From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Faces Turmoil: Trump Tariffs Hit Production Amidst Geopolitical Tensions

India’s steel market faces growing headwinds as escalating tariffs imposed by the U.S. impact production. The situation is compounded by geopolitical tensions highlighted in “Trumps US-Zölle im Liveticker: Trump droht Indien: Ihnen ist egal, wie viele Menschen Russland tötet,” with the U.S. criticizing India’s foreign policy. These external pressures potentially contribute to the sharp drop in overall steel plant activity observed in August. Specifically, “Trump India Tariffs 2025 Live Updates: Trump Doubles Tariff On India To 50%, Centre Responds” reports a significant tariff increase, which may have led to anticipatory production cuts.

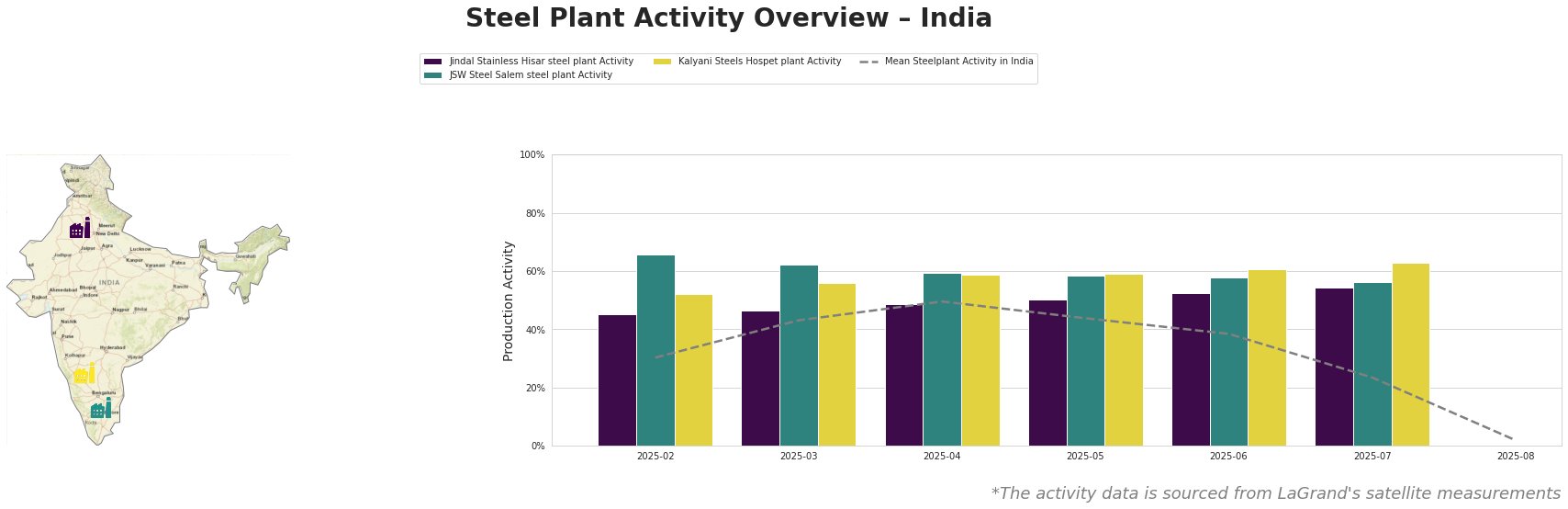

The mean steel plant activity in India shows a clear downward trend, plummeting to a concerning 2.0% in August after a steady decline from a high of 50.0% in April. While activity levels varied among the three observed plants, the overall sharp reduction suggests a systemic issue, possibly influenced by the trade policy shifts detailed in “Zoll von 25 Prozent: Indien fühlt sich von Trump verraten” and “Trump India Tariffs 2025 Live Updates: Trump Doubles Tariff On India To 50%, Centre Responds“.

Jindal Stainless Hisar, an EAF-based stainless steel producer in Haryana with an 800 ttpa crude steel capacity, maintained relatively stable activity, ranging from 45.0% to 54.0% between February and July. This suggests a degree of resilience, potentially due to its specialization in stainless steel products for sectors like automotive and building infrastructure. However, the absence of August activity data makes it impossible to assess the full impact of the tariffs. No direct link between the news articles and specific activity changes at this plant can be explicitly established with the available data.

JSW Steel Salem, an integrated BF-EAF steel plant in Tamil Nadu with a 1030 ttpa crude steel capacity, exhibited declining activity from 66.0% in February to 56.0% in July. The plant’s reliance on BF technology and production of hot-rolled products for industries like energy and transport might make it more susceptible to tariff-related disruptions. As with Jindal, the lack of August data prevents a complete evaluation. It is not possible to establish a direct connection between the observed activity decrease and the mentioned news articles given the available information.

Kalyani Steels Hospet, an integrated BF/DRI-BOF/EAF plant in Karnataka with an 860 ttpa crude steel capacity, showed a consistent increase in activity from 52.0% in February to 63.0% in July. Its diversified production processes and product range (rolled bars for automotive and infrastructure) may have initially buffered it against market fluctuations. However, the missing August data and the broad market downturn reflected in the mean activity suggest potential future impacts. We cannot directly link Kalyani Steels activity to the provided news items without more data.

Given the sharp decline in mean steel plant activity and the imposition of substantial tariffs, steel buyers should anticipate potential supply disruptions across the Indian market, particularly for commodity-grade steel products. Procurement professionals should immediately contact their suppliers in India, especially those relying heavily on exports to the US, to assess potential price increases and delivery delays. Explore diversifying supply sources to mitigate risk associated with tariff-impacted producers and products. Focus on securing long-term contracts with domestic producers less reliant on the export market to the U.S. given the present market conditions. Prioritize suppliers with ResponsibleSteel Certification to ensure ethical sourcing practices in the face of economic pressure.