From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Faces Headwinds: EU Anti-Dumping Probe and Declining Plant Activity Signal Procurement Risks

India’s steel market faces increasing headwinds due to potential export restrictions and declining domestic plant activity. The European Commission’s recent actions, detailed in “EU launches AD probe on cold-rolled steel imports from five countries” and “EU launches anti-dumping investigation into cold-rolled steel from five countries“, specifically targeting cold-rolled steel (CRC) imports from India, raise concerns about export volumes and pricing. While these investigations are focused on the EU market, they point to a global trend of increased scrutiny on steel imports and potential trade barriers, which could indirectly impact the Indian domestic market. There is no direct link between these news articles and the observed activities.

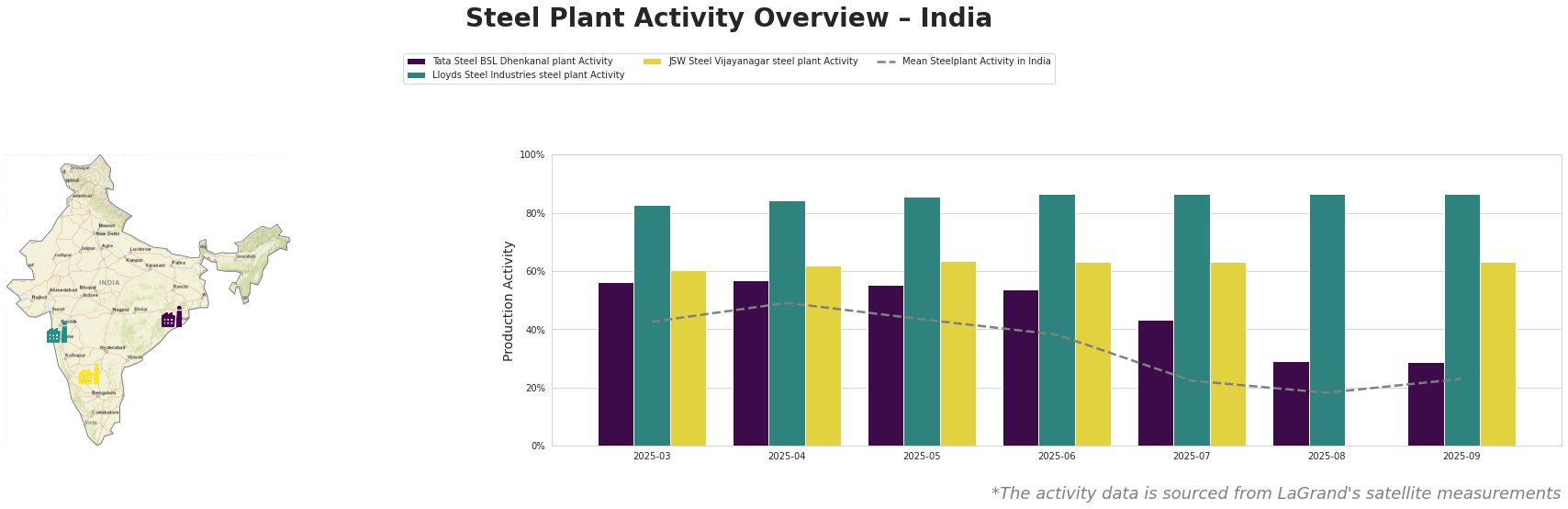

The mean steel plant activity in India has shown a concerning downward trend, plummeting from 49% in April to a low of 18% in August, before a slight recovery to 23% in September. The Lloyds Steel Industries steel plant activity has remained consistently high at around 85%, contrasting sharply with the general trend.

Tata Steel BSL Dhenkanal plant, an integrated steel producer in Odisha with a crude steel capacity of 5.6 MTPA and a DRI capacity of 1.825 MTPA, has witnessed a significant drop in activity. From a relatively stable activity level around 56% between March and June, it experienced a steep decline to 29% by August, remaining at that level in September. This represents a nearly 50% drop from March to August. The plant produces hot rolled coil and cold rolled products, which are directly affected by the EU’s anti-dumping investigations. However, given the EU’s anti-dumping investigations focus on CRC, and the plant’s location in Odisha, no explicit connection can be established between EUROFER has filed a petition for an anti-dumping investigation into Turkish hot-rolled coil and observed changes.

Lloyds Steel Industries steel plant in Maharashtra, with a smaller capacity of 0.641 MTPA crude steel produced via the electric arc furnace (EAF) route, has maintained remarkably high activity levels around 85%. This is in stark contrast to both the overall market trend and the activity of other major plants. The company focuses on slabs and cold-rolled coil and sheets. The sustained high activity, despite the general downturn, suggests a stable order book or a strategic focus on domestic markets. However, in light of EU launches AD probe on cold-rolled steel imports from five countries targeting cold rolled coil, one would expect at least some effect. The article refers to five countries and even singles out India.

JSW Steel Vijayanagar steel plant, a major integrated steel producer in Karnataka with a 12 MTPA crude steel capacity, has shown relatively stable activity compared to the Tata Steel BSL plant. Activity levels fluctuated between 60% and 64% from March through September, with a very slight drop to 63% in September. Given the plant’s product mix of hot rolled, cold rolled, and galvanized products, EU launches AD probe on cold-rolled steel imports from five countries may have impacted the plant, though this is difficult to confirm.

Evaluated Market Implications

The EU’s anti-dumping investigations, particularly “EU launches AD probe on cold-rolled steel imports from five countries“, targeting Indian CRC exports could lead to supply disruptions, especially for companies heavily reliant on the European market.

Recommended Procurement Actions:

- For steel buyers reliant on cold-rolled coil: Given the uncertainty surrounding Indian CRC exports to the EU, buyers should immediately diversify their sourcing strategies to mitigate potential supply disruptions and price volatility. Explore alternative suppliers within India and in other regions not subject to anti-dumping investigations.

- For market analysts: Closely monitor the progress of the EU’s anti-dumping investigation and its impact on Indian steel export volumes and prices. Focus on tracking domestic demand and supply dynamics to anticipate potential shifts in the Indian steel market landscape. The activity data of Tata Steel BSL Dhenkanal plant should be closely monitored, as production of this plant is most likely impacted by the investigation.

- For procurement managers: Assess inventory levels and consider increasing safety stock, particularly for CRC. Negotiate longer-term contracts with suppliers, where possible, to secure stable pricing and supply.