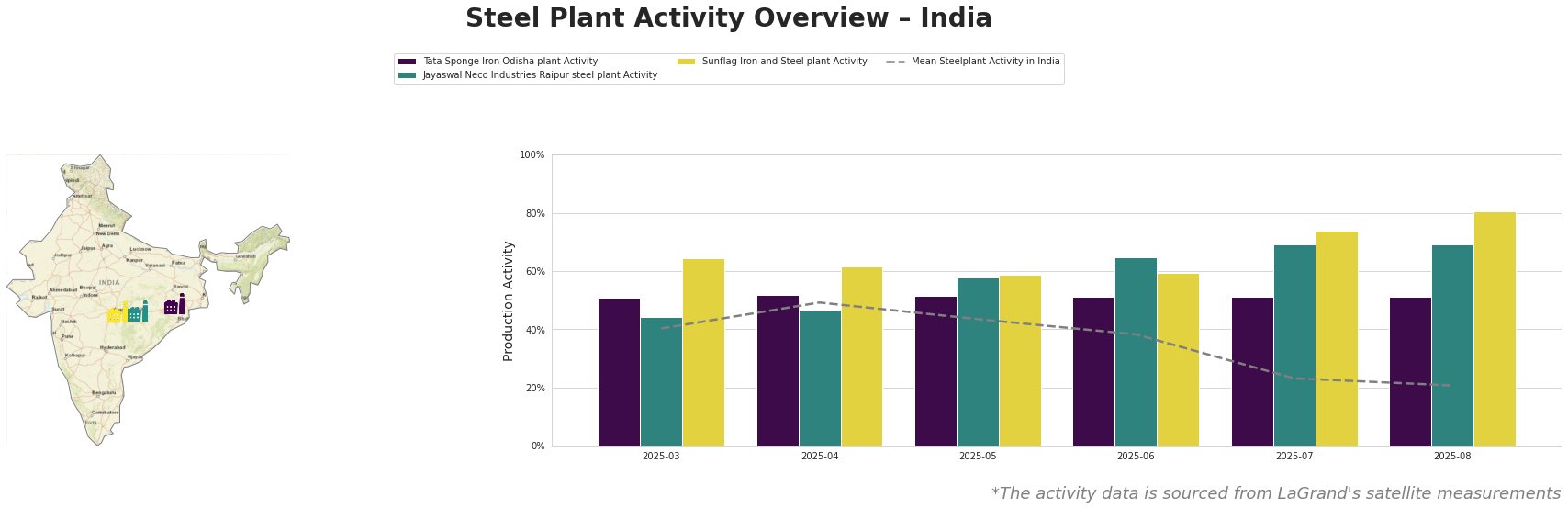

The average steel plant activity in India has generally decreased between March and August 2025, falling from 40% to 21%. Notably, July and August saw the lowest activity levels. In contrast, the Tata Sponge Iron Odisha plant consistently maintained an activity level around 51-52% throughout the period. Jayaswal Neco Industries Raipur steel plant saw an increase in its activity from 44% in March to 69% in August, while the Sunflag Iron and Steel plant activity shows the most visible increase from 64% to 80% over the same period. The significant rise in activity at Jayaswal Neco Industries and Sunflag Iron and Steel Plants from June to August coincides with the period when “Global DRI output up nine percent in July 2025,” which names India as the leader in DRI output.

Tata Sponge Iron Odisha plant produces 400 thousand tonnes per annum (ttpa) of DRI using waste heat recovery. While the average steel plant activity in India has dropped significantly between March and August 2025, this plant’s activity remained relatively stable near 51-52%, consistently above the national average. Given its stable production and DRI focus, Tata Sponge Iron Odisha likely contributes steadily to India’s overall DRI output. No direct connection between the plant activity and the named news articles can be established.

Jayaswal Neco Industries Raipur steel plant, an integrated plant with 270 ttpa DRI capacity, BF with 750 ttpa capacity, and EAF, experienced a notable increase in activity levels from 44% in March 2025 to 69% in both July and August. This rise corresponds with the increased DRI production reported in “Global DRI output up nine percent in July 2025” and likely indicates increased utilization of its DRI and BF capacity to capitalize on growing DRI demand. This plant’s increased activity supports the overall trend of rising DRI production in India as highlighted in “Report: Worldwide DRI Production Sets New Record“.

Sunflag Iron and Steel plant in Maharashtra, with an integrated setup featuring both BF (300 ttpa) and DRI (262 ttpa) along with a 500 ttpa EAF, exhibited a substantial increase in observed activity, reaching 80% in August 2025. Its activity rose from 64% in March, peaking in August. This plant’s increasing activity may suggest it’s scaling up DRI production in response to favorable market conditions, potentially contributing to the growth trend highlighted in “Report: Worldwide DRI Production Sets New Record.” The end products of the plant are bars and coils for the automotive industry.

Market Implications & Procurement Actions:

The news article “Report: Worldwide DRI Production Sets New Record” paired with sustained high activity at the Tata Sponge Iron Odisha plant, coupled with rising activity at Jayaswal Neco Industries and Sunflag Iron and Steel plants indicates a stable and potentially growing DRI supply.

- For Steel Buyers: Given the rising DRI production, particularly from rotary kiln-based plants like Jayaswal Neco Industries, explore opportunities to diversify DRI sourcing. Steel buyers should proactively negotiate long-term contracts with DRI producers, especially those demonstrating increased activity and capacity utilization, to secure stable supply amidst growing demand, as reported in “Global DRI output up nine percent in July 2025“.

- For Market Analysts: Closely monitor capacity utilization rates of DRI plants, especially those using rotary kiln technology. Analyze the impact of captive power plants on DRI production costs and competitiveness. Track Sunflag Iron and Steel plant activity as its expansion could signal further DRI supply increases. Analyze the interplay of stable DRI trade as reported in “Global DRI trade to remain stable in 2025 despite tariffs and sanctions” with domestic Indian DRI production increases.