From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFos-sur-Mer Incident Impacts European Steel Supply: Monitor Order Diversions

Europe’s steel market faces potential disruptions due to an incident at ArcelorMittal’s Fos-sur-Mer plant in France. As detailed in “ArcelorMittal Fos-sur-Mer plans to resume production in early December,” “ArcelorMittal plans restart at Fos-sur-Mer in December after site incident,” “ArcelorMittal plans to resume operations at the Fos-sur-Mer plant in December after the incident at the construction site.“, “Fos-sur-Mer redirects orders and plans temporary restart of production“, and “Fos-sur-Mer redirects orders, plans temporary production restart,” the plant is undergoing repairs following a fire, leading to order diversions and sourcing of slabs externally. While these articles do not provide direct insights into other European plant activities, the disruptions in Fos-sur-Mer could influence demand and production patterns elsewhere.

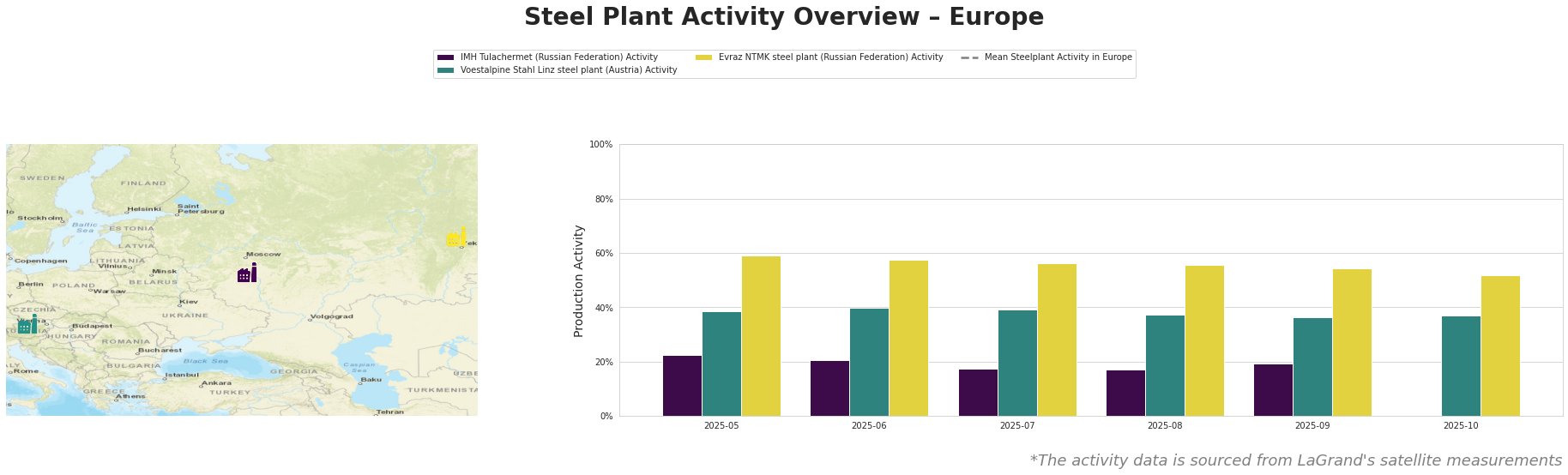

The Mean Steelplant Activity in Europe fluctuated, peaking in July/August before decreasing to 271853108.0 in October. IMH Tulachermet’s activity in Russia saw a gradual decline from 23.0 in May to 17.0 by July/August, with a slight increase to 19.0 in September. Voestalpine Stahl Linz in Austria experienced a relatively stable activity level, hovering between 36.0 and 40.0, with a slight dip to 36.0 in September. Evraz NTMK in Russia showed a gradual decrease from 59.0 in May to 52.0 in October. No direct links between these activity levels and the Fos-sur-Mer incident can be established based on the provided news articles.

IMH Tulachermet, an integrated BF/BOF steel plant located in the Tula region of Russia, produces 1.8 million tonnes of crude steel annually, focusing on semi-finished and finished rolled products like rebar and wire rod. Its activity decreased from 23.0 in May to 17.0 in July/August before recovering slightly to 19.0 in September. However, there is no direct connection to the Fos-sur-Mer incident reported in the provided news articles.

Voestalpine Stahl Linz, an integrated BF/BOF steel plant in Austria, boasts a 6 million tonne crude steel capacity, specializing in high-quality flat steel products. Its activity showed a relatively stable trend, fluctuating between 36.0 and 40.0. There is no direct connection to the Fos-sur-Mer incident evident in the provided news articles.

Evraz NTMK, another integrated BF/BOF steel plant based in the Sverdlovsk region of Russia, has a 4.5 million tonne crude steel capacity and produces a diverse range of products including rails, wheels, and billets. The plant’s activity decreased gradually from 59.0 in May to 52.0 in October. The provided news articles do not establish any direct connection between Evraz NTMK’s activity and the Fos-sur-Mer incident.

The incident at ArcelorMittal’s Fos-sur-Mer plant is creating a localized supply disruption within Europe, as “Fos-sur-Mer redirects orders and plans temporary restart of production” and “Fos-sur-Mer redirects orders, plans temporary production restart” outline order diversions to other ArcelorMittal facilities and external slab sourcing.

Recommended Actions for Steel Buyers and Analysts:

- Monitor Order Fulfillment: Buyers who typically source from Fos-sur-Mer should closely monitor the status of their orders and potential delays due to the production disruption.

- Assess Alternative Sources: Given the redirection of orders, procurement professionals should evaluate alternative steel suppliers within Europe, particularly those with spare capacity, to mitigate potential price increases or delivery delays.

- Track Slab Prices: With ArcelorMittal sourcing slabs externally, closely tracking slab prices and availability is crucial, as this could impact the overall cost of finished steel products.

- Evaluate Inventory Levels: Analysts should monitor inventory levels of relevant steel products across Europe to gauge the impact of the Fos-sur-Mer disruption on overall supply.

- Stay Updated on Restart Timelines: Closely follow updates regarding the restart timeline for Fos-sur-Mer, as indicated in “ArcelorMittal plans restart at Fos-sur-Mer in December after site incident,” to anticipate when normal supply patterns might resume.