From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineExceptional Growth in China’s Steel Industry Amidst New Export Regulations

China’s steel market is exhibiting a very positive sentiment, driven by a record surge in exports and the introduction of new regulatory measures. The articles “China issues new regulations for exports of steel products“ and “China’s Ministry of Commerce Introduces Export License System for Steel Products to Enhance Monitoring and Quality Control“ highlight a significant increase in finished steel exports, reaching 107.717 million metric tons in 2023, encouraging the government to enforce export quotas and an export license system starting January 2026. While these measures aim to stabilize domestic supply chains, satellite data indicates a mixed impact on manufacturing activity across key steel plants.

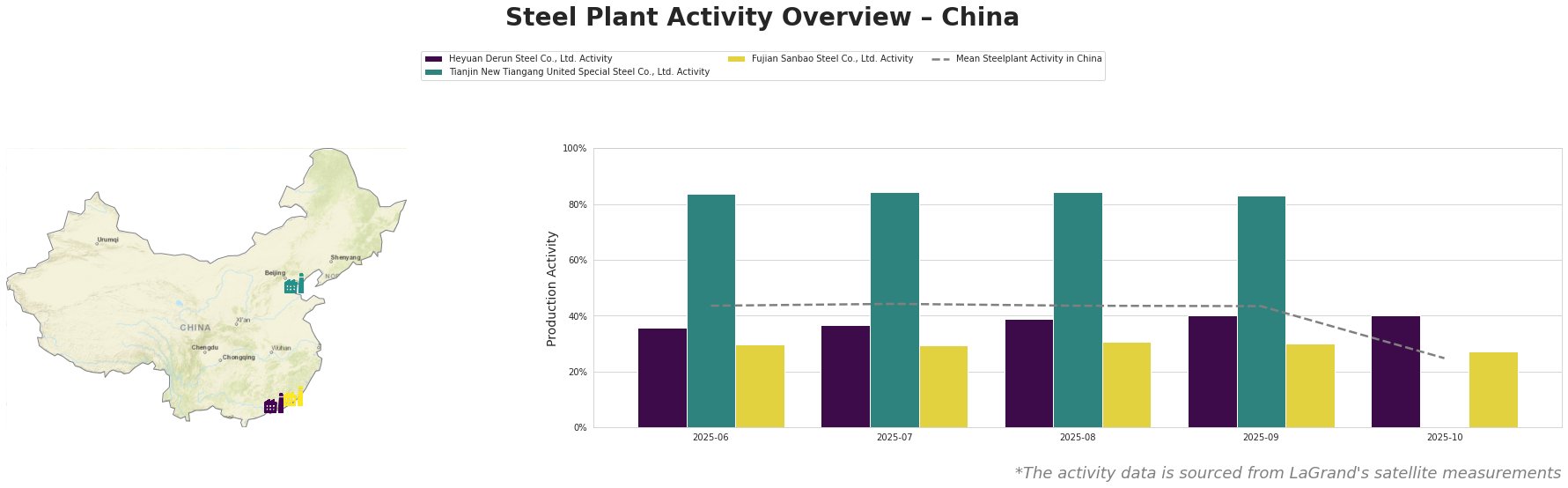

Heyuan Derun Steel Co., Ltd., located in Guangdong, experienced stable activity at 40% in October 2025, reflecting the industry’s resilience amid regulatory changes yet does not directly correlate with the new export licensing announcement. In contrast, Tianjin New Tiangang United Special Steel Co., Ltd. maintained a peak activity of 84% through this period, suggesting strong operational performance aligning with increased export demands. Fujian Sanbao Steel Co., Ltd. showed a more significant decrease to 27% in October 2025, which could indicate adjustments to comply with upcoming regulations though no direct linkage can be made to the news articles.

The new export licensing system introduced for steel products is designed to enhance quality control and monitoring, which may address concerns about low-quality exports but could also imply increased scrutiny and potential delays in shipments—all factors that could ease trade tensions globally as highlighted in the article “Licensing of steel exports from China should ease trade tensions.”

Procurement Insights:

1. Monitor Compliance: Buyers should prepare for possible shipment delays due to the licensing requirements starting January 2026. Engage with suppliers early to ensure compliance and avoid procurement disruptions.

2. Diversify Suppliers: Given the current high activity levels in Tianjin, consider increasing orders from this region as they are better positioned to meet demand amidst growing export pressures.

3. Assess Pricing: With the impending regulations aimed at raising costs for exporters, establish forward contracts now to lock in prices before potential hikes occur.

By navigating the complexities introduced by regulatory changes and monitoring plant activity levels, steel buyers can position themselves to capitalize on the robust growth in China’s steel exports while mitigating supply chain risks.