From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFrench Steel Market Poised for Growth: ArcelorMittal Investment Drives Optimism

France’s steel market shows positive momentum driven by ArcelorMittal’s renewed decarbonization efforts. This report analyzes recent activity at key steel plants, linking it to industry news and providing actionable insights for steel buyers. ArcelorMittal’s commitment is directly linked to favorable EU policy, as reported in “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk,” “ArcelorMittal confirms its intention to invest in the decarbonization of its Dunkirk plant,” “ArcelorMittal has committed to resume the implementation of the French decarbonization plan in line with EU measures,” “The European steel giant is preparing to restart green projects after the summer holidays,” and “ArcelorMittal committed to restarting French decarbonization plan following EU measures.” Satellite observations indicate fluctuating plant activity levels.

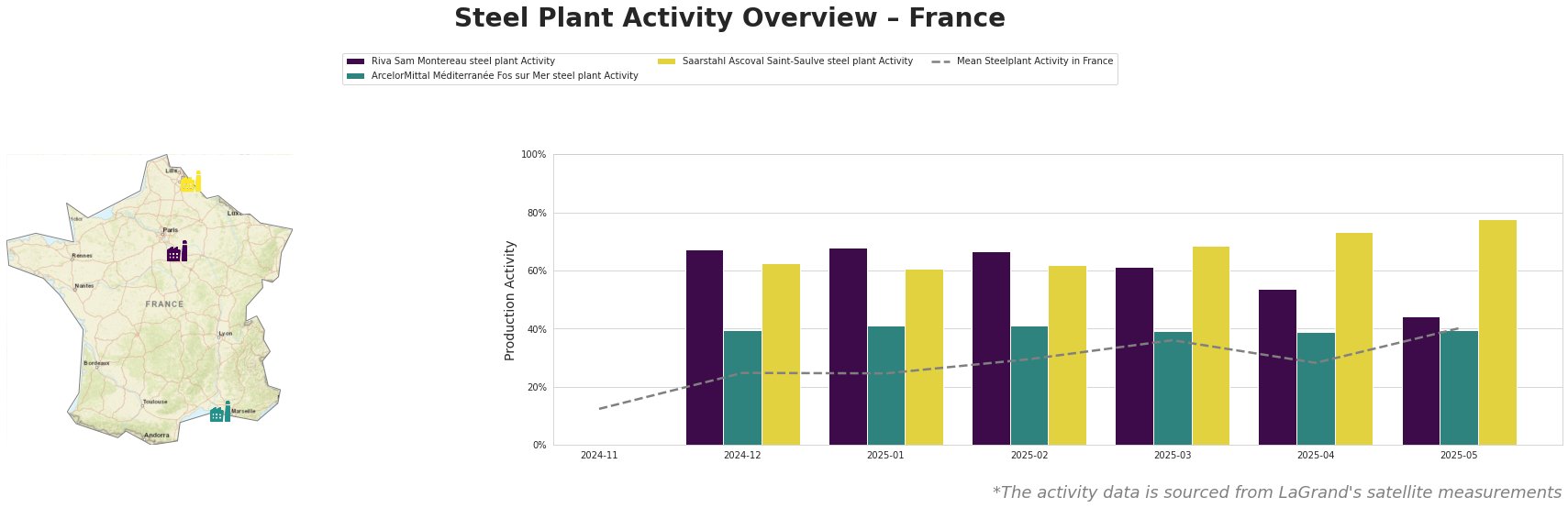

The mean steel plant activity in France increased significantly from 12% in November 2024 to 40% in May 2025, with a dip to 28% in April 2025. This overall upward trend aligns with the positive sentiment expressed in the news articles regarding ArcelorMittal’s investments.

Riva Sam Montereau steel plant: Located in Île-de-France, this plant has an EAF capacity of 720 ttpa, specializing in semi-finished and finished rolled products like rebar. Activity at Riva Sam Montereau has seen a marked decrease from 68% in January 2025 to 44% in May 2025. No direct connection between this specific activity decrease and the provided news articles can be established.

ArcelorMittal Méditerranée Fos sur Mer steel plant: Located in Provence-Alpes-Côte d’Azur, this integrated BF-BOF plant has a crude steel capacity of 4000 ttpa, producing slabs and hot-rolled coil for automotive and infrastructure sectors. The activity level has remained relatively stable at around 40% between December 2024 and May 2025. Considering ArcelorMittal’s announcement to transition Dunkirk away from traditional production methods by 2030 as indicated in “ArcelorMittal committed to restarting French decarbonization plan following EU measures” and the fact that ArcelorMittal Méditerranée Fos sur Mer uses BOF technology, procurement professionals need to watch for signs of similar transformations in Fos sur Mer, as the company seems focused on Electric Arc Furnaces in Dunkirk for now, as reported in “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk“.

Saarstahl Ascoval Saint-Saulve steel plant: Situated in Hauts-de-France, this EAF-based plant with a 730 ttpa capacity focuses on long products. The plant shows a consistent increase in activity, rising from 63% in December 2024 to 78% in May 2025, significantly exceeding the national average. No direct connection between this specific activity increase and the provided news articles can be established.

ArcelorMittal’s investment in Dunkirk, as highlighted in “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk“, aims to secure the long-term viability of steel production in France. However, steel buyers should be aware of potential short-term supply chain adjustments as ArcelorMittal transitions its facilities.

Evaluated Market Implications:

The satellite data indicates a significant divergence in activity levels among French steel plants. While ArcelorMittal is investing heavily in Dunkirk, the fluctuating activity at Riva Sam Montereau might indicate localized supply concerns for rebar and related products.

Recommended Procurement Actions:

- Steel Buyers: Given the planned transition of ArcelorMittal Dunkirk towards EAF technology, as described in “ArcelorMittal committed to restarting French decarbonization plan following EU measures,” buyers should actively engage with ArcelorMittal to understand the timeline for product availability and potential specification changes related to EAF production.

- Market Analysts: Closely monitor the activity levels at Riva Sam Montereau. A sustained decrease in activity could indicate regional supply constraints for long steel products, necessitating the exploration of alternative suppliers. Procurement professionals should monitor the trend and the specific location of Riva Sam Montereau in Île-de-France, as the regional supply chain could be affected.