From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search Engine“Europe’s Steel Market Surge: Satellite Data and Strategic Insights Amid Positive Sentiment”

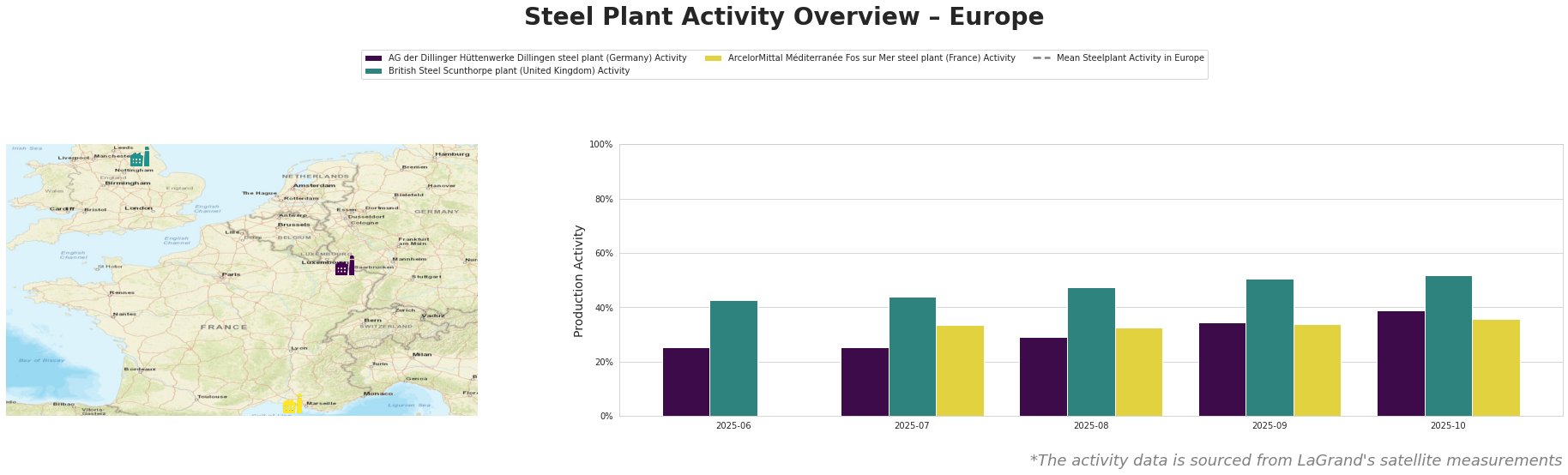

Recent activity trends indicate a very positive sentiment in Europe’s steel market, highlighted by the satellite-observed increases in plant operations in response to evolving industry conditions. Specifically, notable insights can be drawn from the activity reports of the AG der Dillinger Hüttenwerke, British Steel, and ArcelorMittal facilities. The articles titled “Australia coal, Fe prices to fall; LNG up: Treasury“ and “Viewpoint: Dry weather to ease Australia’s coal queues“ provide contextual background for these developments, although a direct linkage between these articles and the observed activity levels in European steel plants cannot definitively be established.

Activity levels show a strengthening trend, with the British Steel Scunthorpe plant reaching a notable peak of 52% in October, suggesting robust demand and operational resilience. The AG der Dillinger Hüttenwerke plant experienced a rise to 39% in October, albeit starting from a lower base. The Fos sur Mer facility has maintained steady yet lower activity, indicative of preparation for potential future challenges.

The AG der Dillinger Hüttenwerke Dillingen, located in Saarland, operates primarily with blast furnaces, focusing on a diverse range of high-performance steel products for sectors such as automotive and infrastructure. Activity rose from 25% in June to 39% in October, reflecting positive demand although no direct connections can be credibly made to external market conditions from the discussed articles.

Meanwhile, the British Steel Scunthorpe plant also leveraging blast furnace technology, shows an impressive climb in activity from 43% in June to 52% in October, hinting at potentially improved supply chain stability, although it remains to be seen how global commodity shifts will affect operational decisions.

In ArcelorMittal Méditerranée Fos sur Mer, which operates as an integrated facility focused on semi-finished and finished steel products, activity levels remained stagnated at 33% in August and September but slightly improved to 36% by October. This stable pace suggests a cautionary approach to market volatility in the wake of warming demand forecasts.

The potential supply disruptions highlighted by the Treasury’s projections on Australian coal and iron prices can signal rising procurement costs for raw materials, making it essential for buyers to optimize their contracts ahead of potential price escalations. The weather conditions improving Australia’s coal supply, as reported may also temporarily alleviate broader supply concerns, though the long-term stability remains uncertain.

Steel procurement professionals should consider initiating contracts now while maintaining flexibility to adjust as global dynamics evolve. It is advisable to focus on securing agreements with plants demonstrating reliability in production capabilities and robust demand signals to mitigate against unexpected market shifts.