From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Update: Italian Plate Prices Surge Amidst Strong Activity Trends

In Europe, particularly Italy, the steel market is experiencing a notably positive shift with rising prices and increased activity levels. This is underscored by the article “Italian plate prices continue to increase” that highlights a rise in heavy plate prices driven by imported slab costs impacted by the Carbon Border Adjustment Mechanism (CBAM). Additionally, the “Prices for Italian tableware continue to rise” article offers insight into the broader upward price movement for rolled steel products as domestic mills respond to international price pressures. Satellite activity observations do indicate increasing production dynamics within these markets.

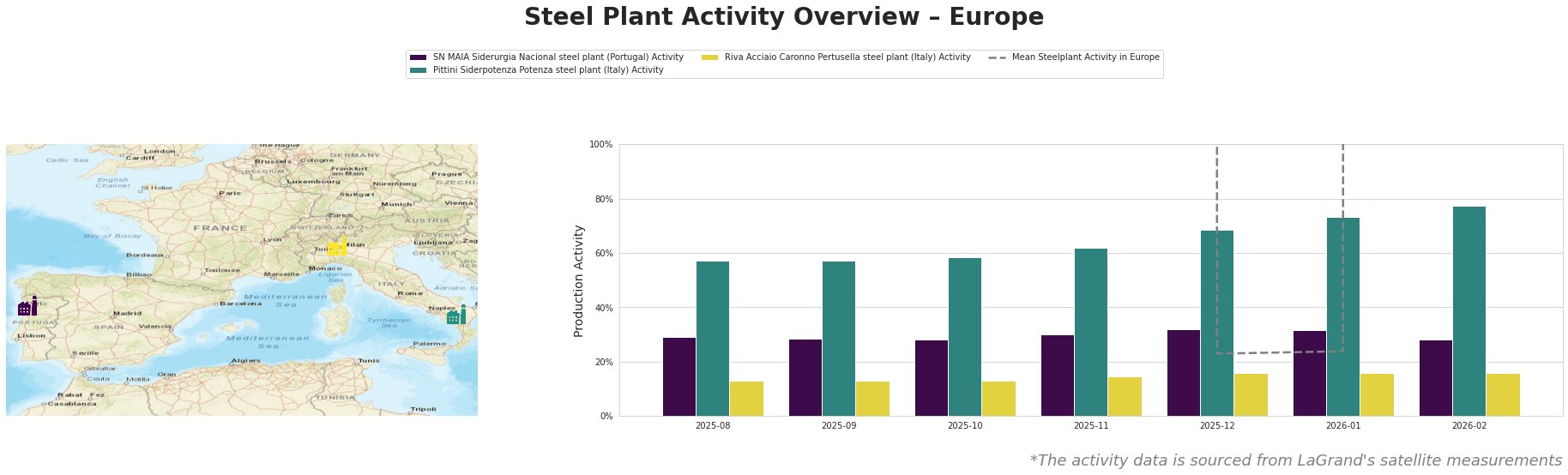

The SN MAIA Siderurgia Nacional steel plant in Porto shows fluctuating activity, peaking at 73.0% in January 2026, aligning with elevated demand for rebars as noted in the positive market sentiment. Despite a later decrease to 28.0% in February, this variance reflects the market’s current dynamics as detailed in the respective articles.

Pittini Siderpotenza in Potenza experienced a robust jump in activity, hitting 77.0% in February, which correlates with the ongoing increase in plate prices noted in “Italian plate prices continue to increase” as this plant focuses on both semi-finished and finished rolled products vital for construction and infrastructure sectors.

Lastly, the Riva Acciaio in Pertusella exhibited steady activity levels without significant peaks, likely influenced by fluctuations in market demand, although related news articles did not establish a direct connection to this steel fabricator’s current performance.

The interplay of increasing prices and improved plant activity suggests potential supply disruptions might arise for buyers, particularly those relying on Northwestern European suppliers who have not matched the price hikes seen in Italy. Procurement actions should focus on securing orders from Italian mills before potential further increases, especially for S235 and S355 steel grades currently trending in demand, as described in relevant articles. Additionally, buyers should evaluate inventory levels critically as regional competition diminishes with rising costs and tightening markets.