From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia-UK FTA Boosts Steel Demand: Plant Activity Signals Strong Market Outlook

The Indian steel market exhibits a very positive outlook, potentially fueled by the anticipated India-UK Free Trade Agreement (FTA). While a direct causal relationship between the FTA and immediate steel plant activity cannot be explicitly established using the provided data, the overall trend suggests robust demand. Specifically, the “India and UK likely to ink FTA on July 24” and “India-UK FTA: From Basmati Rice To Whisky — Here’s What Gets Cheaper” articles indicate potentially increased demand for steel-intensive goods due to reduced tariffs and increased trade. The “India-UK FTA Deal: CBAM Omitted, Talks On Proposed Carbon Tax Ongoing” article highlights India’s strategic positioning regarding carbon regulations, which could influence long-term investment decisions in the steel sector.

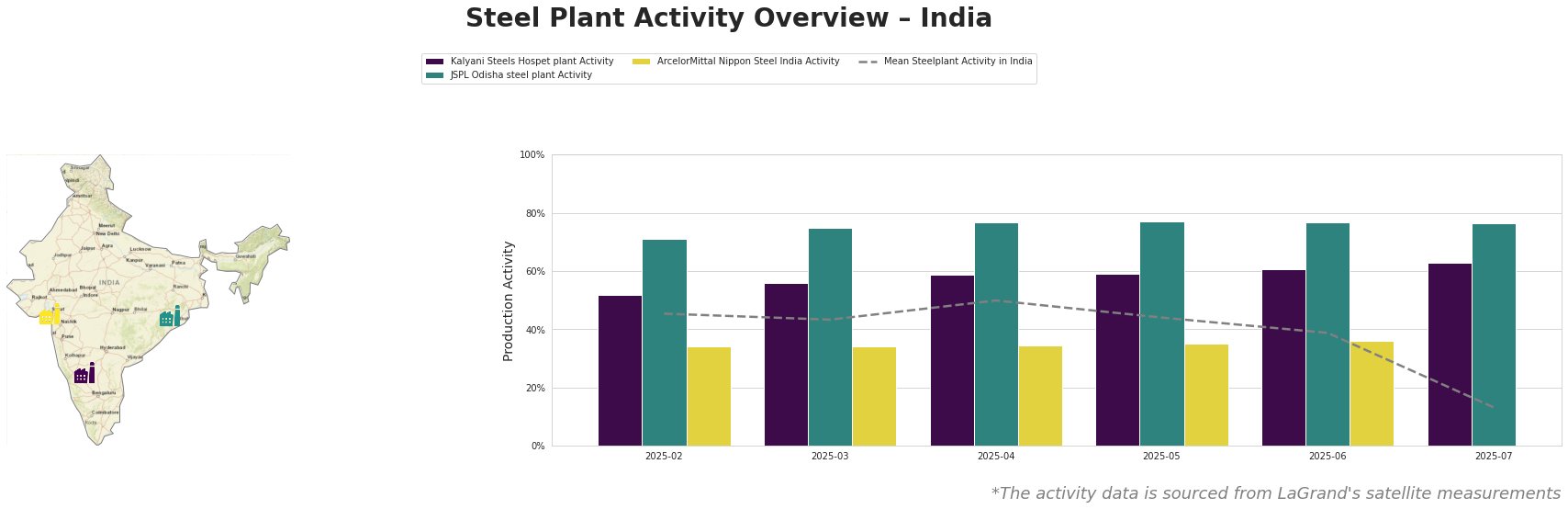

The table illustrates the recent activity trends across selected Indian steel plants. The Mean Steelplant Activity in India shows a dramatic drop in July (13.0%) from 39.0% in June, signaling a broad market-wide slowdown, whose causes cannot be directly established from the provided news. Kalyani Steels Hospet plant consistently operates above the mean, with a continuous increase in activity. JSPL Odisha steel plant shows high activity levels (around 75%), and it shows very little variance. ArcelorMittal Nippon Steel India has a low activity value compared to the mean, but an increasing trend.

Kalyani Steels Hospet plant, located in Karnataka, is an integrated steel plant with a crude steel capacity of 860 ttpa, primarily utilizing BOF and DRI technologies and catering to sectors like automotive and building infrastructure. Its activity level has steadily increased from 52.0% in February to 63.0% in July, consistently outperforming the national average. While no direct link can be established between this growth and the FTA based on the provided articles, its sustained high activity suggests strong regional demand for its rolled bars and rounds.

JSPL Odisha steel plant, based in Odisha, possesses a larger crude steel capacity of 6000 ttpa and uses a combination of BF, BOF, DRI, and EAF processes. It supplies semi-finished and finished rolled products to the automotive, building, and energy sectors. Its activity remained consistently high at around 75% from March to June, decreasing slightly to 76.0% in July. Although no direct connection with the news articles is apparent, its high and stable output implies continuous, robust demand for its products.

ArcelorMittal Nippon Steel India, situated in Gujarat, has a substantial crude steel capacity of 9600 ttpa, relying on DRI and EAF processes. The plant supplies hot-rolled, cold-rolled, and galvanized steel products. This plant’s activity level has remained relatively low but slowly increasing from 34.0% in February to 36.0% in June. The July data for this plant is missing. Without explicit information tying its operation directly to the FTA, it is challenging to infer a conclusive link.

Market Implications:

- Potential Supply Disruptions: The sharp drop in Mean Steelplant Activity in India in July (from 39.0% to 13.0%) suggests possible short-term supply chain disruptions or a significant demand shift. The reason for this cannot be explained with the provided data.

- Procurement Actions:

- Given the FTA and potential increased demand for steel-intensive UK exports, Indian steel buyers should anticipate upward pressure on prices and secure supply agreements proactively. Given the high operational tempo of JSPL Odisha plant with activity levels above 70%, steel buyers should consider negotiating supply contracts with JSPL, to safeguard against potential price increases.

- Monitor ArcelorMittal Nippon Steel India’s activity closely. Given their increasing activity levels, engaging with them now could secure favorable terms before a potential market-wide price surge materializes.