India Steel Market Report: April 2025 – Optimism Amid Global Trade Talks

Recent developments reveal that India’s steel sector is poised for growth, driven by robust trade discussions with the U.S. Prime Minister Modi’s conversation with Elon Musk, as discussed in “Immense Potential For…”: PM Modi, Elon Musk Speak Amid US-China Trade War, emphasizes India’s capacity for technology and manufacturing, which aligns with increasing activity at key steel plants. Coupled with U.S. Vice President Vance’s visits and optimism shared in “India’s Modi and U.S. Vice President Vance optimistic on New Delhi-Washington trade deal,” we observe a significant uplift in local manufacturing sentiment, reflected in satellite observations of steel plant activities across the nation.

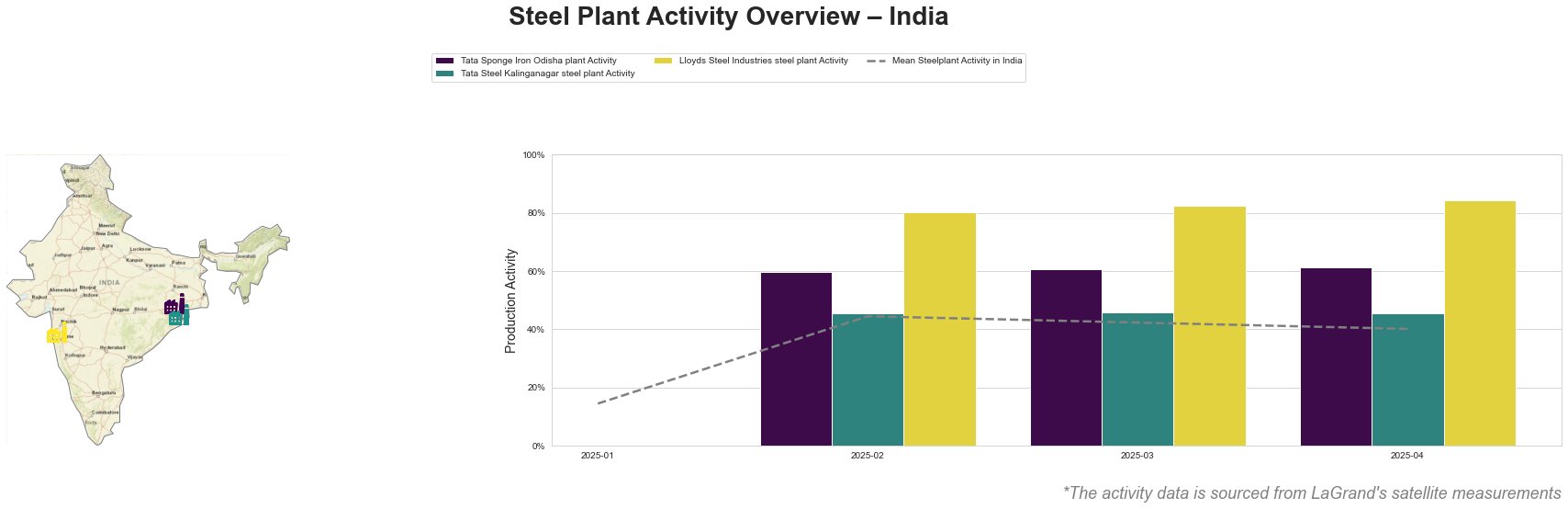

Active monitoring shows the Tata Sponge Iron Odisha plant maintaining stable activity at 61% in April, reflecting no significant disruptions or changes in production. This aligns with Modi’s push for manufacturing strength amid a trade war, suggesting this plant benefits from enhanced sentiment regarding local industrial capabilities.

The Tata Steel Kalinganagar steel plant recorded consistent activity at 46%, indicating its operations are less influenced by external trade dynamics but remain stable amid ongoing negotiations. The focus on enhancing bilateral trade relations, as emphasized in “Great Leader”: JD Vance Lauds PM Modi During His India Visit, aligns with sustaining activity levels, although this plant may benefit more from potential agreements rather than immediate operational changes.

Conversely, the Lloyds Steel Industries plant noted a rise in activity from 80% in February to 84% in April. This increase can be attributed to the positive sentiment surrounding trade discussions, particularly those concerning energy and technology sectors, further validated in “US-Vizepräsident Vance zu Gesprächen über Handel in Indien.” Such upward momentum suggests potential procurement opportunities for suppliers focusing on semi-finished and finished rolled products crucial for the energy and machinery sectors.

The current market sentiment in India is Very Positive, spurred by anticipated increases in trade agreements that may bolster production in key sectors, including steel.

Potential supply disruptions are minimal based on the current data trends; however, buyers should remain vigilant regarding global trade evolutions following U.S.-India negotiations. It is recommended that procurement professionals:

- Prioritize sourcing from Lloyds Steel Industries, given its robust operational upswing and alignment with excitements surrounding energy and manufacturing sectors.

- Monitor Tata Steel Kalinganagar’s activity closely for any shifts that might impact pricing or availability as trade agreements evolve.

- Remain engaged with developments from upcoming negotiations between India and the U.S. to anticipate any fluctuations in supply or pricing due to trade agreements realized or pending.

Given the interconnectedness of technology discussions, trade agreements, and observed plant activities, stakeholders should leverage these insights for timely and strategic procurement actions.