From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia-US Trade Talks: Steel Tariff Exemption Sought Amid Steady Plant Activity in Asia

Asia’s steel market is exhibiting neutral sentiment as India seeks tariff exemptions from the US, potentially influencing regional trade flows. Ongoing India-US trade negotiations, as reported in “India-US Trade Agreement Talks “Progressing Very Well”: Commerce Secretary” and “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US,” aim to resolve tariff issues before the July 9th deadline. While these trade discussions are underway, satellite-observed activity levels at key Asian steel plants show relatively stable high utilization rates, but no direct relationship between trade-talk developments and observable steel plant activity could be established.

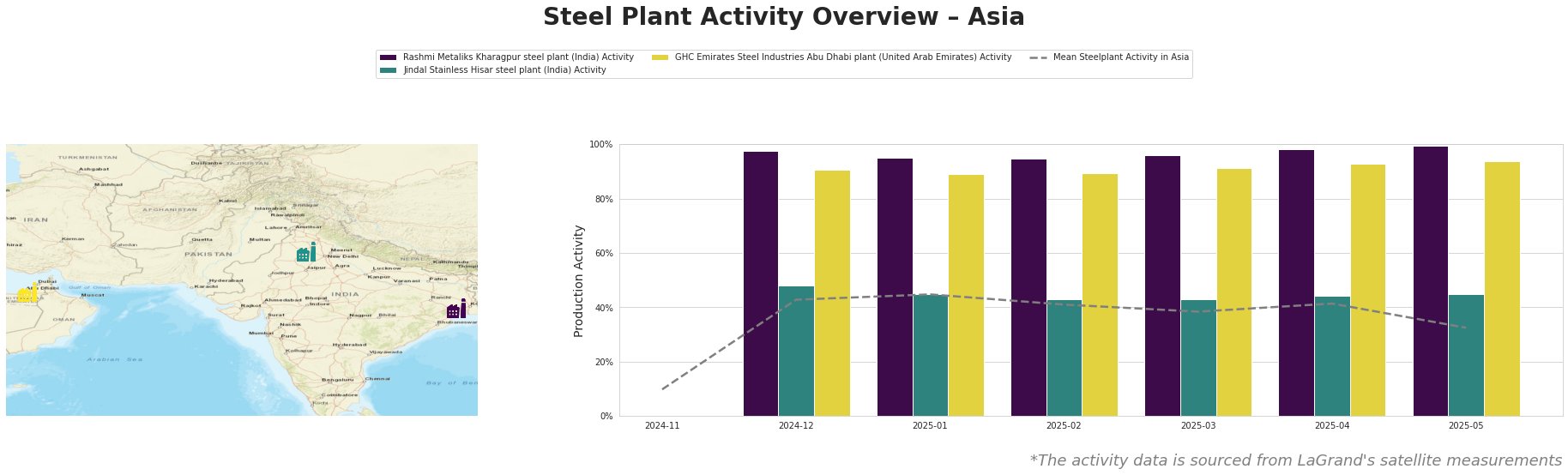

The mean steel plant activity in Asia initially increased sharply from a base of 10.0 in November 2024 to 43.0 by the end of December 2024. It peaked at 45.0 in January 2025, subsequently exhibiting a slight decline to 32.0 by the end of May 2025.

Rashmi Metaliks Kharagpur steel plant, an integrated steel plant in West Bengal, India, demonstrated consistently high activity, ranging from 95.0 to 99.0 between December 2024 and May 2025, significantly above the Asian average. The plant, with a DRI capacity of 1.5 million tonnes and a BF capacity of 200,000 tonnes, produces DRI, pig iron, billets, and TMT bars. Its steady high utilization does not show any immediate impact from the India-US tariff discussions reported in “India Working On US Reciprocal Tariff Exemption, Interim Deal By July 8” and “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US“.

Jindal Stainless Hisar steel plant, located in Haryana, India, showed relatively stable activity. Its activity level has remained fairly stable between 43.0 and 48.0 between December 2024 and May 2025, slightly above the overall Asian average in the last month of the period. This plant primarily utilizes EAF technology with a capacity of 800,000 tonnes and produces stainless steel products. Again, no connection to the India-US trade talks mentioned in “India-US Trade Agreement Talks “Progressing Very Well”: Commerce Secretary” can be explicitly established based on observed activity.

GHC Emirates Steel Industries Abu Dhabi plant, an integrated DRI-based steel plant, exhibited a steady increase in activity, rising from 90.0 in December 2024 to 94.0 by May 2025, significantly above the regional average. The plant has a DRI capacity of 2 million tonnes and an EAF-based crude steel capacity of 3.5 million tonnes, producing rebar, wire rod, and heavy sections. There is no direct correlation to the India-US trade negotiations.

The ongoing trade negotiations between India and the US, particularly India’s pursuit of a full tariff exemption as detailed in “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US“, could potentially shift trade dynamics.

Specifically, If India secures the tariff exemption, increased steel exports to the US could follow, potentially impacting regional supply chains. Given the high activity at Rashmi Metaliks, a potential increase in exports from India to the US could absorb some of their production, possibly stabilizing domestic prices.

Recommended Procurement Actions:

Steel buyers and market analysts should closely monitor the outcome of the India-US trade talks. Specifically, track the July 9th deadline for the tariff suspension, highlighted in “India Working On US Reciprocal Tariff Exemption, Interim Deal By July 8“. If an agreement for tariff exemptions is reached, analyze potential shifts in Indian steel export volumes and adjust procurement strategies accordingly. Diversify supply sources to mitigate risks associated with potential shifts in trade flows driven by the trade agreement.