From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFrance’s Steel Market: Positive Momentum Driven by ArcelorMittal’s Major Investments

Recent developments in France’s steel market indicate a very positive outlook, particularly following ArcelorMittal’s announcement of a new €500 million electric steel production line in the country. According to the articles “ArcelorMittal launches new €500 million electric steel production line in France” and “ArcelorMittal France to launch new electrical steel production line by end of 2025,” this new facility in Mardyck is set to substantially increase electrical steel production capacity, which is crucial for the burgeoning electric vehicle market. The expected operational ramp-up of three lines by late 2025 corresponds with significant plant activity increases observed through satellite data.

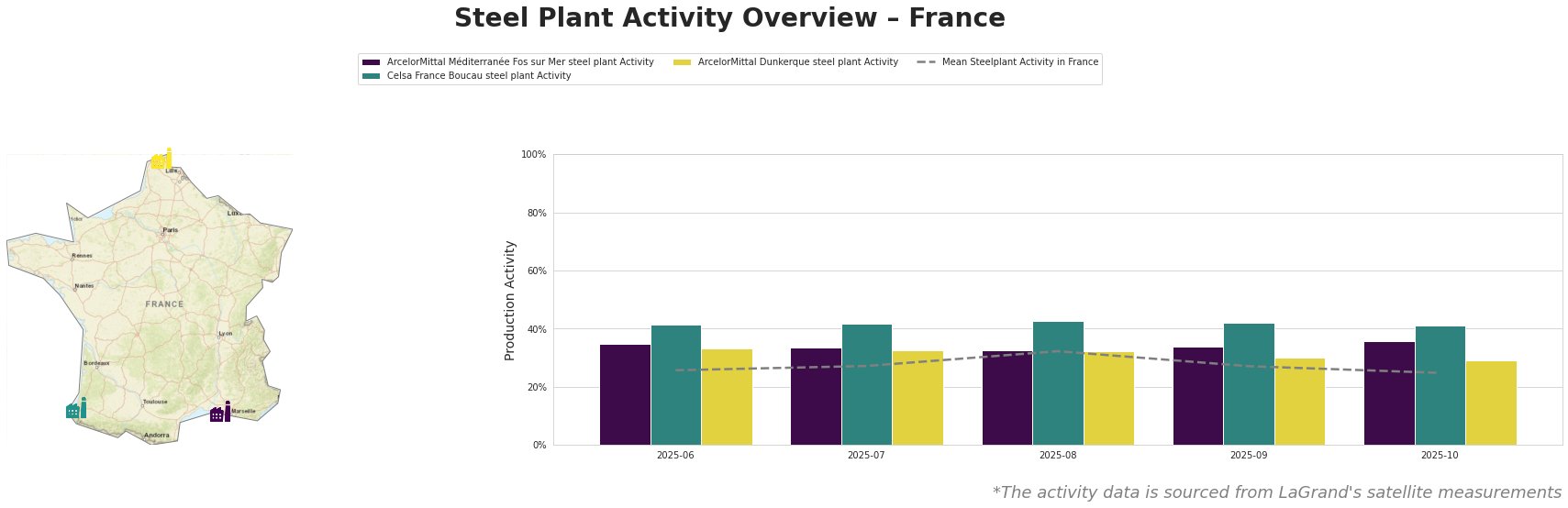

Monthly Activity Overview

Activity at ArcelorMittal Dunkerque and the mean across French plants have been notably consistent, though there was a sharp peak in August with 32% overall activity, likely bolstered by anticipation of the new production alignments in Mardyck. The recent spike to 36% in October at the Fos sur Mer facility follows the investments indicated in “ArcelorMittal France to start Mardyck lines,” reflecting a direct relationship with the increased operational preparations for the new units.

ArcelorMittal Dunkerque’s activity trend seems stable but declined to 29% in October, indicating possible temporary disruptions as upgrades are undertaken in line with broader investment initiatives. As ArcelorMittal ramps up its capacities, the current output levels at Celsa France remain strong at 41%, supported by sustained demand.

Evaluated Market Implications

The introduction of the electrical steel production line is poised to alleviate Europe’s reliance on imported steel, directly supporting local supply chains vital for the electric mobility sector. Steel buyers should be aware that with the projected production growth in Mardyck, procurement opportunities will likely arise for high-performance electrical steels domestically, reducing lead times.

However, potential supply disruptions from existing facilities cannot be overlooked, particularly from ArcelorMittal Dunkerque, where activities have slightly dipped amidst ongoing upgrades. Buyers should prepare for strategic procurement concerning long-term contracts to secure competitive pricing and assured supply from key production sites poised for growth.

In summary, active engagement with ArcelorMittal and awareness of ongoing changes in operational capacities across French plants presents an avenue for steel buyers to optimize intake strategies aligned with the evolving market dynamics. Tailored actions based on these insights can enhance supply chain resilience and capitalize on emerging opportunities in the electrification spectrum.