From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Investments Signal Positive Outlook for European Steel Market

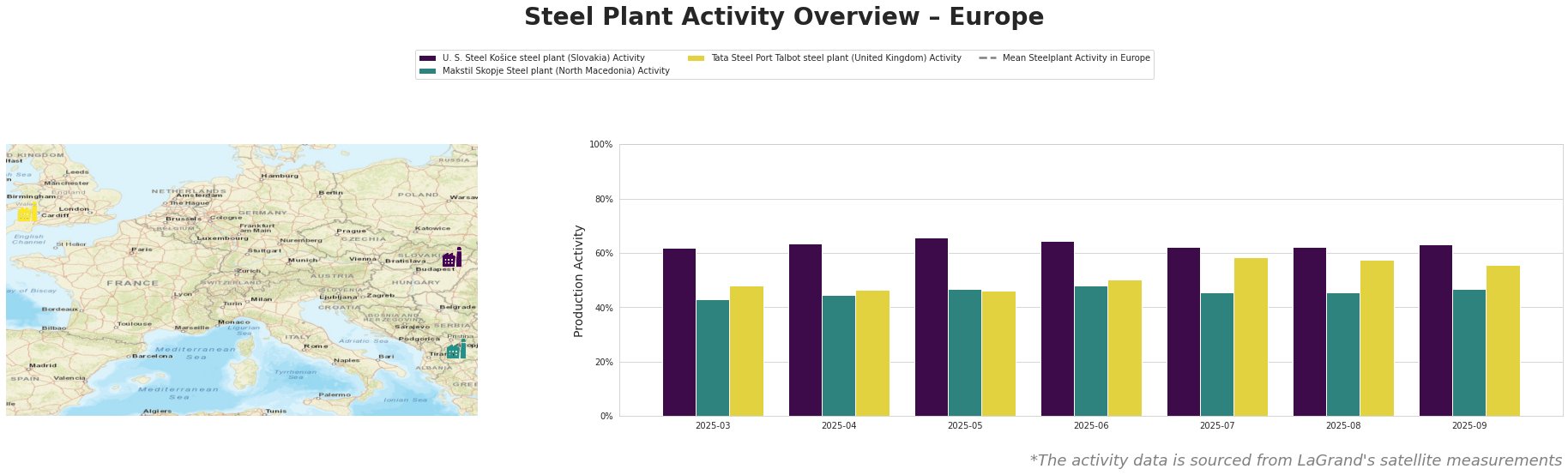

Europe’s steel market sentiment is very positive, driven by significant investments in green steel production. This report analyzes the impact of SSAB’s new green steel mill in Luleå, Sweden, and the satellite-observed activities of selected steel plants, including U. S. Steel Košice, Makstil Skopje, and Tata Steel Port Talbot. The report uses several news articles to derive its conclusions, including “Sweden’s SSAB breaks ground for Luleå green steel mill” and “Construction begins on SSAB’s fossil-free steel mill in Sweden“. A direct relationship between these news articles and the observed activity levels of the selected steel plants could not be established within the given data.

The mean steel plant activity in Europe shows fluctuations. U. S. Steel Košice activity ranged from 62% to 66% over the observed period, with a peak in May. Makstil Skopje saw a slight increase in activity from 43% to 48% between March and June, then decreased. Tata Steel Port Talbot experienced the most significant fluctuation, increasing from 46% in April to 59% in July before decreasing slightly to 56% in September. Direct links between these plant-specific fluctuations and the news articles provided could not be established.

U. S. Steel Košice, an integrated steel plant in Slovakia with a capacity of 4.5 million tons of crude steel produced via the BOF process, showed relatively stable activity between 62% and 66%. There is currently no clear connection in the provided news articles to explain these activity changes.

Makstil Skopje, a North Macedonian steel plant focusing on semi-finished slab production via EAF, has a capacity of 550,000 tons of crude steel. Its activity level saw a small increase and then a decline from the first to the latest entry. The fluctuations in activity do not directly correlate with the news regarding SSAB’s green steel mill, as no direct connection can be established.

Tata Steel Port Talbot, an integrated steel plant in Wales, UK, utilizing BF and BOF processes with a 5 million ton crude steel capacity, exhibited a significant increase in activity to 59% in July, before returning to 56% in September. As with the other plants, no clear link could be found in the current news to explain these activity fluctuations.

The commencement of SSAB’s green steel mill in Luleå, as reported in “Sweden’s SSAB breaks ground for Luleå green steel mill“, “SSAB begins construction of a new plant in Luleå“, and other articles, signals a long-term shift towards sustainable steel production in Europe. While immediate supply disruptions are not anticipated, the transition to green steel may affect long-term procurement strategies.

Given the long-term nature of the Luleå project (completion by late 2029) and the absence of immediate impacts on plant activity, steel buyers should:

- Monitor developments related to green steel production closely. While no immediate changes are expected, track the progress of SSAB’s Luleå mill and similar projects for future sourcing opportunities and potential price premiums associated with green steel.

- Maintain existing supplier relationships. Ensure stable supply chains by continuing to work with current suppliers while exploring future options for sourcing greener steel.

- Factor potential supply chain shifts into long-term forecasting. As green steel production ramps up, integrate potential changes in steel availability and pricing into long-term procurement plans, considering factors such as carbon emissions and sustainability certifications.