From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market: Jindal Expansion & JSW Acquisition Uncertainty Fuel Optimism Amidst Production Slowdown

India’s steel market shows positive sentiment driven by strategic investments and expansions, despite a recent dip in observed plant activity. Jindal Steel’s growth plans are particularly noteworthy, highlighted by “India’s JSPL officially renamed as ‘Jindal Steel Limited’” reflecting a focused approach on its core steel business, and “India’s Jindal Steel Chhattisgarh inks pact to invest $12 billion in local steel and power projects” indicating significant capacity expansion. However, uncertainty surrounds JSW Steel’s acquisition as “India’s Supreme Court to reconsider earlier order scrapping JSW Steel Limited’s acquisition of BPSL” introduces potential market shifts. While Jindal’s growth aligns with overall positive sentiment, the legal challenge might introduce short-term volatility. While the long-term market sentiment remains positive, the future of JSW Steel Limited’s acquisition adds short-term uncertainty. No direct relationship between activity levels and news could be explicitly established.

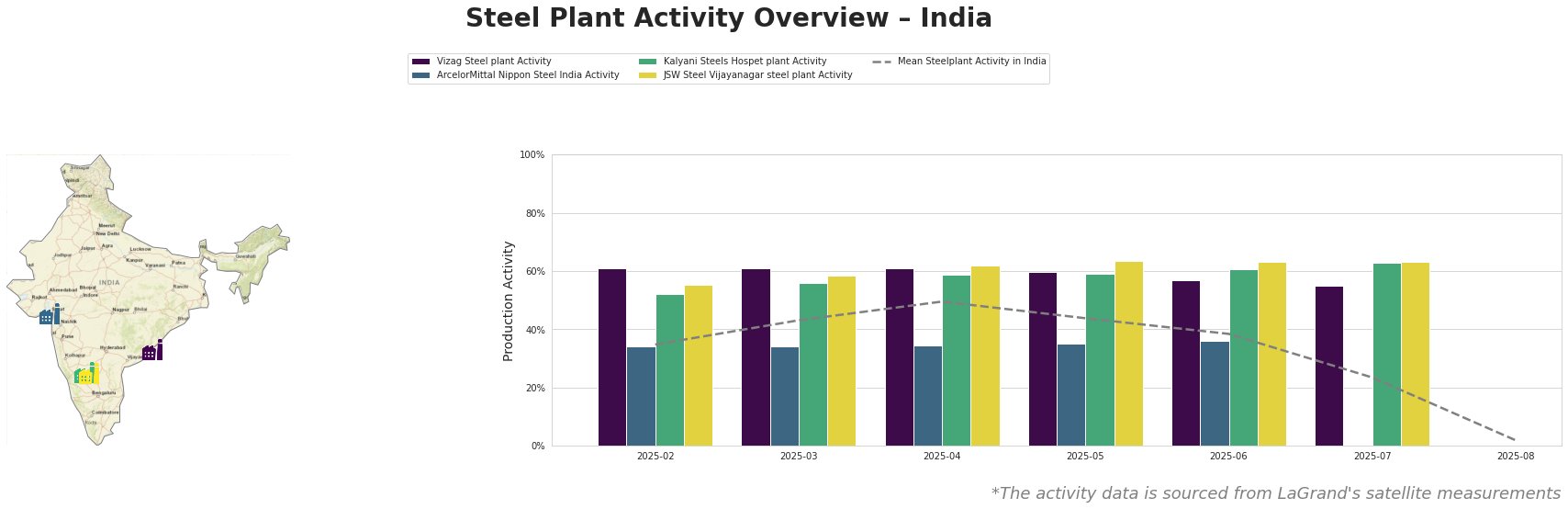

The mean steel plant activity in India shows a steady decline from 50.0 in April to a low of 2.0 in August, indicating a broad-based slowdown. Vizag Steel plant’s activity shows a gradual decline, but remains significantly above the mean. Kalyani Steels Hospet plant shows a stable activity level with its highest activity level in July. JSW Steel Vijayanagar steel plant demonstrates high activity through July, declining sharply in August. ArcelorMittal Nippon Steel India activity data is only available until June.

Vizag Steel plant, located in Andhra Pradesh, operates primarily with integrated BF-BOF technology and has a crude steel capacity of 7.3 million tons per annum (MTPA). While the plant holds a ResponsibleSteel Certification, satellite data reveals a steady drop in activity from 61.0 in April to 55.0 in July, substantially above the mean, and no data is available for August. No direct connection could be established between this activity trend and any of the provided news articles.

ArcelorMittal Nippon Steel India, based in Gujarat, uses a combination of BF and DRI integrated processes, with a crude steel capacity of 9.6 MTPA. It also has a ResponsibleSteel Certification. Activity levels remained relatively stable between February and June at around 34-36. No activity data is available for July and August. No direct connection could be established between the available data and any of the provided news articles.

Kalyani Steels Hospet plant in Karnataka has a smaller capacity of 0.86 MTPA, utilizing integrated BF and DRI processes alongside BOF and EAF technologies. It also holds a ResponsibleSteel Certification. Activity levels rose steadily from 52.0 in February to a peak of 63.0 in July, significantly above the mean, but no data is available for August. The increase does not correlate to the news articles.

JSW Steel Vijayanagar steel plant, situated in Karnataka, is a major player with a 12 MTPA capacity utilizing integrated BF-BOF and DRI-EAF processes. Satellite data shows that activity remained high throughout the observed period, from 55 in February to 63 in July, and declined sharply in August. The trend is not aligned to the news articles.

Evaluated Market Implications:

Given the planned capacity expansion by Jindal Steel Chhattisgarh, buyers can anticipate increased supply in the long term, potentially moderating price increases. The $12 billion investment announced in “India’s Jindal Steel Chhattisgarh inks pact to invest $12 billion in local steel and power projects” suggests a future reduction in reliance on other producers, particularly in regions served by the new Chhattisgarh facility.

However, the Supreme Court’s reconsideration of JSW Steel’s acquisition of BPSL, as stated in “India’s Supreme Court to reconsider earlier order scrapping JSW Steel Limited’s acquisition of BPSL“, creates short-term uncertainty. Steel buyers should closely monitor the court’s decision on August 7.

Procurement Actions:

- Steel Buyers: Given the news of Jindal Steels capacity expansion and JSCL’s investment in new plants, buyers should negotiate long-term contracts with Jindal Steel Limited to secure future supply, capitalizing on their planned increased production volume.

- Market Analysts: Closely monitor the Supreme Court’s ruling regarding the JSW Steel-BPSL acquisition. A reversal of the initial decision could lead to increased market consolidation and potentially impact pricing strategies.