From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia-US Trade Talks & Stable Steel Plant Activity: A Neutral Outlook for Asian Steel

Asia’s steel market shows a neutral sentiment influenced by ongoing India-US trade negotiations. Recent news indicates India is working towards a reciprocal tariff exemption with the US, as highlighted in “India Working On US Reciprocal Tariff Exemption, Interim Deal By July 8“. This development occurs amidst a 90-day tariff suspension, as mentioned in “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US“, but no direct relationship can be established with observed steel plant activity levels.

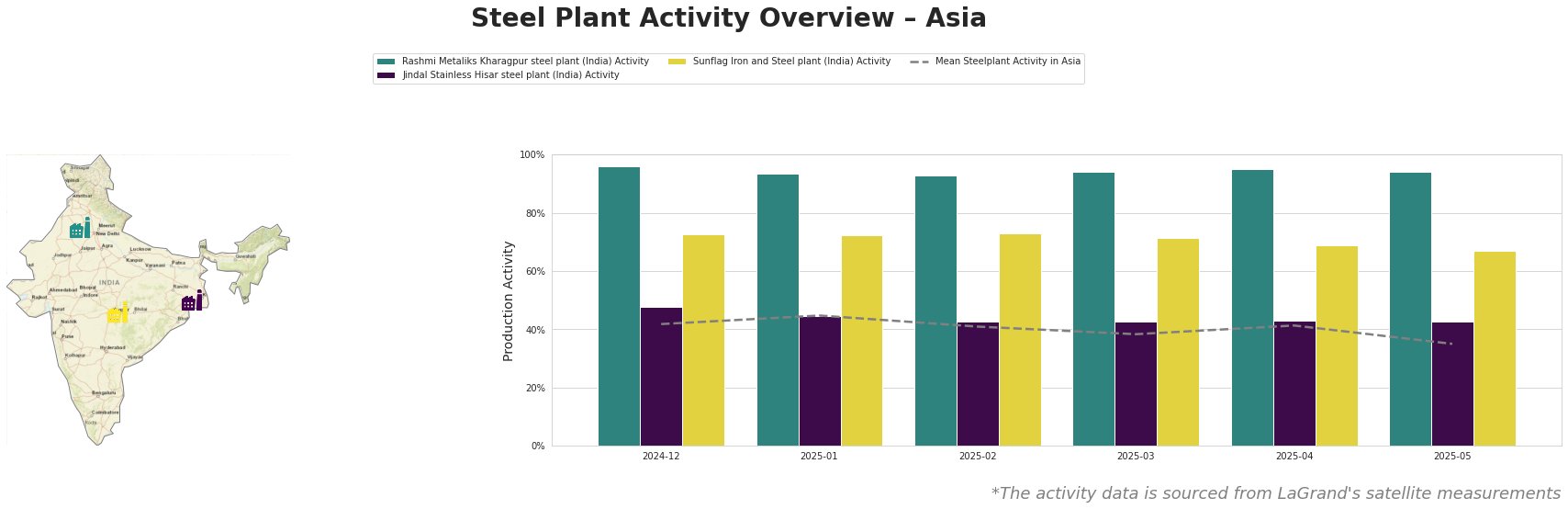

The mean steel plant activity in Asia has fluctuated, reaching a peak of 45% in January 2025 and dropping to 35% in May 2025. Rashmi Metaliks Kharagpur consistently shows high activity, ranging from 93% to 96%. Jindal Stainless Hisar steel plant reports relatively stable activity, hovering around 43%-48%. Sunflag Iron and Steel plant’s activity shows a gradual decline from 73% in December 2024 to 67% in May 2025.

Rashmi Metaliks Kharagpur steel plant, a significant producer of DRI, pig iron, and TMT bars using integrated BF and DRI processes, maintained consistently high activity levels (93%-96%) from December 2024 to May 2025. This suggests stable production despite ongoing trade negotiations, and no connection can be established with the news articles.

Jindal Stainless Hisar steel plant, an EAF-based plant producing stainless steel and various finished rolled products for sectors like automotive and infrastructure, shows stable activity levels around 43%-48% during the same period. This stable production might be influenced by domestic demand, but no direct relationship can be established with the news articles provided.

Sunflag Iron and Steel plant, producing crude, semi-finished, and finished rolled products with integrated BF and DRI processes, experienced a gradual activity decline from 73% in December 2024 to 67% in May 2025. This plant relies on a captive power plant and produces DRI, pig iron, billets, bars, and coils. The activity decline could be related to maintenance, market demand or input costs, but there is no direct connection that can be established with the news articles.

Given the ongoing India-US trade talks and the potential for tariff adjustments described in “India, US Make Progress On Mutually Beneficial Trade Agreement: Piyush Goyal“, steel buyers should closely monitor the progress of these negotiations. If India secures a full tariff exemption, as discussed in “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US“, increased trade flows could impact steel prices and availability. Procurement teams should evaluate their sourcing strategies to leverage potential cost advantages or mitigate risks associated with tariff changes, specifically in relation to US-India trade routes.