From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope’s Steel Market Faces Major Challenges Amidst Regulatory Uncertainty

The European steel market is encountering severe downturns as illustrated by recent policy shifts and observable activity declines across major plants. Notably, The EU will abandon plans to ban internal combustion engines from 2035, says a senior EU official and The EU may ease the ban on ICE from 2035 under pressure from the automotive industry reflect a recalibrated regulatory framework that jeopardizes demand for steel used in automotive applications, such as electric arc furnace (EAF) products, thereby contributing to this industry’s negative sentiment.

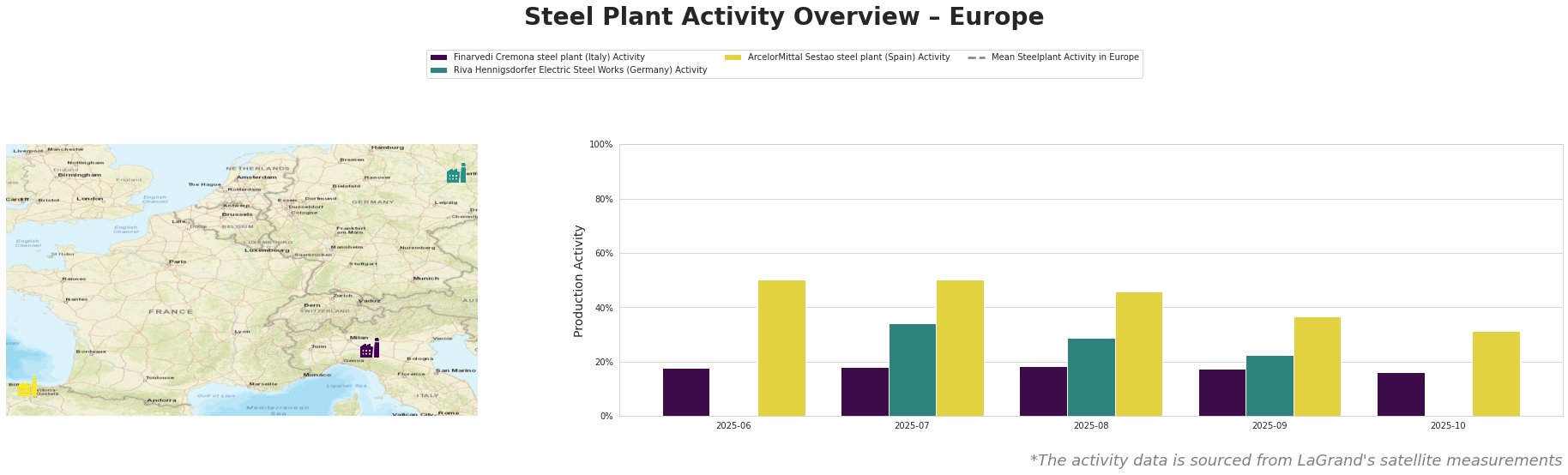

Activity across the key steel plants in Europe reveals a downward trend with the mean activity of observed plants falling from 40.78% in July to 27.18% by October 2025. The Finarvedi Cremona steel plant in Italy shows a concerning decrease from 18% in June to 16% in October, significantly trailing the mean. The Riva Hennigsdorfer Electric Steel Works had a noticeable decline from 34% in July to 22% in September, further contributing to the negative market outlook. Meanwhile, the ArcelorMittal Sestao plant showed a steep drop from a peak of 50% in June to 31% in October, suggesting an urgent need for market adaptation.

The Finarvedi Cremona steel plant, primarily focused on EAF technologies, is experiencing stagnation in production, verified by a drop from 18% to 16%. This downturn coincides with the automotive sector’s uncertainty following the shifting regulatory landscape described in the articles. As the automotive industry lobbies for flexible emissions regulations, demand for EAF-produced steel may diminish, impacting Finarvedi’s prospects.

The Riva Hennigsdorfer Electric Steel Works, another significant player, registered a concerning reduction from 34% to 22%, likely reflective of lagging automotive demand amidst ongoing pressures. While exact connections to the news articles are indirect, the overarching sentiment of regulatory changes influencing automotive production is palpable, indicating potential trouble for rebar and steel billets markets.

Finally, despite some fluctuations, the ArcelorMittal Sestao steel plant faced a major decline from 50% to 31%. This drop can also be tied back to the hesitations within the automotive sector regarding strict emissions regulations as articulated in the news articles.

Given these observations, steel buyers should prepare for potential supply disruptions, particularly from Finarvedi and Riva, due to their reliance on automotive demand and recent activity decreases. Immediate procurement strategies should focus on identifying alternative suppliers, considering redundancies in orders and diversifying their supply chains to mitigate the impacts of declining activities and shifts in regulatory climates. The combination of observed activity levels and ongoing news developments signals a strong cautionary stance in purchasing decisions within the coming months.