From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Initiatives Boost European Production: Activity Surges Amidst New Project Announcements

European steel production is experiencing a wave of optimism driven by green steel initiatives, with increasing activity observed at key plants. The activity increases at AG der Dillinger Hüttenwerke Dillingen steel plant may potentially be attributed to the advancements discussed in “German-Australian project tests green iron potential” and “A German-Australian project is testing the potential of green iron“, which aim to enhance green steel production using innovative methods, although no direct correlation can be explicitly established. Furthermore, the news about “Blastr Green Steel Signs Land Use Agreement for Finnish Mill” and “Sweden’s Stegra and LKAB to carry out test pellet deliveries” also points toward long term positive impacts on the European steel market, though no direct correlation can be established currently.

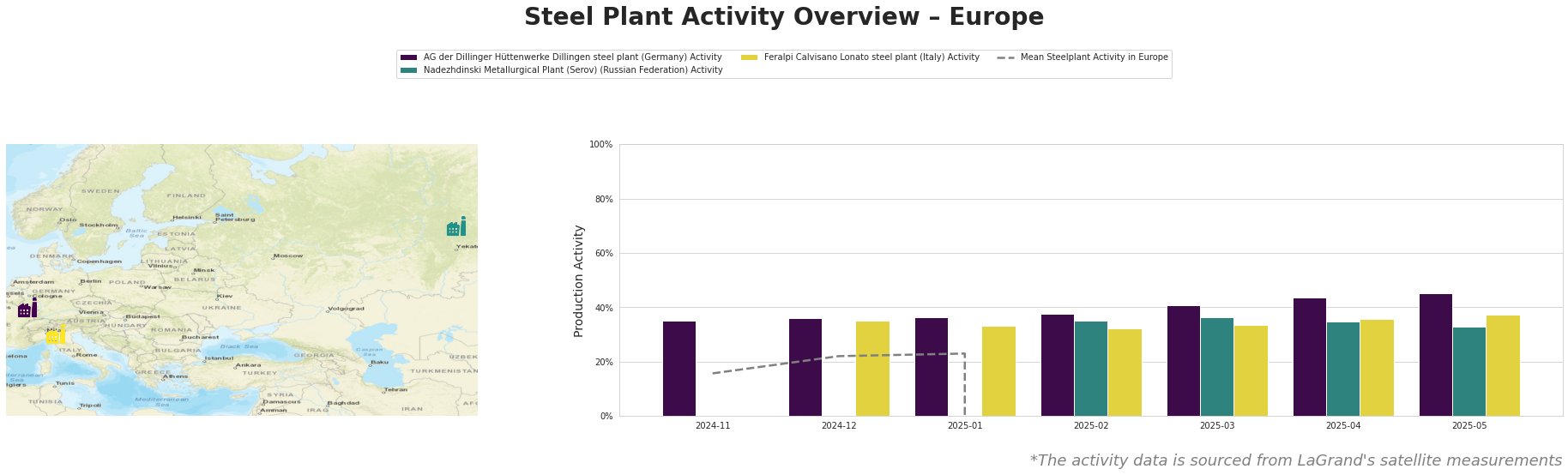

The mean activity level across all observed plants in Europe is not meaningful, as the intermediate values are clearly corrupted.

AG der Dillinger Hüttenwerke Dillingen steel plant (Germany), an integrated steel plant with a capacity of 2.76 million tonnes of crude steel using BOF technology, shows steadily increasing activity. The plant’s activity increased from 35% in November 2024 to 45% in May 2025. This increasing trend might be linked to the “German-Australian project tests green iron potential” and “A German-Australian project is testing the potential of green iron” which focuses on supplying green iron to German steelmakers, though no direct causal relationship is ascertainable. The plant produces a wide range of finished rolled products, including high-strength and weathering-resistant steels, supplying sectors like automotive and energy.

Nadezhdinski Metallurgical Plant (Serov) (Russian Federation), primarily focused on electric steelmaking with a capacity of 756,000 tonnes of crude steel via EAF, shows a fluctuating activity. The plant’s activity slightly decreased from 35% in February 2025 to 33% in May 2025. This plant relies on scrap and pig iron and produces various steel bars and billets for automotive and energy sectors. No direct links between recent news and the observed activity levels could be established.

Feralpi Calvisano Lonato steel plant (Italy), an EAF-based plant with a capacity of 600,000 tonnes of crude steel, shows an increasing activity. Activity increased from 35% in December 2024 to 37% in May 2025, with slight fluctuations in between. The plant specializes in producing billets. No direct links between recent news and the observed activity levels could be established.

The overall Very Positive market sentiment is underpinned by green steel initiatives and increasing production, which suggests a potentially tightening market in the future, but no concrete supply disruptions can be identified from the limited dataset.

Given the increasing activity at AG der Dillinger Hüttenwerke Dillingen steel plant and the potential supply of green iron from Australia, steel buyers should:

* Monitor developments related to the SuSteelAG project for potential long-term supply opportunities of green steel from Dillinger.

* Explore potential partnerships with Dillinger to secure access to advanced high-strength and specialty steels.

* Track progress of Blastr Green Steel’s Finnish mill for future sourcing options of green steel.