From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market: Anti-Dumping Probes and Plant Activity Shifts Signal Cautious Outlook

India’s steel market faces potential shifts driven by trade policy and fluctuating plant activity. Recent news, including “India Initiates Series Of Anti-Dumping Probes Targeting Chinese Imports” and “India considers replacing restrictions on coke imports with anti-dumping duties,” indicates a move towards protecting domestic producers. It cannot yet be established whether or not the anti-dumping probes are linked to recent activity level changes.

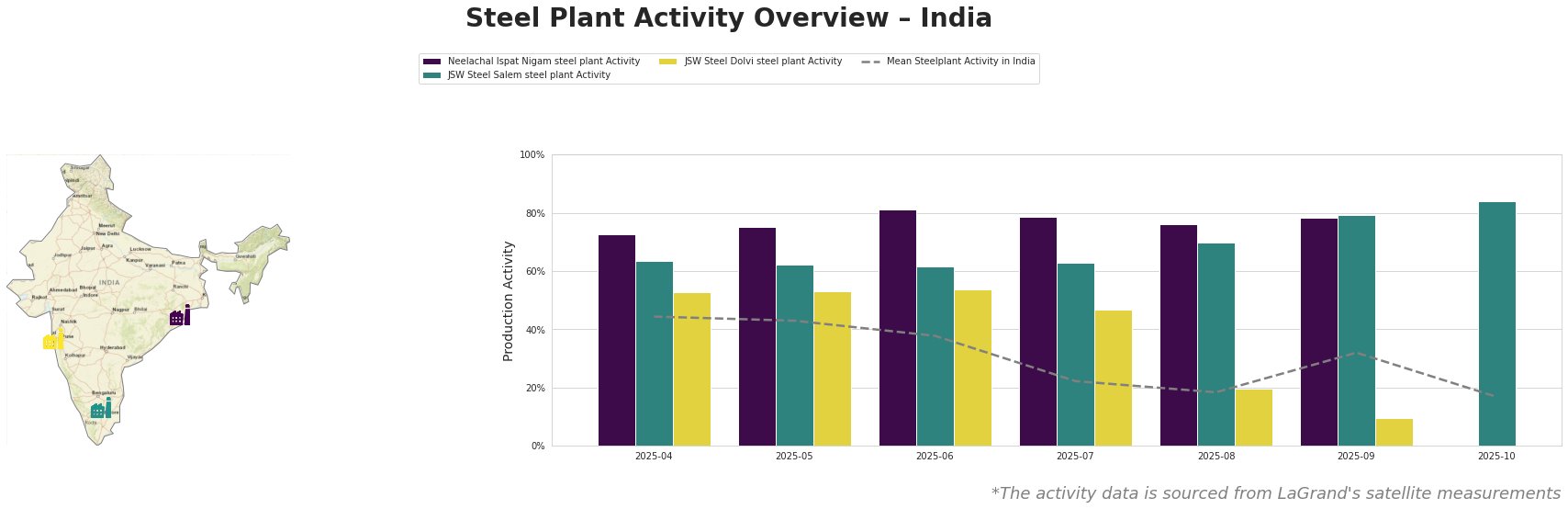

Overall, the mean steel plant activity in India shows a declining trend, dropping from 44% in April to 17% in October. Neelachal Ispat Nigam steel plant has maintained a relatively high and stable activity level throughout the observed period. JSW Steel Salem steel plant has generally increased activity levels, peaking at 84% in October. JSW Steel Dolvi steel plant saw a significant drop in activity, reaching a low of 10% in September and lacking activity data in October. No direct connections between the activity level changes and the named news articles can be established.

Neelachal Ispat Nigam steel plant in Odisha, an integrated BF-BOF plant with a 1.1 million tonne crude steel capacity, has consistently operated at high activity levels (above 70%) despite the overall market decline. This could indicate strong demand for its pig iron and semi-finished products or efficient operations. No correlation can be found to the named news articles.

JSW Steel Salem steel plant in Tamil Nadu, another integrated BF-EAF plant with a 1.03 million tonne crude steel capacity, demonstrated increasing activity, reaching 84% in October. This may reflect strong regional demand for its hot-rolled and heat-treated products for the energy, infrastructure, and automotive sectors. No correlation can be found to the named news articles.

JSW Steel Dolvi steel plant in Maharashtra, with a larger 5 million tonne crude steel capacity using both BF and DRI technologies, experienced a sharp decline in activity, particularly in August and September. The plant produces a range of finished and semi-finished products. The news article “India considers replacing restrictions on coke imports with anti-dumping duties” mentions JSW Steel requesting increased import quotas for metallurgical coke due to shortages and operational issues, hinting at possible raw material constraints impacting production at plants like Dolvi. However, a direct link cannot be explicitly established based on the available information.

Given the anti-dumping investigations and potential restrictions on coke imports, steel buyers should:

- Monitor coke supply closely: The article “India considers replacing restrictions on coke imports with anti-dumping duties” suggests potential disruptions. Buyers dependent on coke-based steel production should secure alternative sources or consider forward purchasing.

- Evaluate domestic supply options: With anti-dumping duties potentially increasing import costs, assess the feasibility and cost-effectiveness of sourcing steel from domestic producers like Neelachal Ispat Nigam.

- Factor in potential price increases: The anti-dumping probes and potential coke import restrictions could lead to higher steel prices. Adjust procurement budgets and strategies accordingly. The fact that Neelachal Ispat Nigam steel plant is working at such a stable production rate while other steel plants are suffering losses means that they may be well postioned to exploit price increases.

- Monitor JSW Steel Dolvi plant activities: Closely monitor and investigate the root causes behind JSW Steel Dolvi steel plants large drop in production for potential lasting negative impact.