From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Optimistic Amid US Trade Talks & Stable Plant Activity

India’s steel market sentiment remains positive, fueled by progressing trade negotiations with the US, as indicated in news articles titled “India-US Trade Agreement Talks ‘Progressing Very Well’: Commerce Secretary” and “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US.” However, the actual impact on steel plant activity levels requires careful observation, as no direct immediate link can be established between these trade talks and specific production changes.

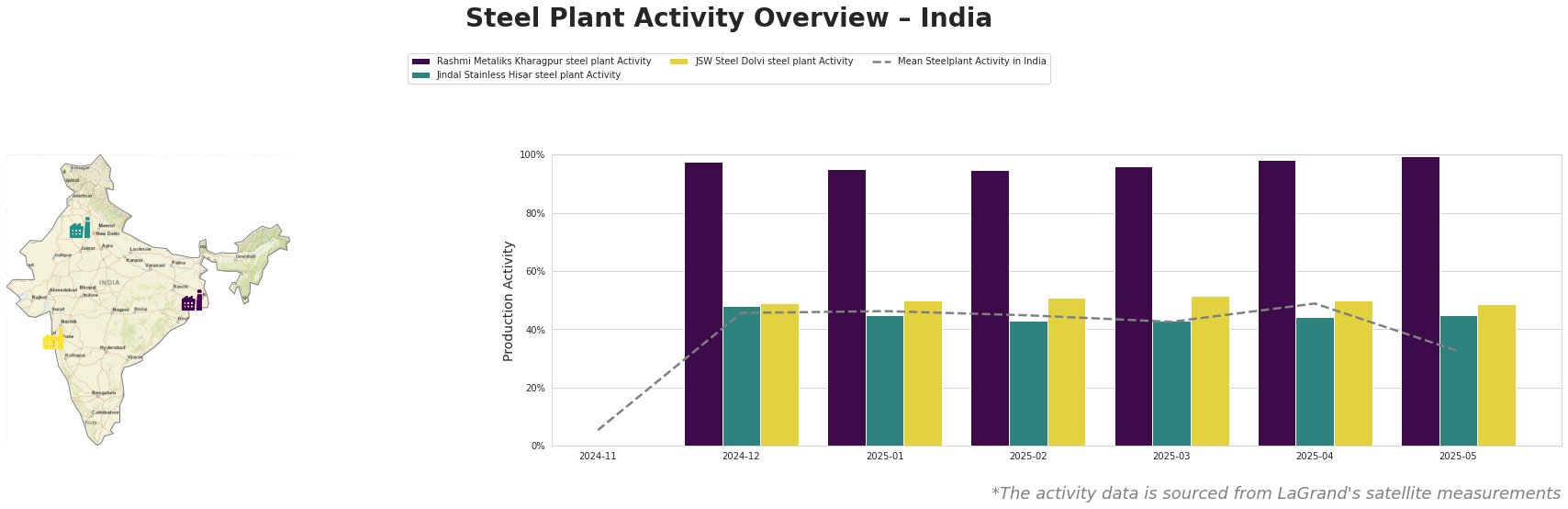

Observed activity reveals the mean steel plant activity in India shows significant volatility and a sharp drop to 33% in May after a rise in April to 49%. Rashmi Metaliks Kharagpur steel plant consistently maintains very high activity, peaking at 99% in May. Jindal Stainless Hisar steel plant activity remains relatively stable around the mid-40s. JSW Steel Dolvi steel plant shows stable activity in the high 40s and low 50s.

Rashmi Metaliks Kharagpur steel plant in West Bengal, an integrated plant with both BF and DRI processes and a crude steel capacity of 1500 ttpa, demonstrates consistently high activity levels, remaining near peak production (95%-99%) throughout the observed period. The plant’s focus on DRI, pig iron, billets, TMT bars, DI pipes, and wire rod production may be benefiting from sustained domestic demand, but no direct connection to the named news articles can be explicitly established.

Jindal Stainless Hisar steel plant in Haryana, primarily an electric arc furnace (EAF) based plant with a crude steel capacity of 800 ttpa, shows relatively stable activity, fluctuating between 43% and 48%. Its production of stainless steel products, including razor blades, coins, and various rolled forms, caters to diverse sectors like automotive and infrastructure. This stable production might indicate consistent demand in these sectors, yet no direct correlation with the mentioned trade discussions is evident.

JSW Steel Dolvi steel plant in Maharashtra, an integrated plant with both BF and DRI processes and a crude steel capacity of 5000 ttpa, exhibits stable activity levels, generally in the high 40s and low 50s. The plant produces a range of finished and semi-finished products, including wire rod, hot rolled, and specialty steel. The stable activity could be attributed to diversified product offerings, catering to multiple end-user sectors, but no direct impact of the India-US trade talks can be explicitly identified from the activity data.

The news articles highlight the US imposing and then suspending a 26% tariff on Indian goods until July 9, as covered in “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US”. Given the July 9th deadline and ongoing trade negotiations, potential disruptions could arise if tariffs are reinstated. The drop in mean steel plant activity in India could be related to such uncertainty.

Procurement Recommendations:

1. Monitor US-India trade talks closely: Given the potential for tariff reinstatement after July 9th, as highlighted in “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US”, steel buyers should closely monitor the progress of negotiations. Prepare for potential price fluctuations or supply chain adjustments if the 26% tariff is reimposed.

2. Assess Rashmi Metaliks’ output: Given the consistently high activity at Rashmi Metaliks Kharagpur, and the recent sharp drop of the mean steel plant activity in India, buyers should secure contracts with this plant, and be ready to explore diversification of suppliers to mitigate risks should Rashmi Metaliks output suddenly drop, for any reason.

3. Negotiate contracts with JSW Steel Dolvi: Despite stable activity at JSW Steel Dolvi, assess contract terms now, during period of low mean steel activity, to mitigate any supply risks to your business.