From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market: Ukrainian Exports Surge Amidst Fluctuating Plant Activity

Europe’s steel market is showing mixed signals with increased Ukrainian exports juxtaposed against variable steel plant activity. Specifically, the rise in exports of flat and long rolled products from Ukraine, as detailed in “Ukraine exported 971,700 tons of flat rolled products in January-July” and “Ukraine increased its exports of long rolled products by 56.7% y/y in January-July“, coincides with fluctuations in activity at key European steel plants. While these news items highlight shifts in supply dynamics, a direct causal link to the observed plant activity changes cannot be definitively established based solely on the provided information.

Measured Activity Overview

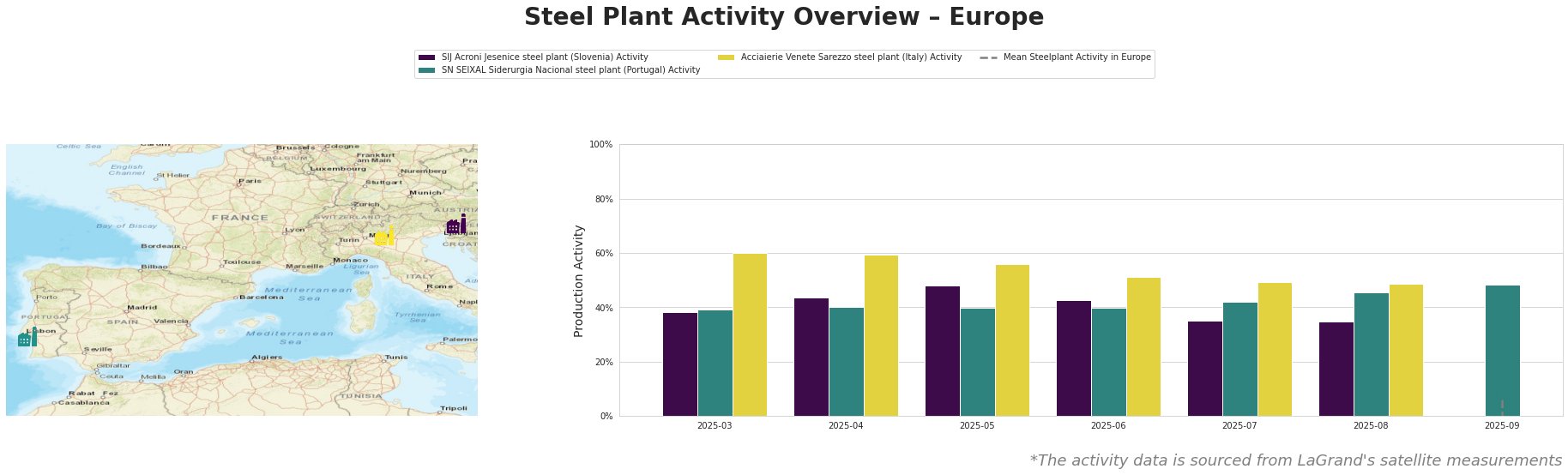

Across the observed period, the SIJ Acroni Jesenice plant shows a decline in activity from a peak of 48% in May to 35% in July and August. Conversely, the SN SEIXAL plant experiences a rise to 48% activity level by September, following a relatively stable period. Acciaierie Venete Sarezzo’s activity gradually decreases from 60% in March to 49% in July and August. The provided ‘Mean Steelplant Activity in Europe’ data contains anomalously large negative values, rendering it unusable for meaningful comparison.

SIJ Acroni Jesenice steel plant

SIJ Acroni Jesenice, a Slovenian steel plant relying on EAF technology with a crude steel capacity of 726 ttpa, focuses on flat rolled steel products. Satellite data indicates a decrease in activity from 48% in May 2025 to 35% in July and August 2025. No direct link can be established between this decrease and the provided news articles regarding Ukrainian exports or Turkish scrap imports.

SN SEIXAL Siderurgia Nacional steel plant

SN SEIXAL, a Portuguese steel plant with a 1100 ttpa EAF-based crude steel capacity, produces semi-finished and finished rolled products like mesh and wire. Satellite observations show an increase in activity, reaching 48% in September 2025. A direct connection between this increase and the news articles available cannot be definitively stated.

Acciaierie Venete Sarezzo steel plant

Acciaierie Venete Sarezzo, an Italian EAF steel plant with a 540 ttpa crude steel capacity, specializes in bars and wire rod for automotive and construction sectors. Its activity decreased from 60% in March to 49% in July and August. The observed decline in activity at Acciaierie Venete Sarezzo is not directly explainable by the provided news articles concerning Ukrainian exports or Turkish scrap imports.

Evaluated Market Implications

The surge in Ukrainian long rolled product exports, as highlighted in “Ukraine increased its exports of long rolled products by 56.7% y/y in January-July“, combined with the recent decrease in activity at Acciaierie Venete Sarezzo – an Italian producer of similar products, warrants caution for buyers. The article “Scrap exports from Ukraine exceeded 44,000 tons in July” further complicates the matter as scrap is suspected of being re-exported through Poland to Turkey and experts predict scrap may lose its export commodity status due to its strategic importance for green metallurgy and the need for domestic supply to support Ukrainian steel producers.

While Turkey reduced scrap imports, it may benefit from such re-exports, potentially affecting supply chains.

Recommended Procurement Actions:

- For buyers of long rolled steel products in Italy: Closely monitor price trends and lead times from Acciaierie Venete Sarezzo, given its recent activity decrease coinciding with increased Ukrainian exports. Consider diversifying suppliers to mitigate potential supply disruptions.

- For analysts tracking scrap prices: Closely monitor the development of the export status of Ukrainian scrap and its implications for steel production, as indicated in “Scrap exports from Ukraine exceeded 44,000 tons in July“.

- For steel buyers reliant on Turkish suppliers: Track Turkish scrap import data and its impact on steel prices. The article “Turkey reduced scrap imports by 6.1% y/y in January-July” highlights a decrease in scrap imports, which may affect production costs and, consequently, steel prices.