From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia-US Trade Talks & Steel Output: Rashmi Metaliks Leads Asian Plant Activity Amid Tariff Negotiations

Asia’s steel market shows positive sentiment as India-US trade negotiations progress. “India-US Trade Agreement Talks “Progressing Very Well”: Commerce Secretary” and related articles highlight ongoing efforts to address tariffs and market access. Satellite data reveals no direct relationship between the reported trade deal progression and the observed activity levels at the selected steel plants.

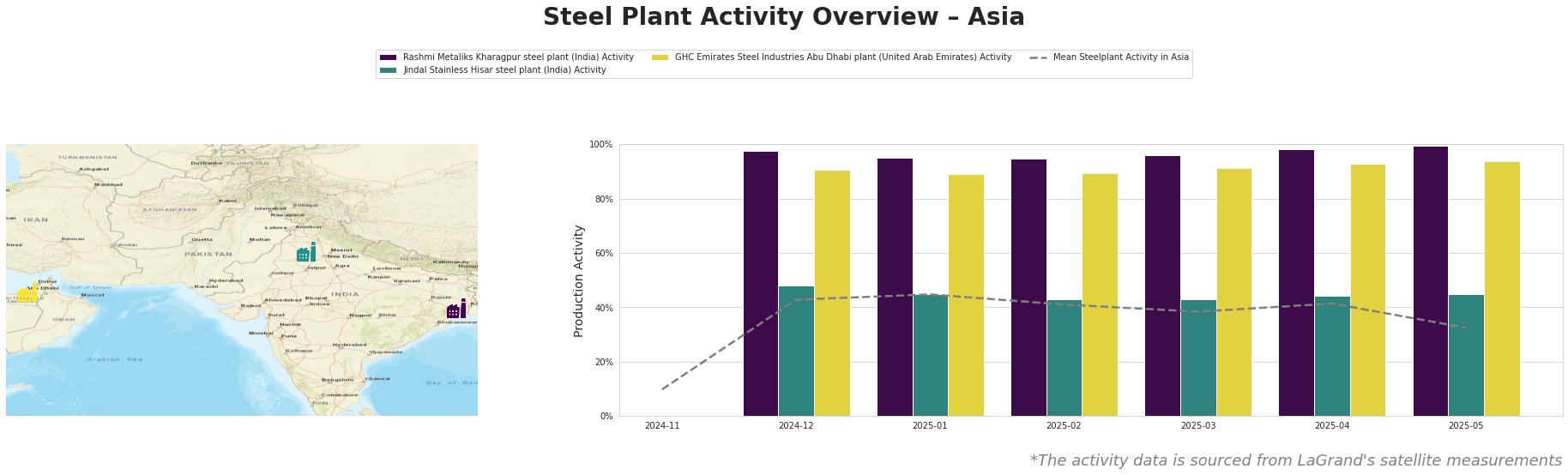

The mean steel plant activity in Asia shows a fluctuating trend. From December 2024 to January 2025, it rose from 43.0% to 45.0%, then declined to 32.0% by May 2025. Rashmi Metaliks Kharagpur consistently exhibited the highest activity levels, reaching 99.0% in May 2025. Jindal Stainless Hisar showed a relatively stable activity, hovering around 43.0%-48.0%. GHC Emirates Steel Industries maintained high activity, increasing from 90.0% in December 2024 to 94.0% in May 2025.

Rashmi Metaliks Kharagpur steel plant, a major Indian producer with integrated BF and DRI processes and a crude steel capacity of 1.5 million tonnes, has consistently operated at high activity levels. The plant’s activity has been consistently high, ranging from 95% to 99% between January and May 2025, significantly above the Asian average. “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US” and the related news articles detailing tariff negotiations between the US and India, do not appear to have a direct impact on the plant’s operational tempo, as activity remained consistently high. The plant’s focus on DRI, pig iron, billets, and TMT bars makes it a key supplier in the region.

Jindal Stainless Hisar steel plant, with a focus on stainless steel products using EAF technology and a crude steel capacity of 800,000 tonnes, has maintained relatively stable activity. Its activity levels have remained around 43%-48% from December 2024 to May 2025. There is no discernible connection between the plant’s steady output and the “India-US Trade Agreement Talks “Progressing Very Well”: Commerce Secretary” or other news regarding trade negotiations with the US. The plant primarily serves the automotive, building and infrastructure, and energy sectors.

GHC Emirates Steel Industries in Abu Dhabi, a DRI-based integrated plant with a crude steel capacity of 3.5 million tonnes, shows high and slightly increasing activity. Activity increased from 90% in December 2024 to 94% in May 2025. There is no observable relationship between the trade discussions reported in the news and the activity levels at this UAE-based steel plant. The plant produces rebar, wire rod, and heavy sections for the construction and energy sectors.

Evaluated Market Implications:

The high activity levels at Rashmi Metaliks Kharagpur suggest stable supply for its key products (DRI, pig iron, billets, TMT bars). Given the “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US,” and related articles discussing potential tariff changes, steel buyers should:

- Prioritize securing supply contracts with Rashmi Metaliks Kharagpur: High activity indicates reliable output, mitigating potential supply disruptions regardless of the outcome of US-India tariff talks. This can reduce procurement costs, as the news articles focus on import tariffs, thus favoring local suppliers such as Rashmi Metaliks.

- Carefully Monitor Trade Deal Developments: While current plant activity isn’t directly affected, the ultimate resolution of tariff negotiations could shift market dynamics and affect longer-term procurement strategies.