From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFrench Steel Market Poised for Green Growth: ArcelorMittal Investments and Plant Activity Signal Positive Outlook

France’s steel market is showing positive signs, driven by ArcelorMittal’s commitment to decarbonization and supported by EU initiatives. According to “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk” and “ArcelorMittal committed to restarting French decarbonization plan following EU measures,” the company is moving forward with investments in electric arc furnace (EAF) technology, prompted by the European Commission’s Steel and Metal Action Plan. These developments may impact steel availability and pricing, but their connection to current satellite-observed activity levels is not yet directly evident.

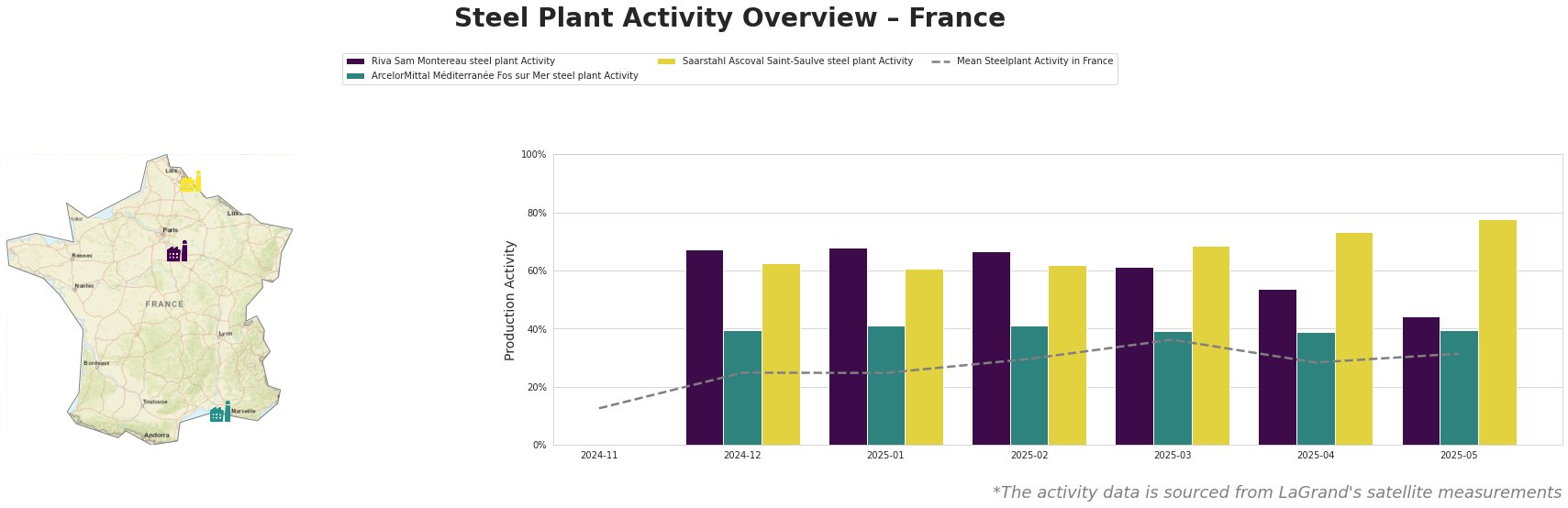

The satellite data reveals fluctuating activity across French steel plants in recent months:

Overall steel plant activity in France shows a general upward trend from November 2024 (13%) to March 2025 (36%), followed by a dip in April (28%) and a slight recovery in May (31%).

Riva Sam Montereau steel plant, an EAF-based facility in Île-de-France with a capacity of 720 thousand tonnes per annum (ttpa), exhibited high activity levels relative to the national average, starting at 67% in December 2024. There was a significant decrease to 44% in May 2025. This drop does not directly correlate with information presented in the news articles concerning ArcelorMittal investments, implying the existence of other factors driving activity at this plant.

ArcelorMittal Méditerranée Fos sur Mer steel plant, an integrated BF-BOF plant in Provence-Alpes-Côte d’Azur with a 4,000 ttpa capacity, has demonstrated relatively stable activity around 40% since December 2024. The news articles suggest a modernization of Dunkirk and other facilities, but a direct link to increased production in Fos-sur-Mer can’t be established from available information. ArcelorMittal plans to transition Dunkirk away from traditional production methods by 2030, as indicated in the article “ArcelorMittal committed to restarting French decarbonization plan following EU measures“, which could indirectly impact future activity at Fos-sur-Mer.

Saarstahl Ascoval Saint-Saulve steel plant, an EAF-based plant in Hauts-de-France with a 730 ttpa capacity, has shown the most consistent growth, reaching 78% activity in May 2025, significantly above the national average. The sustained increase might be partially attributable to the overall positive market sentiment mentioned in the news articles and future demand expectations for greener steel, however, a direct correlation cannot be established.

Market Implications:

ArcelorMittal’s confirmed investments in EAF technology, particularly in Dunkirk, as per “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk“, suggest a strategic shift towards decarbonization and potential future shifts in steel production methods. The increased activity at Saarstahl Ascoval Saint-Saulve might signal a growing demand for EAF-produced steel.

Recommended Procurement Actions:

- Monitor Riva Sam Montereau: The significant decrease in activity at Riva Sam Montereau in May 2025 warrants close monitoring. Steel buyers who rely on this plant for billet, coils, wire, mesh, or rebar should consider diversifying their supply sources to mitigate potential disruptions.

- Engage with ArcelorMittal: Procurement professionals should engage with ArcelorMittal to understand the timeline and impact of their planned investments in Dunkirk and other facilities. Inquire about the availability and pricing of steel produced using EAF technology.

- Assess Saarstahl Ascoval Saint-Saulve capacity: With Saarstahl Ascoval Saint-Saulve’s increasing activity, steel buyers could assess the plant’s capacity to meet future demand, especially in relation to continuous cast round bars, forged products, and billets.

- Factor in Carbon Border Adjustment Mechanism (CBAM): The EU’s Steel and Metal Action Plan, cited in multiple articles, emphasizes the Carbon Border Adjustment Mechanism (CBAM). Procurement strategies should account for the potential impact of CBAM on the cost of imported steel and prioritize suppliers with lower carbon footprints.