From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Update: Price Increases Amid Cautious Demand

The European steel market exhibits a Neutral sentiment as producers strive to raise prices amidst cautious buyer responses, particularly following Northwest Europe coil hikes fail to surprise buyers and European steel market sees growing price increase attempts. Observational data reveal varying activity levels across key plants, correlating with these recent developments.

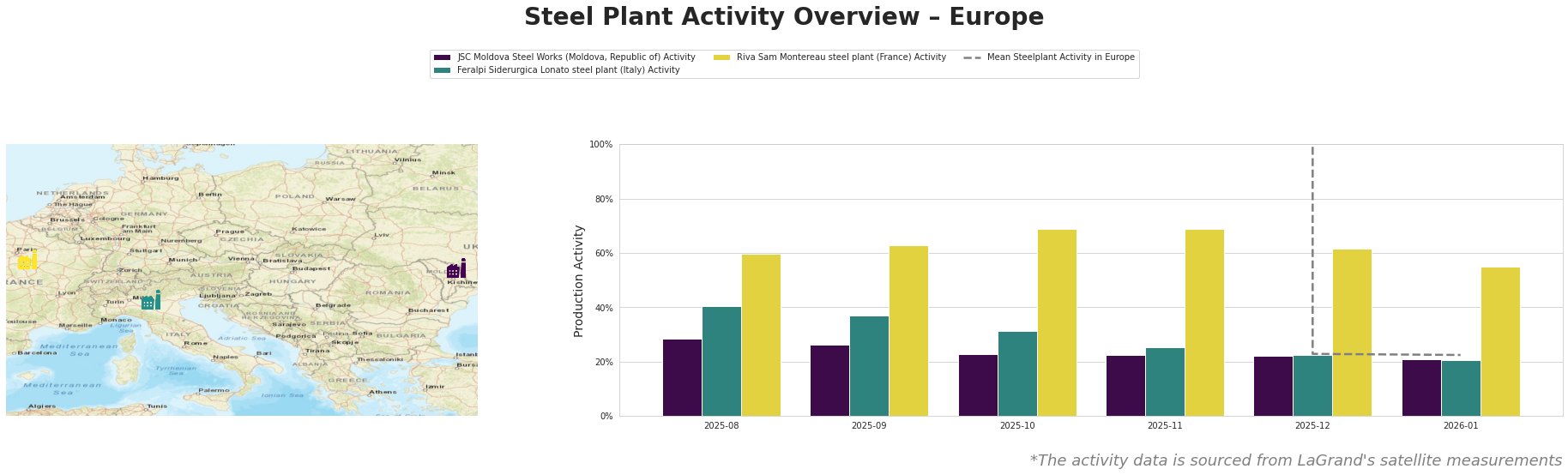

Measured Activity Overview

Recent months indicate a downward trend in mean activity, dropping sharply from 326.2% in August 2025 to just 22.0% by January 2026. JSC Moldova Steel Works shows a consistent decline from 28.0% to 21.0%, aligning with the cautious market sentiment highlighted in Reel trips to the North-West of Europe could not surprise the buyers, as production capacity constraints continue into March 2026. In contrast, the Riva Sam Montereau plant peaked at 69.0% in October and November before declining to 55.0% by January, reflecting potential impacts of pricing dynamics on operational levels.

Plant Information

JSC Moldova Steel Works in Transnistria has experienced a significant reduction in activity, with drops of 7% from August to January, likely influenced by the market’s cautious approach as indicated by Growing feedstock costs, tighter availability push Polish domestic long steel prices higher. As a producer with an electric arc furnace (EAF) for semi-finished and finished rolled products, this drop may limit its capacity to fulfill demand amid rising costs.

Feralpi Siderurgica Lonato, located in Italy, has seen less fluctuation (from 40.0% to 21.0% activity) and remains a critical player in the rebar segment. However, decreased demand may be hindering higher output, as highlighted in There are growing attempts to raise prices in the European steel market, wherein flat product price increases have been attempted but are met with buyer hesitance.

Riva Sam Montereau is characterized by stable, though declining, activity. Its peek at 69.0% coincided with strong pricing attempts by ArcelorMittal, yet decreased demand resulted in a shift back to 55.0%. This dynamic correlates with available inventory levels and production planning amid the market’s uncertain price trajectory.

Evaluated Market Implications

The combination of rising prices and cautious buyer sentiment may suggest potential supply disruptions, particularly for the JSC Moldova Steel Works, where production limitations align with observed activity reductions. Buyers should proceed with caution, favoring flexibility in procurement strategies as production capacity is tightly constrained, particularly for long products influenced by changing feedstock costs and anticipated increases driven by the Carbon Border Adjustment Mechanism.

Recommended Action: Steel buyers should prioritize negotiating contracts with suppliers ahead of anticipated price surges, particularly in Germany and Italy, while also monitoring the shifts in feedstock availability due to regulatory changes. This focus could mitigate risks associated with limited supply and fluctuating pricing in an evolving regulatory landscape.