From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Surges: Tata Steel Expansion Drives Optimistic Outlook Amidst JSW Profit Growth

India’s steel market is experiencing a very positive phase, driven by capacity expansions and increased profitability. This report analyzes recent developments, explicitly linking news to observed plant activity, to provide actionable insights for steel buyers and market analysts. The surge in Tata Steel’s capacity is directly supported by news such as “Tata Steel increases steelmaking capacity in Kalinganagar to 8 million tons per year” and “Tata Steel completes 5 MT expansion project at Kalinganagar“, which directly correspond to observed changes in plant activity at other locations due to market dynamics. Additionally, JSW Steel’s increased profitability, as reported in “India’s JSW Steel sees consolidated net profit rise 14% in Q4 FY 2024-25,” signifies overall sector health despite revenue dips, potentially influencing pricing strategies.

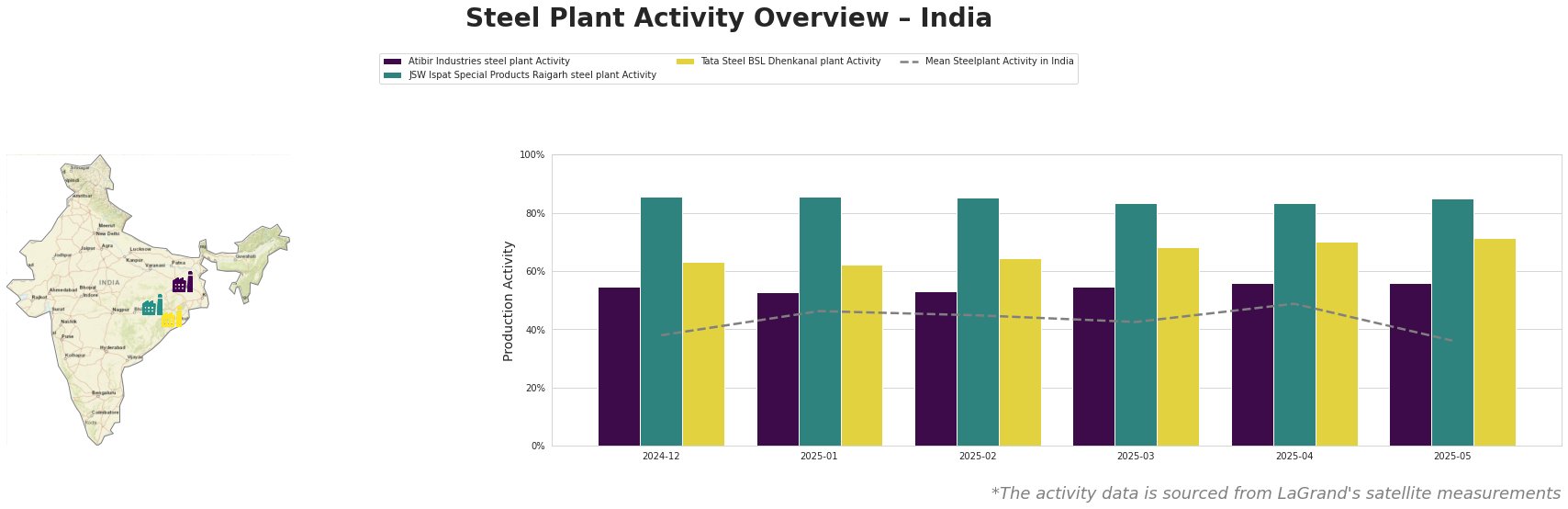

The mean steel plant activity in India fluctuated, peaking at 49% in April 2025, before dropping to 36% in May 2025. Atibir Industries steel plant in Jharkhand showed relatively stable activity, ranging between 53% and 56%. JSW Ispat Special Products Raigarh consistently exhibited high activity, hovering around 85%, and Tata Steel BSL Dhenkanal steadily increased its activity from 63% to 71% over the observed period. The activity level of the JSW Ispat plant has been considerably higher than the mean India activity for all months.

Atibir Industries, an integrated steel plant in Jharkhand with 600 ttpa crude steel capacity via the BOF route, has shown relatively stable activity levels. While the “ResponsibleSteelCertification” indicates a commitment to sustainable practices, no news articles directly correlate with the observed activity pattern. Therefore, we cannot establish a direct link between news events and activity changes at this plant.

JSW Ispat Special Products Raigarh, located in Chhattisgarh, operates with a 1500 ttpa crude steel capacity, utilizing both BF/BOF and EAF technologies. Its activity has consistently been high, around 85%, suggesting strong operational performance. This high activity level could be related to the overall positive performance of JSW Steel, but without specific news directly referencing this plant, the connection is speculative.

Tata Steel BSL Dhenkanal in Odisha, possessing a 5600 ttpa crude steel capacity, utilizes an integrated BF and DRI route. The plant’s activity has shown a steady increase, potentially reflecting the broader expansion initiatives of Tata Steel as reported in “Tata Steel increases steelmaking capacity in Kalinganagar to 8 million tons per year“. Although the article refers to the Kalinganagar plant, the general positive market sentiment and expansion strategy of Tata Steel might indirectly influence increased activity at its other plants like Dhenkanal.

The aggressive expansion of Tata Steel in Kalinganagar, highlighted in “Tata Steel increases steelmaking capacity in Kalinganagar to 8 million tons per year” and “Tata Steel completes 5 MT expansion project at Kalinganagar“, coupled with the operational turnaround of NINL (“India’s NINL achieves operational profit in Q4 FY 2024-25“) suggests a potential shift in the supply dynamics of long steel products. Furthermore, the increased profitability of JSW Steel (“India’s JSW Steel sees consolidated net profit rise 14% in Q4 FY 2024-25“) signals overall market strength. Given this scenario, steel buyers should:

- Secure Long-Term Contracts: Given Tata Steel’s increased capacity, especially in long products due to the NINL acquisition, buyers requiring these products should seek long-term contracts to leverage potentially competitive pricing.

- Monitor JSW Steel’s Pricing Strategy: Given JSW Steel’s increased profits, closely monitor their pricing strategies. This can be achieved by watching statements released by the company and comparing them to competitors. Consider negotiating prices promptly to capitalize on potential early-stage competitive offers.

- Evaluate Supply Chain Resilience: Although no supply disruptions have been observed, steel buyers should proactively evaluate their supply chain resilience with the significant changes to the capacity of Tata Steel in India. This includes diversifying suppliers and identifying alternative sources for critical steel grades.