From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market: JSW Steel Investment and Import Concerns Drive Bullish Outlook Despite Activity Dips

India’s steel market shows positive sentiment, driven by expansion plans and concerns over imports, as evidenced by news articles such as “India’s JSW Steel Limited sees 158% rise in consolidated net profit in Q1 of FY 2025-26“ and “India’s steel giant is fighting imports by investing in its own facilities“. While JSW Steel invests heavily, the need for import safeguard duty is also discussed in “JSW Steel: India needs higher level of import safeguard duty“. However, satellite-observed activity reveals recent declines across several key plants.

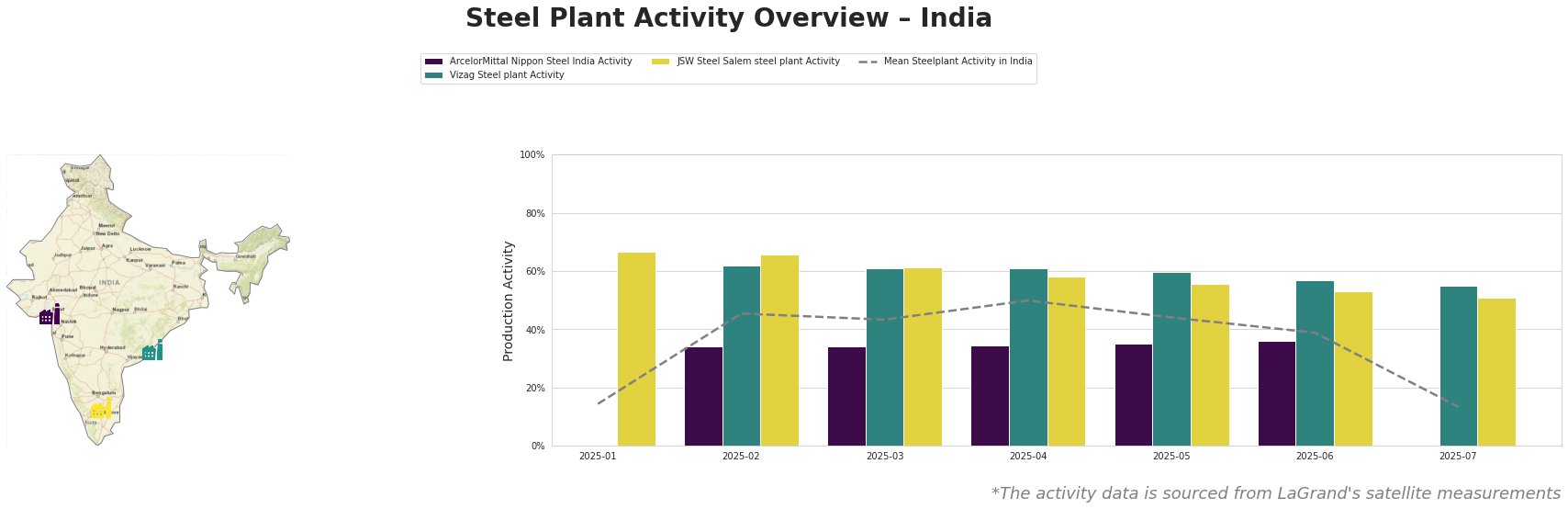

The mean steel plant activity in India peaked in April 2025 at 50%, declining sharply to 13% by July 2025. ArcelorMittal Nippon Steel India shows relatively stable activity around 35% between February and June. Vizag Steel plant’s activity decreased steadily from a high of 62% in February to 55% in July. JSW Steel Salem steel plant showed the highest activity in January (67%), decreasing to 51% in July.

ArcelorMittal Nippon Steel India, located in Gujarat, operates with both BF and DRI technologies, boasting a crude steel capacity of 9.6 million tons per annum (MTPA). The observed activity remained relatively stable between February and June. However, its absence from the data in January and July prevents a comprehensive assessment of its recent operational status. No direct connection can be established between the plant’s operational patterns and the provided news articles.

Vizag Steel plant in Andhra Pradesh, a BOF-based integrated steel plant with a capacity of 7.3 MTPA, shows a gradual decline in activity from 62% in February to 55% in July. While this decline does not directly correlate with specific announcements in the news articles, broader industry trends towards planned shutdowns for maintenance, as mentioned in “India’s JSW Steel Limited sees 158% rise in consolidated net profit in Q1 of FY 2025-26” could be a contributing factor.

JSW Steel Salem steel plant in Tamil Nadu, an integrated BF-based plant with 1.03 MTPA crude steel capacity, showed a decrease from 67% in January to 51% in July. No direct connection can be established between this specific plant’s activity and the provided news articles, although the broader context of JSW Steel’s investment plans outlined in “India’s steel giant is fighting imports by investing in its own facilities” and “India’s JSW Steel hikes capex by 19 percent for FY 2025-26“ suggests a company-wide strategy focusing on larger expansion projects elsewhere, which could indirectly influence activity at smaller plants like Salem.

Evaluated Market Implications:

Given the observed decline in activity at Vizag Steel plant and JSW Steel Salem steel plant, coupled with JSW Steel’s concerns about rising imports as stated in “JSW Steel: India needs higher level of import safeguard duty”, potential supply disruptions for specific product lines like rebar and rounds (Vizag) and hot-rolled products (JSW Salem) could arise, particularly in regional markets served by these plants.

Recommended Procurement Actions:

Steel buyers should closely monitor inventory levels of products sourced from Vizag Steel plant and JSW Steel Salem. Consider diversifying suppliers, particularly for rebar, rounds, and hot-rolled products, to mitigate potential supply chain risks in Andhra Pradesh and Tamil Nadu. Initiate early contract negotiations to secure supply for the upcoming quarters, factoring in potential price fluctuations due to import duty changes and domestic capacity adjustments mentioned in “India’s steel giant is fighting imports by investing in its own facilities”.