From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Poised for Growth: Electrical Steel Expansion Amidst Activity Dip

India’s steel sector is gearing up for expansion, particularly in electrical steel, despite a recent drop in plant activity. This report analyzes current trends, linking news-driven developments to observed activity data. The planned capacity expansions detailed in “JSW and JFE invest $669 million to expand electrical steel production in India” and “India’s JSW Steel and JFE of Japan commit additional $669 million investments to ramp up CRGO production capacities” aim to reduce import reliance, as highlighted in “Regarding the Expansion of Electrical Steel Manufacturing Capacity in India“. However, the impact of these expansions on near-term supply and pricing needs careful consideration in light of recent satellite-observed trends. The report will correlate news announcements to activity at steel plants in India and discuss market implications for steel buyers and market analysts.

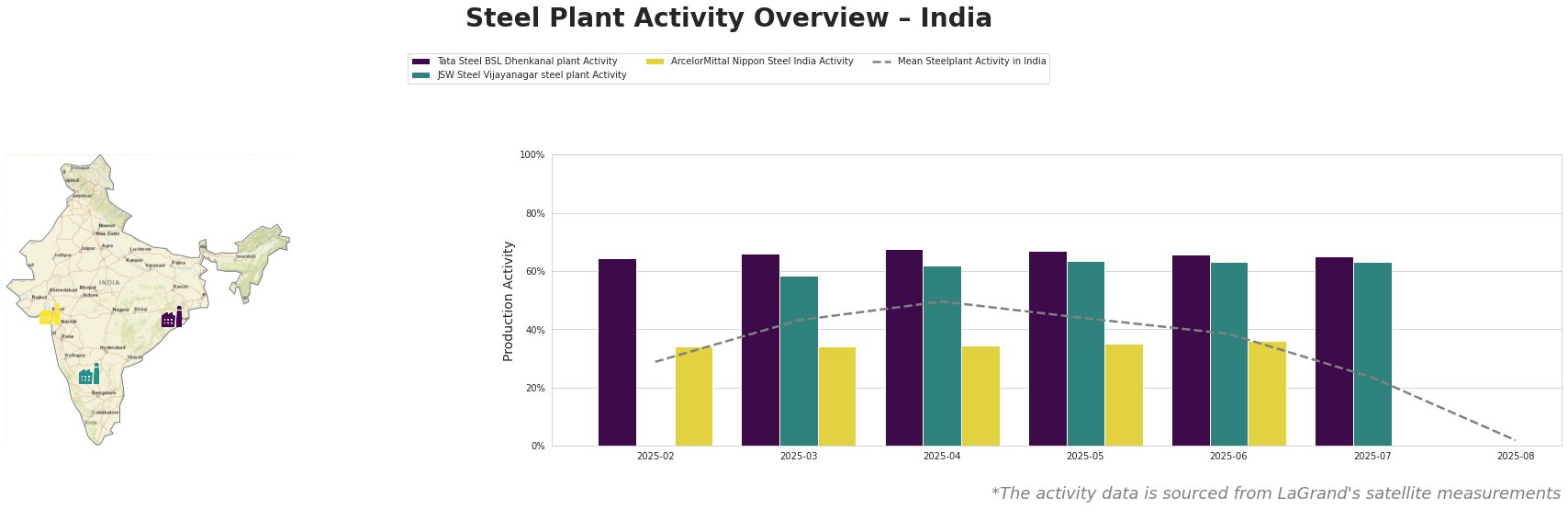

Here’s an overview of recent monthly activity trends:

Overall, mean steel plant activity in India has declined significantly, reaching a low of 2% in August. All three highlighted steel plant activity levels have declined significantly between June and August, according to satellite-observed activity.

Tata Steel BSL Dhenkanal plant, located in Odisha, is an integrated steel plant with a crude steel capacity of 5.6 million tonnes per annum (MTPA), utilizing both Blast Furnace (BF) and Direct Reduced Iron (DRI) processes. The plant primarily produces semi-finished and finished rolled products like hot rolled coil, pipe, sheet, and cold rolled steel. Activity at the Dhenkanal plant remained relatively stable from February to July, hovering between 65% and 67%. While no immediate connection to specific news events can be established, it’s important to note the steady activity prior to the sharp drop observed across all facilities in August.

The JSW Steel Vijayanagar steel plant in Karnataka boasts a crude steel capacity of 12 MTPA, also employing integrated BF and DRI processes, producing hot-rolled, cold-rolled, bar, galvanized, wire rod, and specialty steel. Activity at this plant showed an upward trend from 58% in March to 64% in May before declining to 63% in June and July. The planned expansion highlighted in “JSW and JFE invest $669 million to expand electrical steel production in India” and “India’s JSW Steel and JFE of Japan commit additional $669 million investments to ramp up CRGO production capacities” will eventually increase electrical steel production at Vijayanagar; however, these expansions are not expected to be operational until fiscal year 2028, so the plant’s current activity drop is likely unrelated.

ArcelorMittal Nippon Steel India, situated in Gujarat, has a crude steel capacity of 9.6 MTPA and utilizes both BF and DRI routes. This plant produces a wide range of flat products, including hot-rolled, cold-rolled, galvanized steel, pipes, and plates, catering to diverse sectors like automotive, construction, and energy. The activity level at this plant remained consistent between February and June, ranging from 34% to 36%. As with the other plants, no direct link between the recent electrical steel expansion news and the plant’s activity levels can be confirmed, given the focus of the news articles and the drop in the August data point.

The sharp decline in activity across all observed plants in August warrants close monitoring. While the announcements regarding electrical steel expansion are positive for long-term growth, they do not appear to explain the recent dip in production.

Given the current market dynamics, steel buyers should:

-

Monitor Supply Chains Closely: The sharp drop in August activity across all three steel plants and across the average for India may indicate a broad supply disruption or curtailment. Procurement teams need to closely scrutinize supply lines.

-

Evaluate Contractual Obligations: Steel buyers and analysts need to evaluate contracts in the context of recent activity and planned expansion announcements from “JSW and JFE invest $669 million to expand electrical steel production in India“. With activity declining, prices may increase.

-

Consider Forward Purchases: With production declining, buyers may want to purchase forward to mitigate future cost increases.