From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndian Steel Market: Production Up, Imports Down, Select Plant Activity Shifts

India’s steel sector presents a mixed landscape as domestic production increases and imports decrease, but specific plant activities show notable variations. According to “India’s steel imports down 36% in September, remains net importer,” steel imports have significantly decreased while domestic production has risen. Simultaneously, “India’s NMDC Limited sees iron ore output rise 23% in September,” indicating increased raw material availability. Satellite data reveals corresponding activity changes at individual steel plants, though not all can be directly linked to these specific news events.

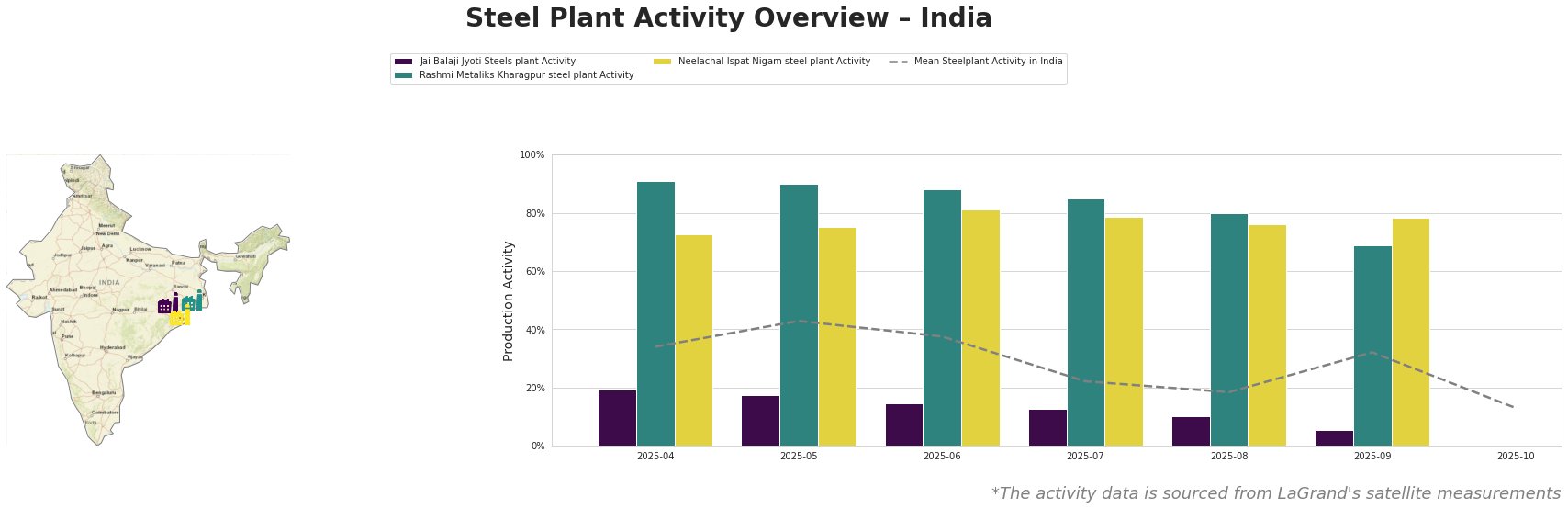

The mean steel plant activity in India fluctuated throughout the observed period, peaking in May at 43% and declining to 13% by October. Jai Balaji Jyoti Steels plant, an Odisha-based plant utilizing DRI and EAF technology with a 92 ttpa crude steel capacity, consistently operated below the national average, experiencing a significant activity drop to 5% by September. This sharp decline does not appear to have a direct correlation with the news about increased iron ore production from “India’s NMDC Limited sees iron ore output rise 23% in September,” suggesting other factors may be influencing production. Rashmi Metaliks Kharagpur steel plant, a West Bengal facility with integrated BF and DRI processes and a 1500 ttpa crude steel capacity, maintained high activity levels, although a decline from 91% in April to 69% in September was observed. Neelachal Ispat Nigam steel plant in Odisha, an integrated BF-BOF plant with an 1100 ttpa crude steel capacity, exhibited relatively stable activity, fluctuating between 73% and 81% before a moderate decline towards the end of the period.

Jai Balaji Jyoti Steels plant in Odisha, focusing on crude, semi-finished, and finished rolled products, particularly DRI, billets, bars, and wire rods, witnessed a sharp decline in activity, reaching a low of 5% in September. It is unclear whether the decrease in activity observed at the Jai Balaji Jyoti Steels plant correlates to MOIL’s increased manganese prices in “India’s MOIL Limited hikes prices for all manganese ore grades for Oct delivery,” as the plant details do not explicitly mention a reliance on manganese. The Rashmi Metaliks Kharagpur steel plant, a key producer of DRI, pig iron, billets, TMT bars, DI pipes and wire rod, saw a notable drop in activity from April to September. While “India’s NMDC Limited sees iron ore output rise 23% in September” reported increasing iron ore output, the Rashmi Metaliks plant still registered a decrease in activity. Neelachal Ispat Nigam steel plant, producing pig iron, LAM coke, and billets, exhibited more stable activity.

The decrease in steel imports reported in “India’s steel imports down 36% in September, remains net importer,” combined with the varying activity levels at key steel plants, warrants careful consideration for steel buyers. The significant decline in activity at Jai Balaji Jyoti Steels plant may signal potential supply constraints for its specific product lines (DRI, billets, bars, wire rods). Therefore, steel buyers relying on these products should explore alternative sources or secure supplies promptly. Given the overall increase in domestic steel production, as highlighted in “India’s steel imports down 36% in September, remains net importer,” the Indian steel market shows resilience, despite the plant-specific production adjustments.