From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndian Steel Market Surges: Tata Boosts Production Amid Pellet Growth, but Coal Imports Dip

India’s steel market displays a very positive sentiment, driven by increased production and strategic investments, although shifts in coal imports and regional activity variations warrant close monitoring.

Tata Steel’s record production highlights the sector’s dynamism. As reported in “Tata Steel increased steel production in India by 4% y/y in FY2024/2025“, the company achieved a record 21.7 million tons of steel production in India. This coincides with a broader increase in iron ore pellet production, detailed in “India increased production of iron ore pellets by 5% y/y in FY2024/2025“, which rose to 105 million tons. Conversely, “India’s coal imports drop in Apr 2024-Feb 2025” indicates a 9.2% decrease in coal imports, signaling a move towards greater self-sufficiency in energy resources. While no direct link can be explicitly established between this coal import decrease and observed plant activities, the increase of domestic iron ore and steel production at the same time are strongly related.

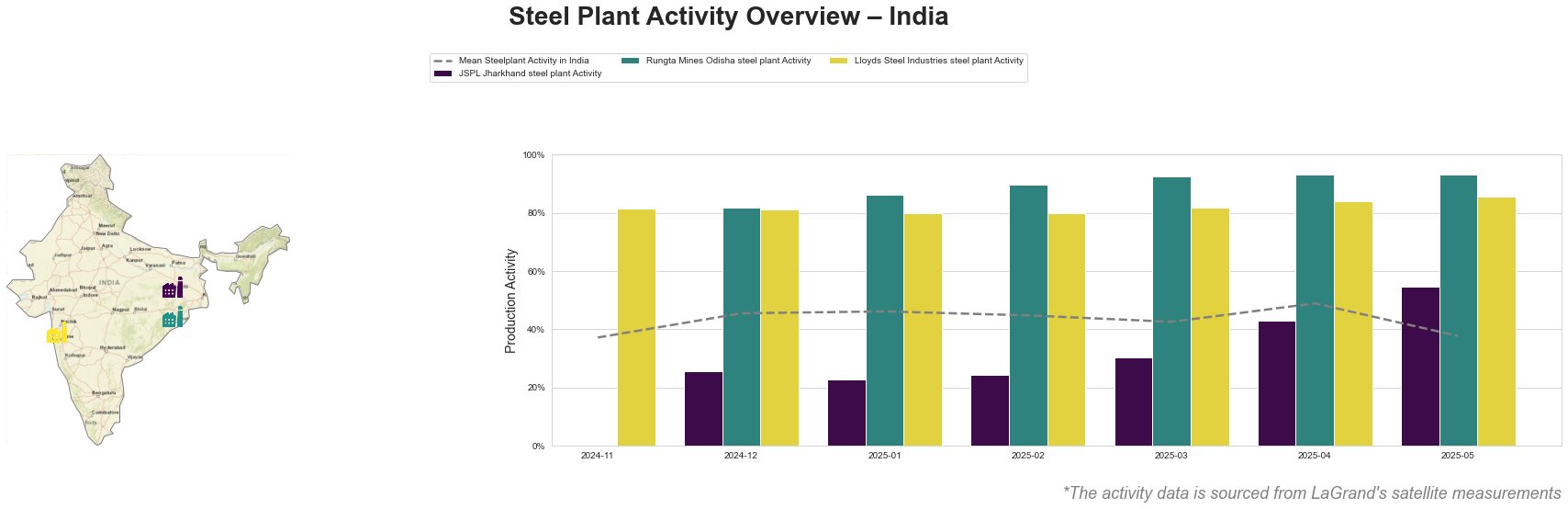

The mean steel plant activity in India fluctuated, peaking at 49% in April 2025 before dropping to 38% in May 2025. Rungta Mines Odisha consistently showed high activity, reaching 93% in March, April, and May 2025, significantly above the mean. Lloyds Steel Industries in Maharashtra maintained a stable, high activity level, around 80-85% throughout the observed period. In contrast, JSPL Jharkhand experienced lower activity levels initially but saw a significant increase to 55% in May 2025.

JSPL Jharkhand steel plant

JSPL’s Jharkhand plant, equipped with electric arc furnaces (EAF) and a capacity of 1.6 million tons of crude steel, focuses on semi-finished products like wire rods and bars. The plant’s activity initially lagged behind the national average, bottoming out at 23% in January 2025 but sharply increased to 55% in May 2025. No direct connection to the provided news articles can be established for this plant.

Rungta Mines Odisha steel plant

Rungta Mines in Odisha, with a capacity of 1.925 million tons of crude steel, employs both integrated (BF and DRI) processes. Its activity consistently remained high, around 80-90%, significantly exceeding the national average. The high activity levels at Rungta Mines Odisha steel plant is related to “India increased production of iron ore pellets by 5% y/y in FY2024/2025“, as their pelletizing capacity of 1.47 million tons benefits from increased domestic steel production and rising pellet use in blast furnaces.

Lloyds Steel Industries steel plant

Lloyds Steel Industries in Maharashtra, with a capacity of 641,000 tons of crude steel using EAF technology, produces semi-finished and finished rolled products like slabs and cold-rolled coils. Its activity remained consistently high, around 80%, and above the national average. The sustained high activity level at Lloyds Steel Industries could be linked to the increased iron ore imports detailed in “India imported about 2.8 million tons of iron ore in January-April“, as the plant sources raw materials to support its operations.

Evaluated Market Implications

The data from Tata Steel’s increased production, as highlighted in “Tata Steel increased steel production in India by 4% y/y in FY2024/2025“, combined with sustained high activity at plants like Rungta Mines and Lloyds Steel, suggests robust steel supply in the near term. This provides stability for steel buyers.

However, the increased imports of iron ore, as reported in “India imported about 2.8 million tons of iron ore in January-April“, indicates potential regional supply chain vulnerabilities, particularly for plants reliant on specific import routes like the plant in Maharashtra.

Recommended Procurement Actions:

* Steel Buyers: Given Tata Steel’s production increase and overall pellet production growth, proactively engage with Tata Steel for potential long-term supply agreements to leverage their increased capacity and cost efficiencies.

* Market Analysts: Closely monitor the Odisha region due to Rungta Mines’ consistently high activity, suggesting potential opportunities to source materials from this area. Additionally, track iron ore import data closely, particularly from Oman and Australia, to anticipate potential disruptions and adjust procurement strategies accordingly, especially for plants in Maharashtra, for which Lloyds Steel Industries is representative.