From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndian Steel Market Surge: Tata Steel Expansion Drives Record Production Amid Pellet Oversupply Concerns

India’s steel market demonstrates strong growth, driven by increased production and significant capital investments, tempered by potential pellet oversupply issues.

Recent activity at key Indian steel plants correlates with news of increased production and planned capital expenditures. As “India’s Tata Steel sees 117% rise in consolidated net profit in Q4 FY 2024-25, profits decline from domestic operations” and “Tata Steel increased steel production in India by 4% y/y in FY2024/2025“, satellite data reflect increased activity, especially at plants linked to iron ore production. The former details quarterly sales in India reached approximately 21 million metric tons, a record high, supported by the ramp-up of the new blast furnace and nearly full capacity utilization at existing facilities. This directly relates to the increased observed mean activity.

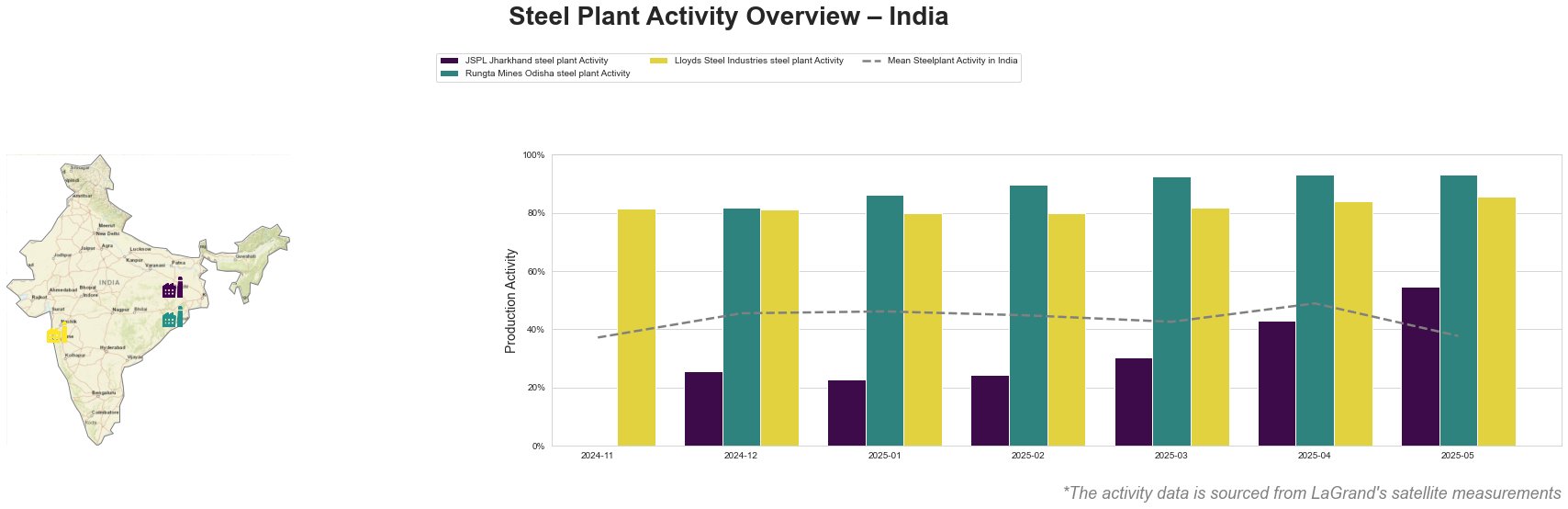

The mean steel plant activity in India shows a fluctuating trend. It increased from 37% in November 2024 to a peak of 49% in April 2025 before dropping to 38% in May 2025. Rungta Mines Odisha steel plant consistently showed the highest activity, reaching 93% in March, April, and May 2025, significantly above the mean. Lloyds Steel Industries steel plant maintained a relatively stable high activity level, ranging from 80% to 85%. JSPL Jharkhand steel plant activity was consistently below the mean but showed a notable increase to 55% in May 2025.

JSPL Jharkhand steel plant, located in Jharkhand, operates with a 1.6 million tonne per annum (ttpa) EAF-based capacity, producing semi-finished products like wire rod and bars. Satellite data shows the plant activity increased to 55% in May 2025, a significant rise from earlier months. While no direct connection to the provided news articles can be explicitly established, this rise could indicate increased production aligning with overall market growth.

Rungta Mines Odisha steel plant, located in Odisha, is an integrated steel plant with a 1.925 ttpa crude steel capacity, utilizing both BF/BOF and DRI/EAF technologies. The plant’s activity remained consistently high, peaking at 93% between March and May 2025. This high level of activity could be linked to the increased iron ore pellet production reported in “India increased production of iron ore pellets by 5% y/y in FY2024/2025“, potentially indicating a focus on pellet production at this site.

Lloyds Steel Industries steel plant in Maharashtra has a 0.641 ttpa capacity, relying on EAF technology to produce semi-finished and finished rolled products. The plant consistently maintained high activity levels, around 80-85%, throughout the observed period. No direct connection to specific news articles can be established to explain this consistent high activity, however, its end-user sectors being energy and tools and machinery could hint at constantly high demand for it’s products.

India’s increased iron ore pellet production, as reported in “India increased production of iron ore pellets by 5% y/y in FY2024/2025”, coupled with a 40% decrease in exports, suggests a potential oversupply situation. This situation could lead to downward pressure on pellet prices. The news that “Tata Steel plans $1.76 billion capex for operations in India, UK and Netherlands in FY 2025-26” could increase demand for raw materials, including iron ore pellets.

Evaluated Market Implications:

- Potential localized pellet oversupply: The news indicates rising pellet production while pellet exports dropped significantly.

- Procurement action: Steel buyers should actively monitor pellet prices and consider negotiating contracts that reflect the potential oversupply situation. The news highlights Odisha as a major pellet-producing region; thus, buyers focusing on plants in that region may find more favorable pricing.

- Procurement action: Buyers should also factor in the planned capital expenditures by Tata Steel (“Tata Steel plans $1.76 billion capex for operations in India, UK and Netherlands in FY 2025-26”), anticipating a potential increase in demand for raw materials in the medium term, mitigating the pellet oversupply concerns and supporting stable domestic steel production.