From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope’s Steel Market Faces Regulatory Shifts and Activity Declines Amid Global Dynamics

The European steel market is currently navigating regulatory changes and activity fluctuations. Recent backing by the European Parliament committee backs proposal to ban Russian steel has prompted considerations for substantial cuts to steel imports, as detailed in EU Parliament Trade Committee supports major cut in steel import quotas. The proposed reduction of tariff-free steel imports to 18.3 million tonnes—representing a 47% decrease—correlates with declining satellite-observed activity at several key plants.

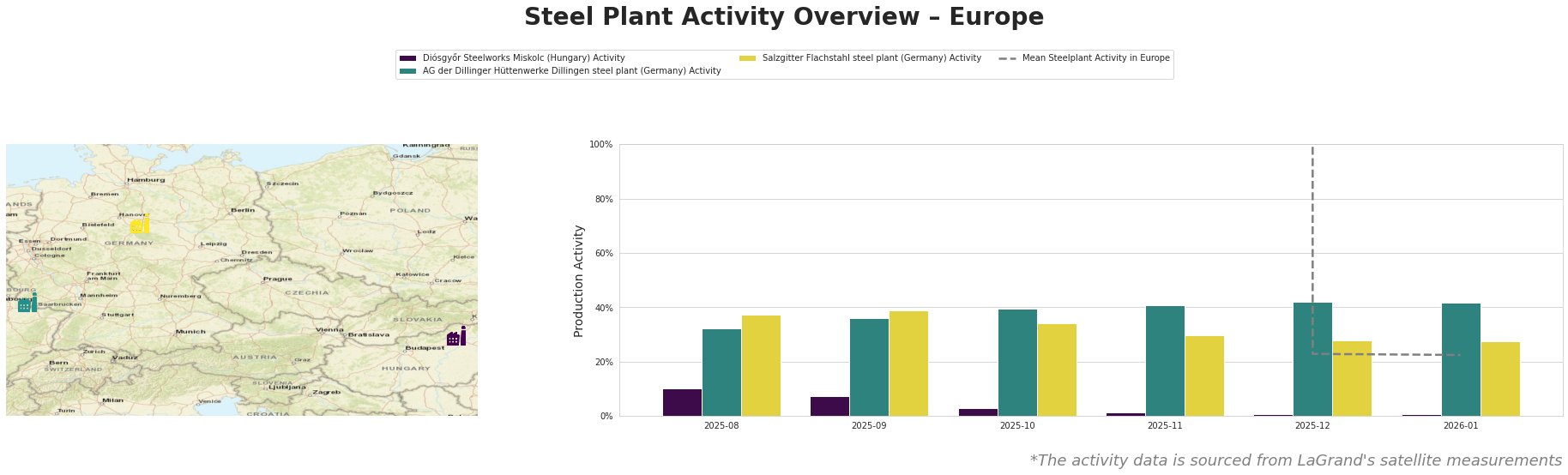

Diósgyőr Steelworks in Hungary has experienced a steep drop in activity, plummeting from 10.0% in August 2025 to just 1.0% by the end of January 2026. This 90% decline aligns with broader market pressures but no direct correlation to specific news developments can be established. In contrast, AG der Dillinger Hüttenwerke and Salzgitter Flachstahl have seen more stable activity levels but have faced declines recently. Notably, Dillinger’s activity peaked at 42.0% in December 2025 before marginally falling to 42.0% in January 2026. These trends suggest plant operations may be increasingly affected by the regulatory environment.

AG der Dillinger Hüttenwerke, one of Europe’s significant integrated steel producers, has maintained relatively stable operations with robust capacity for high-quality structural steels. However, the 50% customs duty on non-quota imports and the total ban on Russian and Belarusian steel imports may lead to supply constraints and necessitate strategic procurement diversification. The Salzgitter Flachstahl plant, also engaged in high-strength steel production, is undergoing a transformative shift towards hydrogen-based steel, which could impact future activity levels amid current geopolitical challenges.

Given the explicit strain indicated by the European Parliament’s Trade Committee’s vote and the observed declines, procurement professionals should prepare for potential supply disruptions, particularly from Eastern Europe. The recommended procurement strategy involves securing contracts ahead of the anticipated regulatory changes and diversifying sources to mitigate risks associated with the ban on Russian and Belarusian steel. Additionally, closely monitoring the situation with key suppliers will be essential in responding to these evolving market dynamics effectively.