From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndian Steel Output Rises Amidst Coke Shortages; Chinese Production Mixed

In Asia, steel production trends are diverging, with Indian output increasing while some Chinese plants show reduced activity. JSW Steel’s production surge, detailed in “India’s JSW Steel Limited achieves 19% rise in consolidated crude steel output in July 2025,” contrasts with activity reductions observed at certain WISCO Group Kunming Steel facilities. However, there is no direct relationship between the JSW article and the WISCO Group Kunming Steel plants’ observed activity. The JSW article titled “JSW Steel seeks to increase its coke import quotas to cover shortages” highlights potential constraints on continued production increases.

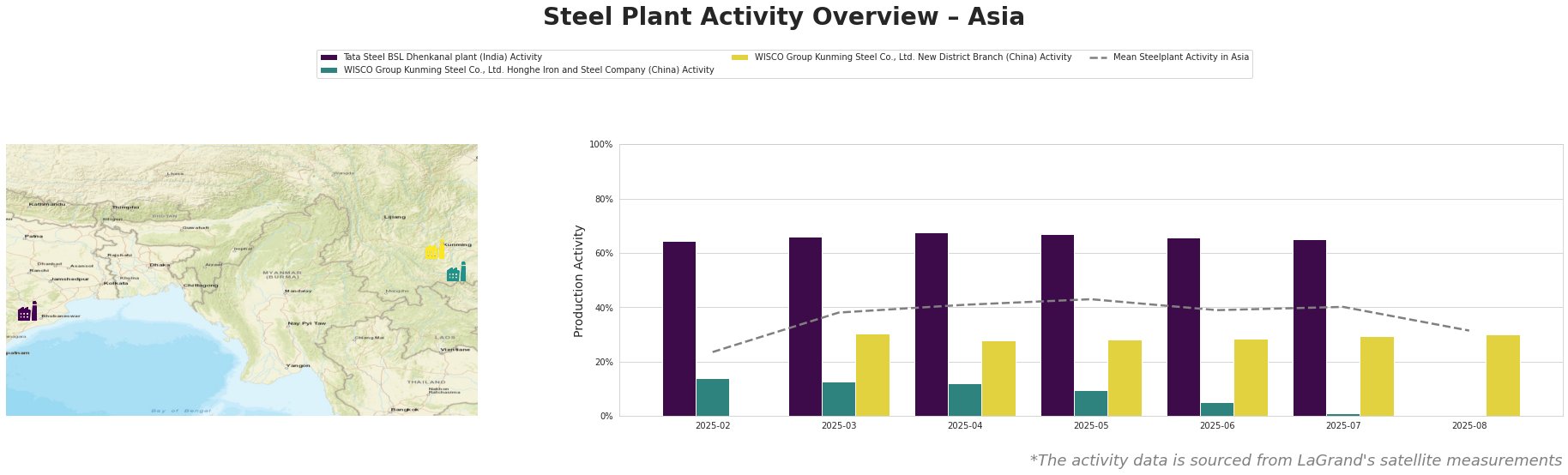

The mean steel plant activity in Asia reached a peak in May 2025 at 43% and has been decreasing since, reaching 31% in August 2025.

Tata Steel BSL Dhenkanal plant in India, an integrated steel plant with BF and DRI capabilities, showed relatively stable activity from February to July 2025, hovering around 65-67%, consistently exceeding the Asian average. The plant’s activity showed a slight drop from 67% to 65% in July 2025. This stability, while average Asian activity has dropped, aligns with the increased production reported by JSW Steel in “India’s JSW Steel Limited achieves 19% rise in consolidated crude steel output in July 2025,” suggesting a broader trend of increasing Indian steel production, although Tata Steel is not explicitly mentioned in the news articles.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company (China), an integrated BF steel plant producing finished rolled products, experienced a significant decline in activity. From February to August 2025, its activity plummeted from 14% to 0%. This sharp decrease contributes significantly to the lower mean steel plant activity in Asia. There is no direct connection between the reported decline in observed plant activity and the provided news articles.

WISCO Group Kunming Steel Co., Ltd. New District Branch (China), another integrated BF steel plant, maintained a stable activity level around 28-30% from March to August 2025. Despite the overall downward trend in Asian steel plant activity, this plant’s consistent output provides some stability. There is no direct connection between the plant’s activity and the provided news articles.

JSW Steel’s pursuit of increased coke import quotas, detailed in “JSW Steel seeks to increase its coke import quotas to cover shortages,” indicates potential constraints on the company’s ability to sustain its current production levels. For steel buyers, this signals a potential future supply risk from JSW Steel if the coke shortage is not resolved and quotas are not increased. Procurement professionals should closely monitor the outcome of JSW Steel’s request for higher coke import quotas. Diversifying supply sources and negotiating flexible delivery schedules with alternative suppliers could mitigate potential disruptions if JSW Steel faces production cuts due to coke shortages. Closely monitor domestic Indian price trends.