From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFrench Steel Market Poised for Growth: New Mill Construction and Stable Plant Activity Signal Positive Outlook

France’s steel market exhibits a very positive sentiment, driven by substantial investments and stable production levels. The commencement of the engineering phase for Marcegaglia’s new Fos-sur-Mer plant, as reported in “Marcegaglia moves to the engineering phase of construction of its plant in Fos-sur-Mer,” “Marcegaglia awards Danieli contract for new Fos-sur-Mer mill,” and “Marcegaglia signs a contract with Danieli for the construction of a new mill in Foz-sur-Mer” promises a significant boost to domestic production capacity by 2028. The ongoing operations, reflected in satellite-observed activity, reveal fluctuating, but stable production levels at existing plants, presenting a complex but ultimately promising picture for steel buyers and market analysts.

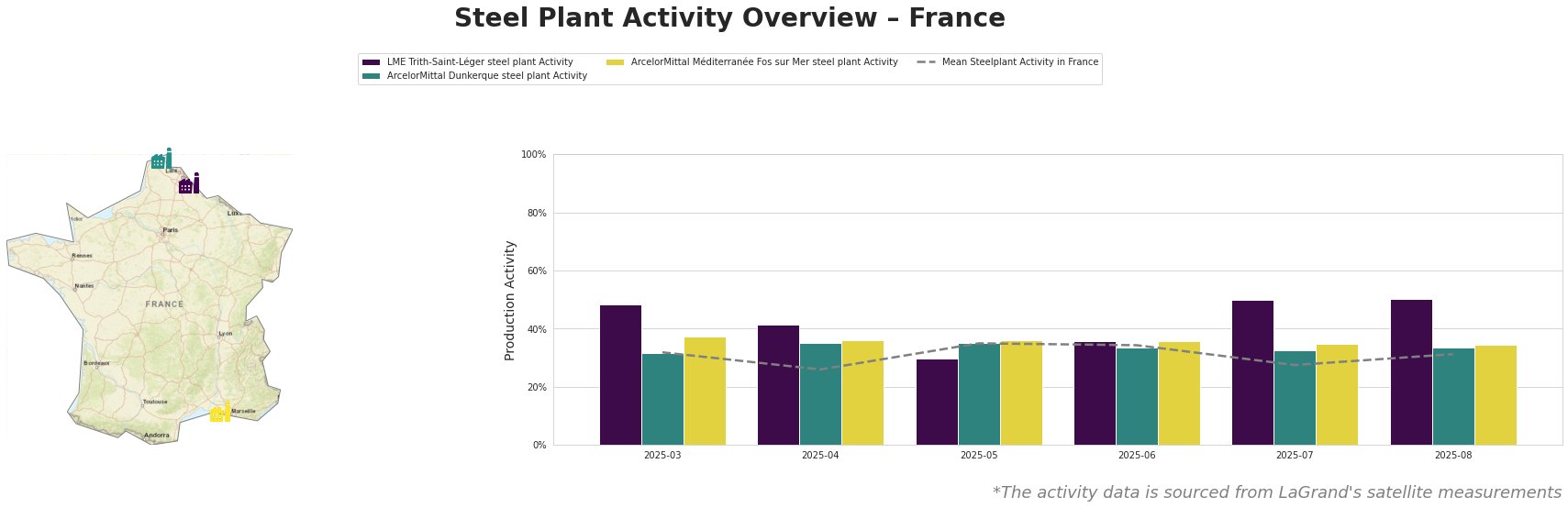

The table shows that mean steel plant activity in France fluctuated between 26.0% and 35.0% from March to August 2025. LME Trith-Saint-Léger exhibited the most variation, peaking at 50.0% in July and August after a drop to 30.0% in May. ArcelorMittal Dunkerque showed relative stability, ranging from 31.0% to 35.0%, and ArcelorMittal Méditerranée Fos sur Mer maintained consistent activity around 36.0%-37.0%. LME Trith-Saint-Léger shows peaks above, and troughs below the national mean.

LME Trith-Saint-Léger, located in Hauts-de-France, is an EAF-based plant with a crude steel capacity of 850 thousand tonnes per annum (ttpa), primarily producing semi-finished and finished rolled products. The plant’s activity levels showed a notable increase to 50% in July and August 2025, from 30% in May. There is no explicitly reported news to indicate the reason for this fluctuation in activity.

ArcelorMittal Dunkerque, also in Hauts-de-France, is an integrated BF-BOF plant with a crude steel capacity of 6,750 ttpa, producing slabs and hot-rolled coil. The plant’s activity has remained relatively stable, fluctuating between 31% and 35% during the observed period. No explicit link between this stability and the Marcegaglia investment in Fos-sur-Mer can be established based on available data.

ArcelorMittal Méditerranée Fos-sur-Mer, situated in Provence-Alpes-Côte d’Azur, is an integrated BF-BOF plant with a 4,000 ttpa crude steel capacity, producing slabs and hot-rolled coil for various sectors. The plant has maintained stable activity levels around 36-37% during the period. Although both ArcelorMittal Méditerranée Fos-sur-Mer and the new Marcegaglia plant are located in Fos-sur-Mer, there is no explicit connection between the satellite activity of the operational ArcelorMittal plant and the news regarding the new Marcegaglia plant.

The construction of the Marcegaglia Fos-sur-Mer plant, detailed in “Marcegaglia moves to the engineering phase of construction of its plant in Fos-sur-Mer,” “Marcegaglia awards Danieli contract for new Fos-sur-Mer mill,” and “Marcegaglia signs a contract with Danieli for the construction of a new mill in Foz-sur-Mer,” is not expected to cause any immediate supply disruptions, as production is slated to begin in 2028. However, the planned shutdown of BOF production at ArcelorMittal Méditerranée Fos-sur-Mer by 2030 could lead to regional supply adjustments in the longer term.

Procurement Actions: Steel buyers should leverage the stable production from ArcelorMittal Dunkerque and Méditerranée Fos-sur-Mer to secure medium-term supply contracts. Furthermore, steel buyers should closely monitor LME Trith-Saint-Léger steel plant Activity for potential short-term opportunities that have risen as high as 50% in late summer 2025. Given the future capacity increases from the Marcegaglia plant, procurement teams should begin exploring potential partnerships to secure future supply at competitive rates when production commences in 2028. Analysts should monitor the progress of the Marcegaglia Fos-sur-Mer plant, as its realization is critical for future supply dynamics in the region.