From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFrench Steel Market Faces Supply Risks After ArcelorMittal Fos-sur-Mer Fire

France’s steel market faces increased uncertainty following a major disruption at ArcelorMittal’s Fos-sur-Mer plant. The observed activity reduction at the plant coincides with news reports titled “ArcelorMittal Fos-sur-Mer shut down blast furnace No. 2 due to a fire” and “ArcelorMittal Shuts Down Fos-sur-Mer Blast Furnace After Major Fire incident,” directly linking the reduced activity to the fire and subsequent shutdown. This event is likely to have short-term implications for slab and hot-rolled product availability.

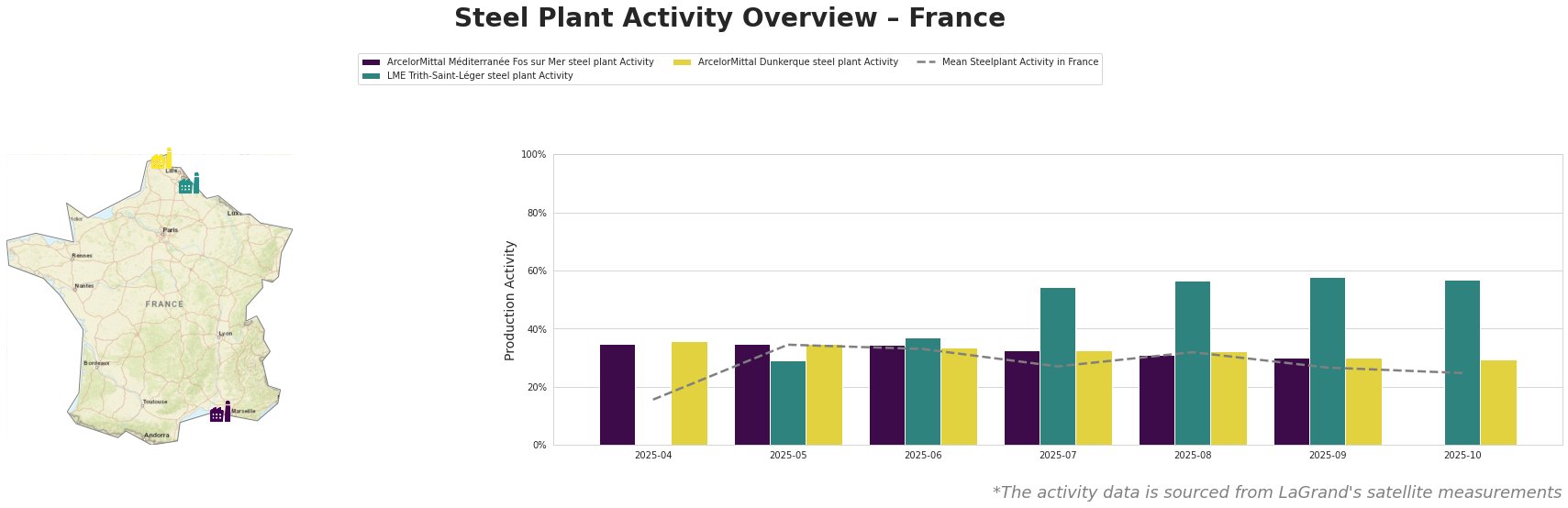

Here’s a summary of observed steel plant activity:

The mean steel plant activity in France decreased to 25% in October 2025.

ArcelorMittal Méditerranée Fos sur Mer steel plant, an integrated BF/BOF steel plant with a 4 million tonne crude steel capacity producing slabs and hot-rolled products, showed an activity level of 30% in September 2025, slightly above the national mean. However, activity data is missing for October, which is consistent with the reports of blast furnace No. 2 being shut down due to a fire, as reported in “ArcelorMittal Fos-sur-Mer shut down blast furnace No. 2 due to a fire“. The news article titles “ArcelorMittal Shuts Down Fos-sur-Mer Blast Furnace After Major Fire” and “ArcelorMittal shuts down Fos-sur-Mer blast furnace after major fire incident” further confirm this disruption. Given the plant’s reliance on the steelmaking shop for slab production and the damage to material transport infrastructure, this outage will likely constrain supply in the short term. The collaboration of GravitHy and HES FOS to develop port infrastructure, as noted in “GravitHy and HES FOS partner to develop port infrastructure in Fos-sur-Mer“, highlights long-term decarbonization efforts but does not mitigate the immediate impact of the fire.

LME Trith-Saint-Léger steel plant, an EAF-based plant with a capacity of 850,000 tonnes, recorded a consistently high activity level, reaching 58% in September and 57% in October 2025, significantly above the national average. No direct connection could be established with the provided news articles.

ArcelorMittal Dunkerque steel plant, another integrated BF/BOF plant with a 6.75 million tonne crude steel capacity, showed a slight decrease in activity, from 30% in September to 29% in October 2025. This decrease is less pronounced than that observed nationally, and no direct connection could be established with the provided news articles.

Evaluated Market Implications:

The fire at ArcelorMittal Fos-sur-Mer, coupled with the lack of operational capacity data, poses a near-term risk to slab and hot-rolled coil supply within France and potentially broader European markets. The news article titles “ArcelorMittal Fos-sur-Mer shut down blast furnace No. 2 due to a fire” and “ArcelorMittal shuts down Fos-sur-Mer blast furnace after major fire incident” explicitly confirm the operational disruption. Given the integrated nature of the plant and the damage to essential infrastructure, the disruption could be more prolonged than initially anticipated, impacting slab availability.

Recommended Procurement Actions:

- Steel Buyers: Immediately assess current slab and hot-rolled coil inventory levels and expected requirements for the next 2-3 months. Contact ArcelorMittal to confirm delivery schedules and potential allocation scenarios based on the blast furnace outage. Explore alternative supply options from other European or overseas mills, factoring in potential lead times and transportation costs. Given the circumstances, buyers should be prepared for potential price increases in the short term. Consider hedging strategies to mitigate price volatility.

- Market Analysts: Closely monitor the duration of the outage at ArcelorMittal Fos-sur-Mer and its impact on regional steel prices. Analyze the capacity utilization rates of other European steel mills to gauge their ability to absorb any supply shortfall. Track import data for slab and hot-rolled coil to identify potential shifts in trade flows. Evaluate the financial impact on ArcelorMittal and the broader implications for the European steel industry. Also, assess the potential impact of the news article titled “GravitHy and HES FOS partner to develop port infrastructure in Fos-sur-Mer” on the region’s long-term steel decarbonization strategy, and investment decisions related to green steel production.